Are you looking to buy a home, but are concerned that your mortgage payments might be too high? Low ratio mortgages can be a great option for homebuyers who want to keep their monthly payments manageable. This type of mortgage is designed to reduce the amount of money used for a down payment and allows a borrower to finance a larger portion of the purchase price. This article will provide an overview of low ratio mortgages, including their advantages and disadvantages.

Overview of Low Ratio Mortgages

Low ratio mortgages are a great way to get into homeownership. With a low ratio mortgage, you are able to put down a smaller down payment, usually around 5-20%, and you can even qualify for a loan with no down payment. This type of mortgage allows you to get into a home without having to save up a large amount of money. You will still have to pay mortgage insurance, but it is much lower than a traditional loan. With a low ratio mortgage, you get the benefit of a lower monthly payment and a shorter term loan, allowing you to pay less interest in the long run. With low ratio mortgages, you can become a homeowner without having to save up a large down payment.

Benefits of Taking Out a Low Ratio Mortgage

If you’re looking for a way to get on the property ladder, a low ratio mortgage could be the perfect fit for you. Not only does it come with a range of benefits, it also helps you get into a home sooner. A low ratio mortgage is a type of loan that requires a smaller downpayment and allows you to finance more of the purchase price of the home. This can give you a better chance of getting approved for a loan and helps you get into a home much faster. With a low ratio mortgage, you can also benefit from lower monthly payments, more flexible interest rates, and the ability to get into a home with less savings. All of these benefits can help you get into a home more quickly and save you money in the long run.

Difference between Low Ratio and High Ratio Mortgages

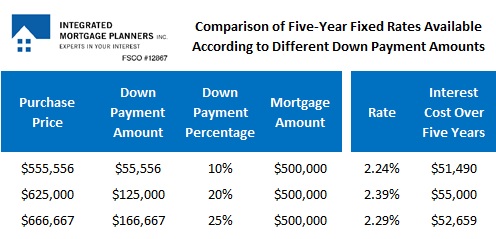

Low ratio mortgages are great for first-time homebuyers who are looking to get in the housing market. The difference between low ratio and high ratio mortgages comes down to the down payment amount. Low ratio mortgages require a smaller down payment than a high ratio mortgage. The down payment for a low ratio mortgage is typically 20% or less of the home’s value, while a high ratio mortgage requires a down payment of 20% or more. Low ratio mortgages are a great option for first-time homebuyers because they don’t require the same amount of money up front, allowing them to get into the housing market without breaking the bank. Plus, with a low ratio mortgage, you can take advantage of lower interest rates and can even qualify for government sponsored programs. Low ratio mortgages are a great way for first-time homebuyers to get into the housing market without having to make a large down payment.

Qualifying for a Low Ratio Mortgage

If you’re looking to buy a property, one of the biggest decisions you’ll have to make is whether to take out a low ratio mortgage. Qualifying for a low ratio mortgage can be a bit tricky, but it can be done with the right knowledge. The key to getting a low ratio mortgage is having a good credit score and a good history of paying off debts on time. You’ll also need to show that you have a steady income that can cover the monthly payments for the mortgage. Additionally, you’ll need to have at least a 5% down payment on the property. With these things in hand, you’ll be well on your way to qualifying for a low ratio mortgage.

Tips and Strategies for Obtaining a Low Ratio Mortgage

If you’re looking to get a low ratio mortgage, it’s smart to do some research. There are some key tips and strategies that can help you get the best deal. First, shop around and compare rates. Different lenders may offer different rates, so it’s important to get quotes from multiple lenders and find the best deal. It’s also important to have good credit and a solid financial history. This will help you secure a lower interest rate on your loan. Finally, consider going with a shorter loan term, such as 15 years instead of 30. This will help you pay off your mortgage faster and save on interest in the long run. By following these tips and strategies, you can get the best deal on a low ratio mortgage.