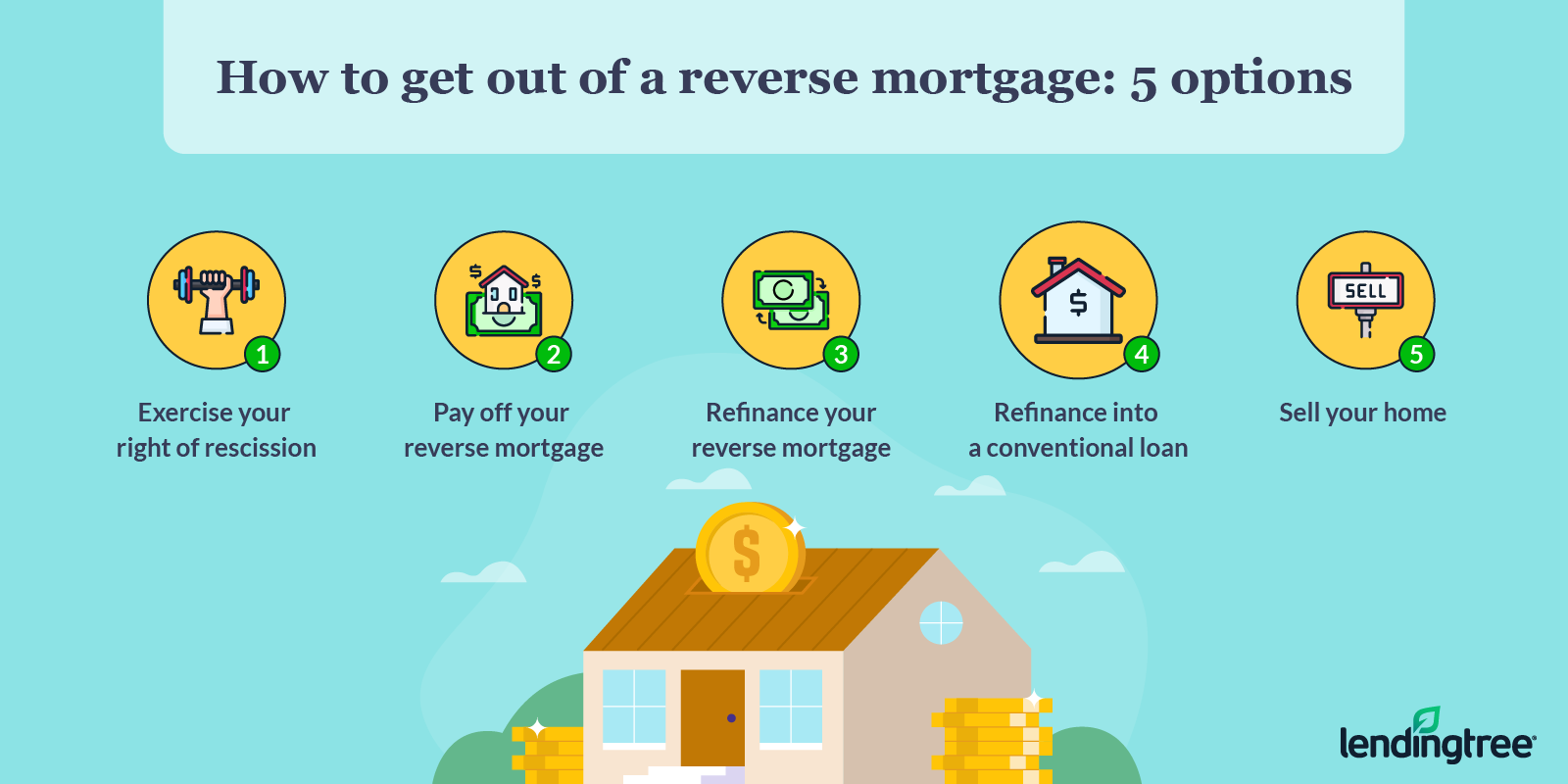

If you’re considering a reverse mortgage to supplement your retirement income, you may want to consider a wraparound reverse mortgage. A wraparound reverse mortgage is a type of loan that can help you make the most of your retirement income and gives you more flexibility than a traditional reverse mortgage. In this article, we’ll discuss how to get a wraparound reverse mortgage, the benefits of doing so, and the risks associated with these products. Whether you’re just starting to research reverse mortgages or you’re ready to apply, this article will provide you with the information you need to make an informed decision.

Research reverse mortgages.

Researching reverse mortgages can be overwhelming at first, so it’s important to take your time and ask questions to make sure you understand all the details.

Find a lender.

Before you start looking for a lender, make sure you understand all the features and risks of a reverse mortgage. Research different lenders and compare offers to find the best deal.

Apply for loan.

Once you have decided to apply for a wraparound reverse mortgage, make sure to do your research to find a lender that is right for you. Make sure to check the fees and interest rates and read the loan agreement carefully.

Provide financial info.

A reverse mortgage is a great way to get financial security in retirement. It allows homeowners aged 62 and over to access the equity in their home without having to sell it. With a wraparound reverse mortgage, you can get access to the equity you need to supplement your retirement income.

Wait for approval.

Once your application is submitted, the lender will review your profile and decide if you meet their eligibility criteria. If approved, you will be able to take advantage of the wraparound reverse mortgage.

Sign contract.

Before signing your contract for a reverse mortgage, make sure you understand the terms and conditions of the loan. Ensure that it is the right option for you and that it meets your needs.