Are you on the hunt for your dream home or looking to refinance your current abode? Navigating the world of mortgage loans can be overwhelming, but fear not! Our comprehensive guide to the top mortgage loan types and rates is here to help you find the best option tailored to your unique needs. Stay ahead of the game and make an informed decision by exploring the various mortgage products, their advantages, and the latest competitive rates available in the market. Let’s embark on this exciting journey together and secure the perfect financing solution for your homeownership goals!

Fixed-rate mortgages: This is the most common type of mortgage, with the interest rate remaining the same throughout the life of the loan

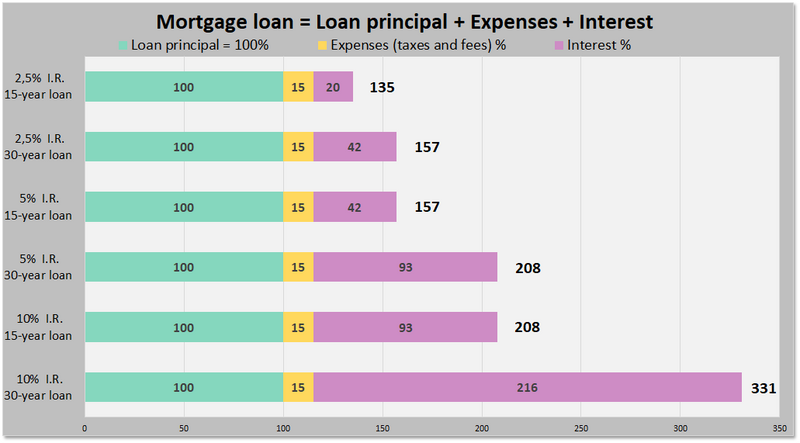

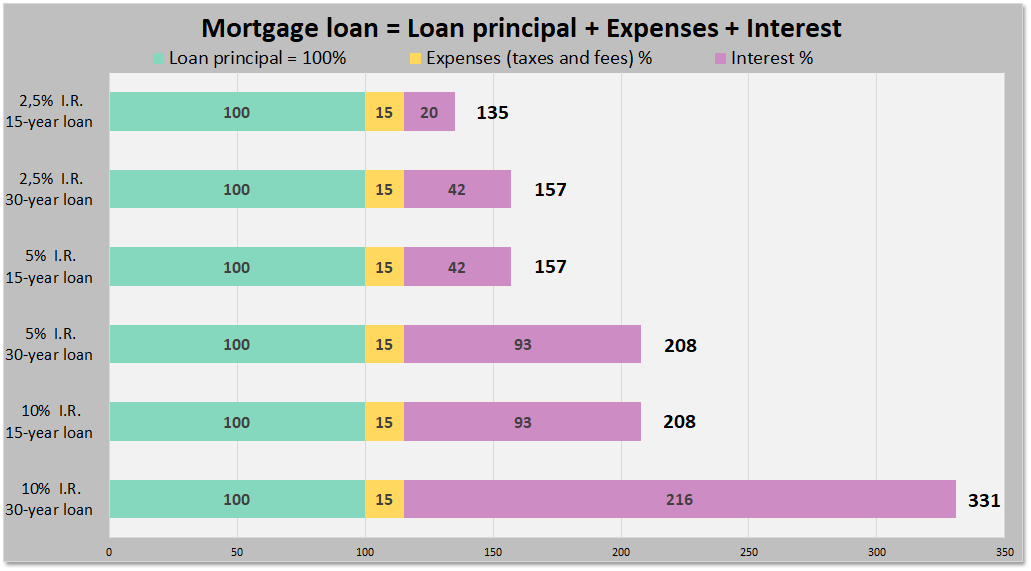

Fixed-rate mortgages are a popular choice among homebuyers due to their stability and predictability. With a fixed interest rate that remains constant throughout the loan term, borrowers can easily budget their monthly mortgage payments without worrying about fluctuating rates. This mortgage type is especially appealing for first-time homebuyers and those with long-term plans to stay in their homes. Fixed-rate mortgages come in various term lengths, such as 15, 20, or 30 years, allowing you to choose the repayment schedule that best fits your financial goals. To find the most competitive fixed-rate mortgage offers, be sure to compare rates, fees, and terms from multiple lenders to ensure you secure the best option for your unique needs.

