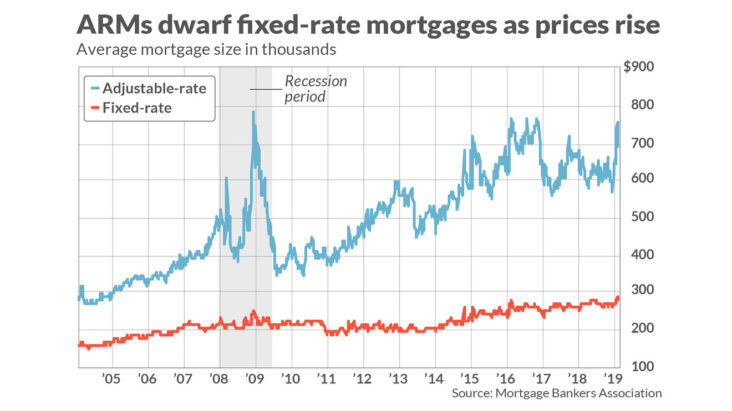

An adjustable-rate mortgage, or ARM, is a loan that offers an initial fixed-rate period and then adjusts annually or quarterly to reflect changes in the interest rate. ARMs are a popular option for borrowers who want to take advantage of current low interest rates, but don’t want to be tied to a long-term fixed-rate mortgage. To help you understand how an adjustable-rate mortgage works, this guide will provide an overview of the key features and benefits, discuss the different types of ARMs, and outline the risks and drawbacks associated with ARM loans.

What is an Adjustable-Rate Mortgage (ARM)?

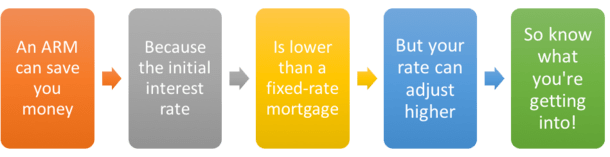

An adjustable-rate mortgage, or ARM, is a type of loan that starts with a fixed rate for a certain amount of time and then adjusts to a new rate at regular intervals. This type of loan is great for people who want the flexibility of a lower interest rate, but don’t want to be locked into a long-term fixed rate. ARMs are popular among those who plan to stay in their home for a short period of time, or who anticipate their income to increase over time. The adjustable-rate mortgage also allows you to take advantage of market fluctuations, so you can get a lower rate if interest rates drop. Keep in mind, however, that your monthly payments may increase if interest rates go up. Before you choose an ARM, make sure you understand the terms, features, and risks associated with this type of loan.

