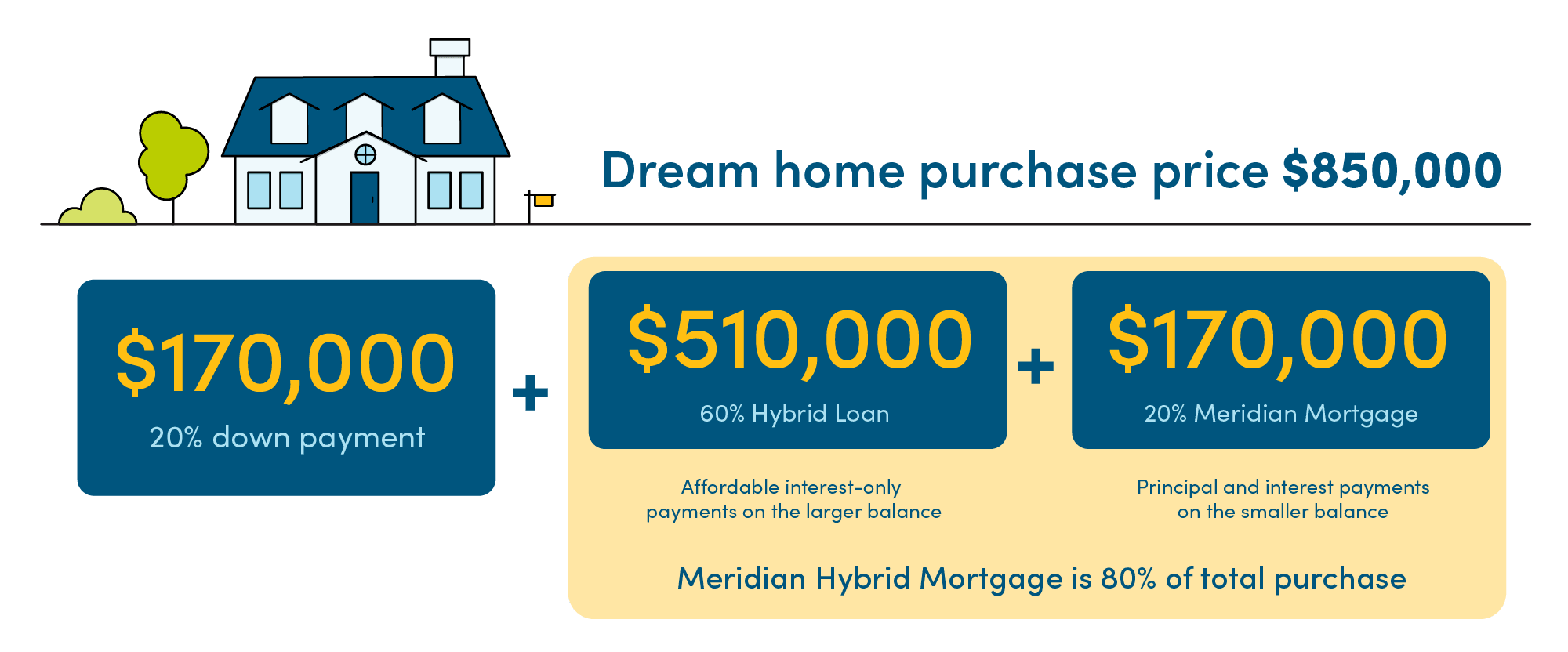

Are you looking to buy a home and don’t know which mortgage option is best for you? Hybrid mortgages are a great option to consider. A hybrid mortgage is a type of mortgage that combines features of fixed and adjustable-rate mortgages, giving borrowers the best of both worlds and more flexibility. In this article, we’ll explore what a hybrid mortgage is, how it works, and the benefits of choosing this type of mortgage. So if you’re looking for a flexible mortgage option with a variety of features, a hybrid mortgage may be the answer. Read on to learn more about this type of mortgage and decide if it’s the right option for you.