This provides stability in monthly payments and makes it easier to budget for the long term

Finding the ideal mortgage loan type and rate is crucial for ensuring financial stability and making budgeting more manageable in the long run. Fixed-rate mortgages offer the advantage of consistent monthly payments, allowing you to plan your expenses with confidence. This unwavering payment structure eliminates the stress of fluctuating interest rates, providing you with peace of mind throughout the loan term. By carefully evaluating your financial goals and researching the top mortgage loan options, you can secure the best possible rate and enjoy the benefits of a predictable and budget-friendly payment plan.

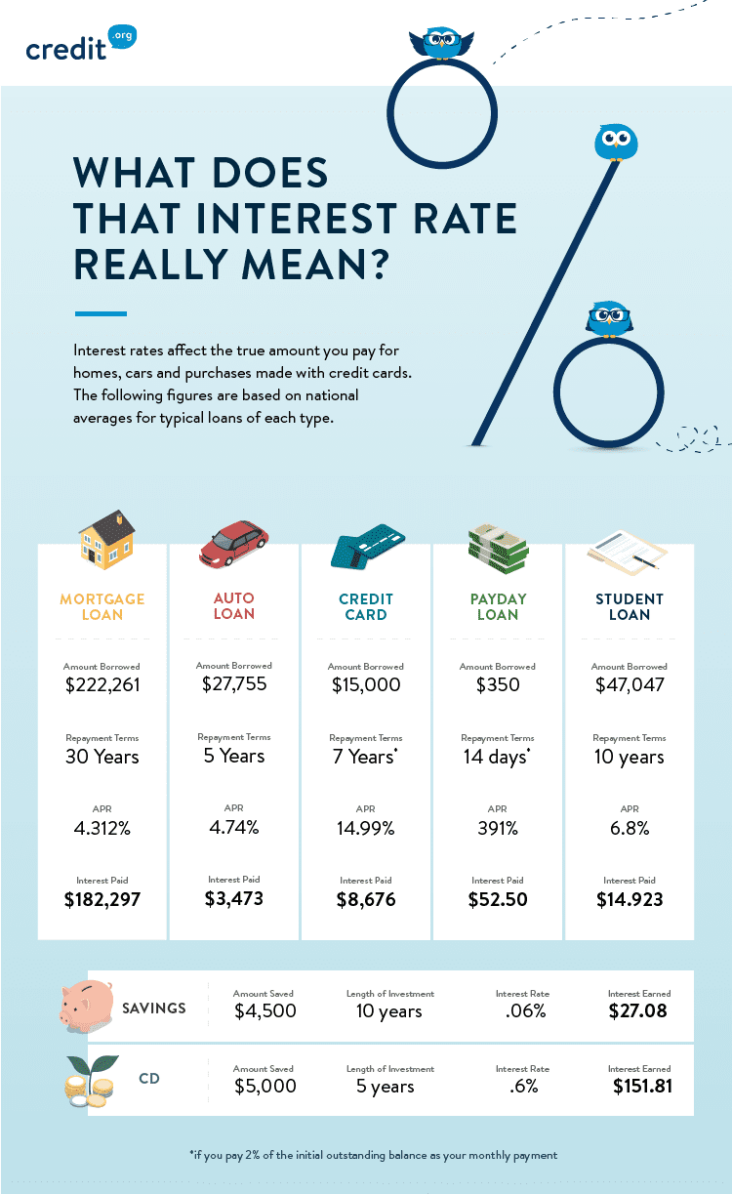

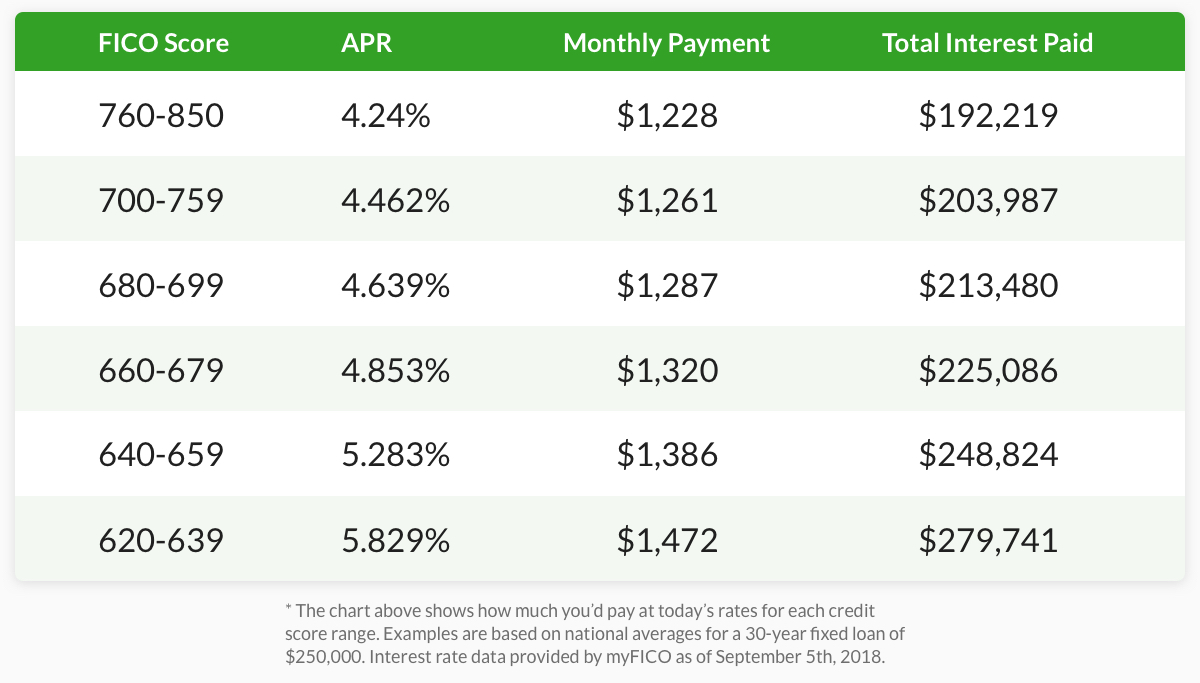

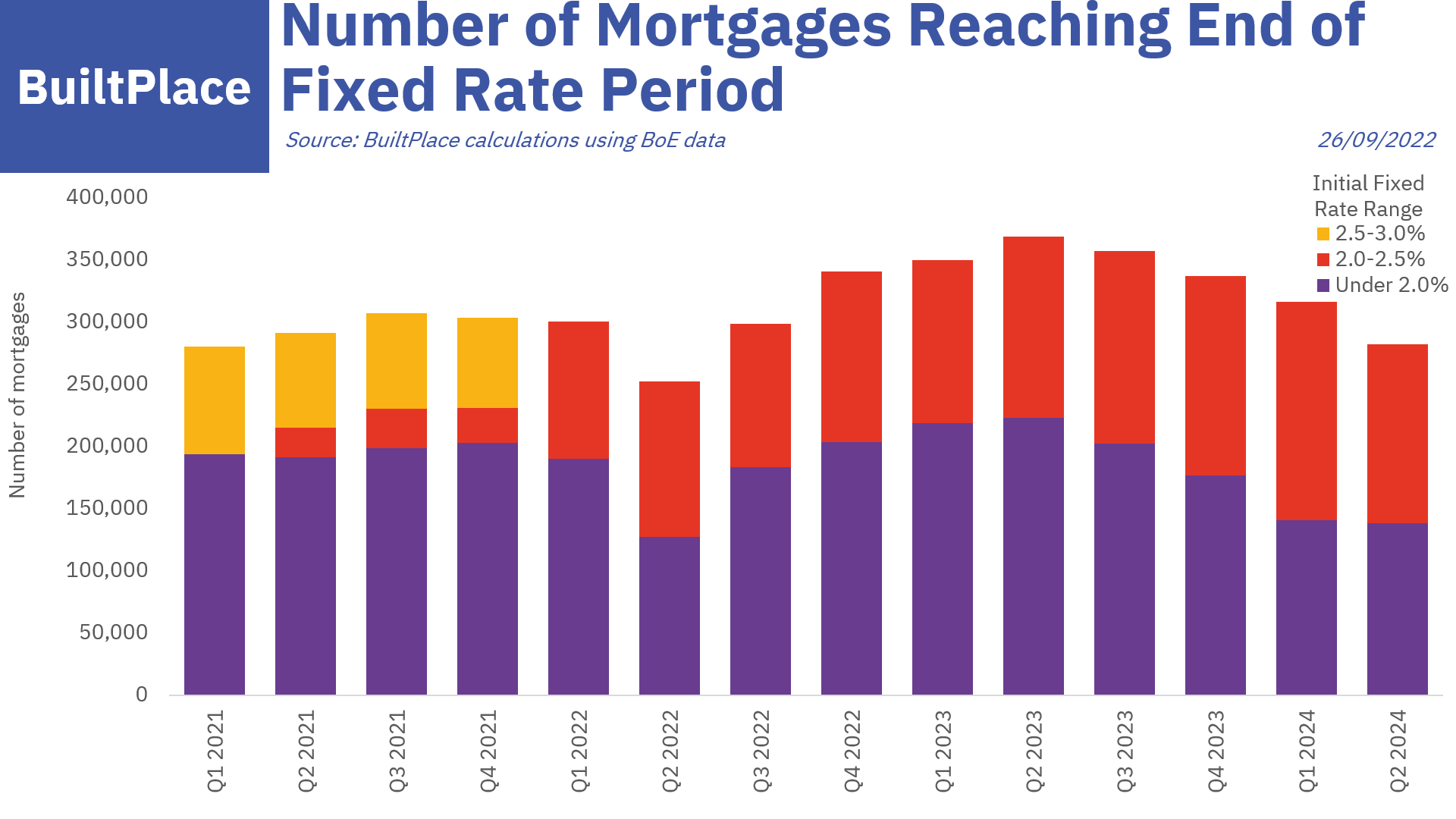

Current fixed-rate mortgage rates range from around 2.5% to 3.5% depending on the lender, the length of the loan, and the borrower’s credit score.

In today’s competitive housing market, it’s crucial to find the perfect mortgage loan type and rate that best suits your financial needs. Current fixed-rate mortgage rates are highly attractive, hovering between 2.5% and 3.5%. These rates can vary based on factors such as lender policies, loan term duration, and the borrower’s