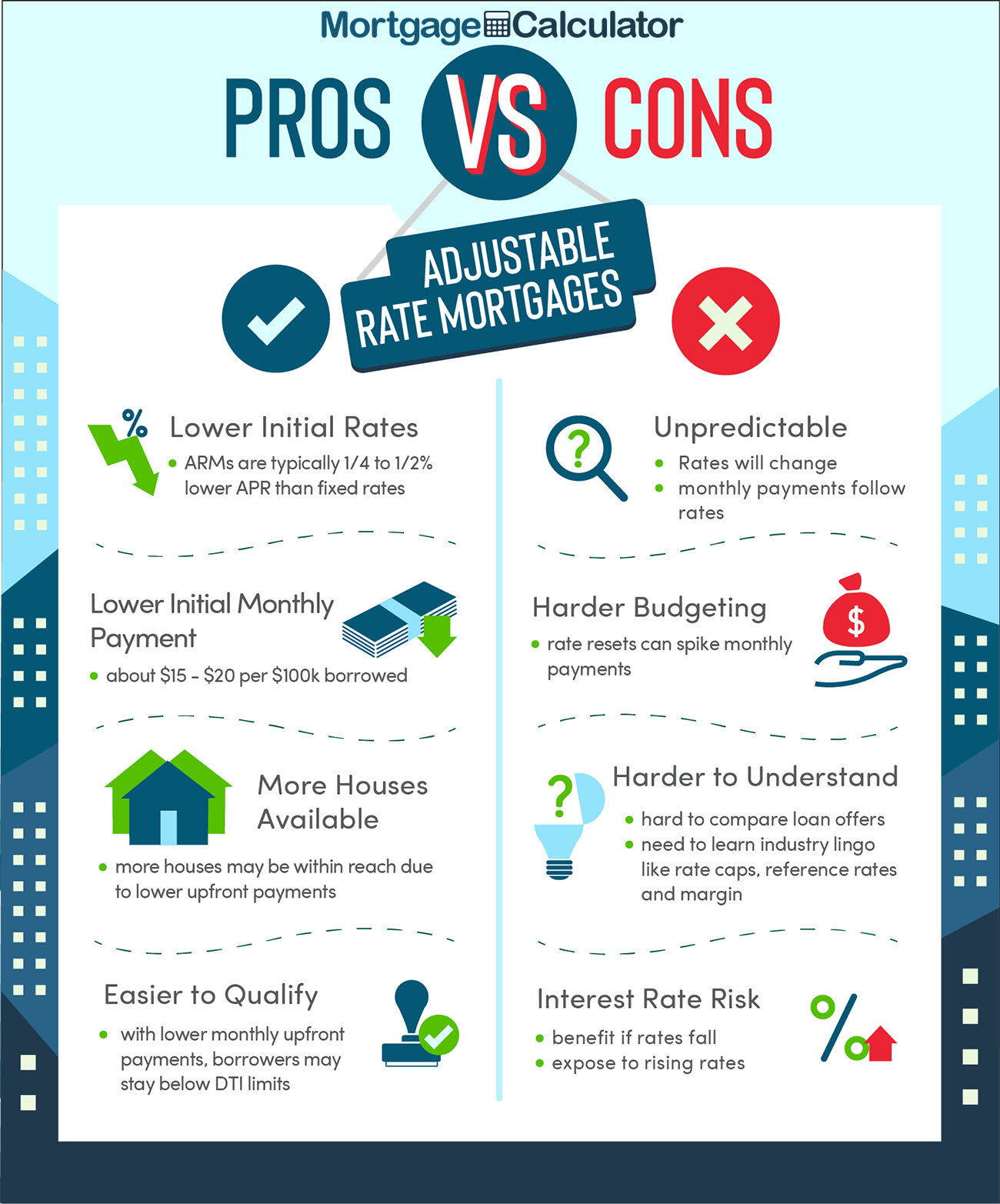

Pros and Cons of an ARM

If you’re looking to buy a home, you’ve probably heard of Adjustable-rate mortgages (ARMs). ARMs are a popular financing option because they offer lower interest rates than traditional fixed-rate mortgages. But before you jump on board, it’s important to know the pros and cons of an ARM. On the plus side, ARMs generally have lower interest rates and lower monthly payments in the initial years of the loan. This can be helpful for people who are on a tight budget. On the other hand, ARMs can be risky because the interest rate increases after the fixed period, which can make your monthly payments higher. It’s important to shop around and compare different ARMs to find the best option for you. Make sure you understand the terms and conditions of the loan, including the interest rate and payment changes, before signing on the dotted line. Knowing the pros and cons of an ARM can help you make an informed decision and save you money in the long run.

How to Calculate an ARM Payment

Calculating an adjustable rate mortgage (ARM) payment can be tricky, but it’s important to understand how to do it. Knowing how to calculate your ARM payment can help you make a more informed decision when deciding whether or not an ARM is the right choice for you. If you’re considering an ARM, understanding how your rate and payment can change over time is key. To calculate your ARM payment, you’ll need to know the index rate, the margin, and the loan amount. You’ll also need to know the number of years you’ll be paying the loan back. Once you have this information, you’ll be able to calculate your ARM payment by using the formula: ARM payment = (Index Rate + Margin) x Loan Amount / 12 x Number of Years. Taking the time to calculate your ARM payment can help you make an informed decision about your mortgage and save you money in the long run.

How to Choose the Right ARM

If you’re in the market for an adjustable-rate mortgage (ARM), you’ll want to make sure you choose the right one for your needs. There are a lot of factors to consider when selecting an ARM, such as the index and margin, the initial interest rate, the payment cap, and the rate adjustment frequency. It’s important to research all of these options to make sure you get the best deal for your situation. To help you choose the right ARM, consider using an online mortgage calculator to compare different ARM options and see which one offers the best rate and payment terms. Additionally, speak to a qualified mortgage professional who can go over all of the terms and help you select the best option for your specific needs. With the right information and research, you can find the right ARM to fit your budget and lifestyle.

Common Mistakes to Avoid When Taking Out an ARM

If you’re considering taking out an adjustable-rate mortgage (ARM), there are a few common mistakes that you should try to avoid. First, it’s important to make sure you understand the terms of the loan, as well as the risks that come with it. You should also pay close attention to the interest rate, as well as any potential changes to the loan. Additionally, you should do your research to make sure you’re getting the best possible deal. Don’t forget to read the fine print and ask questions to make sure you understand the terms of the loan. Finally, it’s important to remember that an ARM is a long-term commitment, so make sure you’re comfortable with the terms before you sign on the dotted line. Taking the time to do your research and ask questions can help you avoid making costly mistakes when taking out an ARM.