Introduction to Hybrid Mortgages: What Are They and How Do They Work?

Hybrid mortgages are a great way to get a handle on your finances. With this type of mortgage, you combine a fixed-rate loan and an adjustable-rate loan to get the best of both worlds. A hybrid mortgage gives you the security of a fixed-rate loan for a set period of time and then the flexibility of an adjustable-rate loan for the rest of the loan term. With this type of mortgage, you get the advantages of both loan types, making it a great choice for many people. With a hybrid mortgage, you can save money on interest payments over the life of the loan and you have the option to refinance when rates drop. Plus, you can also get access to more loan options than with a traditional mortgage. With a hybrid mortgage, you have the control to customize your loan to fit your individual needs. So, if you’re looking for a way to manage your finances and get the most out of your mortgage, a hybrid mortgage is definitely worth considering.

The Benefits of Choosing a Hybrid Mortgage

Choosing a Hybrid Mortgage has lots of benefits! For starters, you get the security that comes with a fixed rate mortgage, while also having the flexibility of an adjustable rate mortgage. Instead of being locked into one rate, you can adjust your rate with the market, while still keeping a fixed rate for a certain period of time. This is great if you want to lower your interest rate when the market is low, but don’t want to commit to a fixed rate for a long period of time. Plus, you can usually get a lower interest rate with a Hybrid Mortgage than with a fixed-rate mortgage, making it a great option for budget-conscious homeowners.

Different Types of Hybrid Mortgages

.There are a few different types of hybrid mortgages, and each one has its own unique advantages and disadvantages. Adjustable Rate Mortgages (ARM) are popular because they offer lower interest rates than traditional fixed-rate mortgages. However, they also come with the risk of the interest rate increasing over time. Hybrid ARMs are a mix between a traditional fixed-rate mortgage and an ARM. They offer a fixed rate for a certain period of time and then switch to an adjustable rate. This is a great option if you want the security of a fixed rate but also the potential to save on interest. Another type of hybrid mortgage is the Balloon Mortgage, which is a short-term loan with a large payment due at the end of the loan. This can be a great option if you plan to sell or refinance your home within a few years. Lastly, Interest-Only Mortgages are a great option for those who can afford the payments but don’t want to pay down their loan balance. With this type of loan, you only pay the interest for a set period of time and then switch to a more traditional loan. Hybrid mortgages can be a great way to save money and lower your monthly payments, but make sure you understand the risks involved before you commit

What to Consider Before Selecting a Hybrid Mortgage

Before you commit to a Hybrid Mortgage, there are a few things you should consider. First and foremost, it’s important to take into account your financial situation and make sure a Hybrid Mortgage is the right choice for you. You should also take into account the length of the fixed-rate period and the amount you’ll be paying in interest over the life of the loan. Additionally, you should look into the fees associated with the loan, such as origination fees, appraisal fees, closing costs, and other costs. Finally, you should compare the rates of different lenders to ensure you’re getting the best deal. Be sure to shop around and compare multiple lenders to get the best Hybrid Mortgage for you.

Questions to Ask a Financial Advisor About Hybrid Mortgages

If you’re looking into a hybrid mortgage, it’s important to ask the right questions of your financial advisor to make sure you’re making the right decision. One of the most important questions to ask is how the mortgage is structured. Is it a fixed-rate loan, or does it have adjustable interest rates? Knowing the structure of the mortgage and the terms of repayment is essential for understanding the long-term implications of the loan. You should also ask how the mortgage will affect your overall financial situation. Will you be able to make the payments on the loan in the long run? Is it financially feasible for you? Additionally, you should ask about the fees associated with the loan and any other costs that you may not be aware of. Finally, make sure to ask your financial advisor how long it will take to pay off the loan and what the total cost of the loan will be. Asking these questions will help you make the best decision possible when it comes to your hybrid mortgage.