credit standing. By diligently comparing different lenders, loan lengths, and analyzing your credit profile, you can secure a fixed-rate mortgage with the lowest possible interest rate. This will ultimately help you save thousands of dollars over the life of your loan and achieve your dream of homeownership with ease.

Adjustable-rate mortgages (ARMs): These loans have interest rates that can change periodically, typically after an initial fixed-rate period

Adjustable-rate mortgages (ARMs) offer a unique blend of flexibility and potential savings for homebuyers. With an ARM, you can enjoy a low fixed interest rate during the initial period, usually ranging from 3 to 10 years. After this phase, your interest rate will adjust periodically, based on market conditions and a specified index. This means your monthly payments may increase or decrease, providing an opportunity to save on interest costs if rates remain low. When considering ARMs, it’s essential to weigh the risks and rewards, and explore various adjustment intervals, caps, and margins to find the best fit for your financial situation.

The interest rate is usually lower during the fixed-rate period, and then it can adjust up or down based on market conditions

Discover the advantages of a hybrid mortgage that combines both fixed and adjustable interest rates, offering you the best of both worlds. Typically, the initial fixed-rate period offers a lower interest rate compared to a fully fixed-rate mortgage, providing you with significant savings during this period. However, keep in mind that after this fixed-rate phase expires, your interest rate becomes adjustable and may fluctuate based on prevailing market conditions. To find the best option for you, consider factors such as your risk tolerance, financial goals, and the anticipated length of time you plan to stay in your home.

This can result in lower initial payments, but there is the risk of higher

Adjustable-rate mortgages (ARMs) offer an attractive option for those seeking lower initial payments. With this type of mortgage, the interest rate fluctuates based on market conditions, which can result in reduced payments during the initial period. However, borrowers face the risk of higher rates and increased monthly payments in the future. To find the best option for your financial situation, it is essential to compare different ARM options, considering factors such as the initial rate, adjustment frequency, and rate cap. By thoroughly evaluating these aspects, you can make an informed decision and secure a mortgage that aligns with your long-term goals and budget.