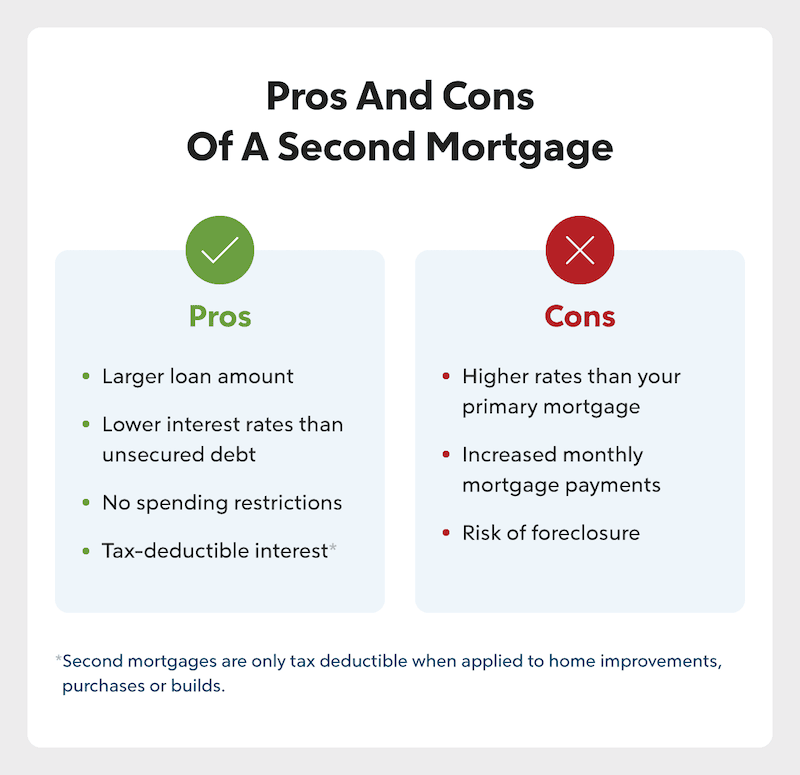

Are you looking for more financial freedom? A second mortgage can help you achieve that goal! With a second mortgage, you can get the extra cash you need to make improvements to your home, pay for college tuition or cover emergency expenses. This article will provide you with a step-by-step guide on how to get a second mortgage, so you can get the financial freedom you deserve.

Research lenders

Doing research on potential lenders is essential before getting a second mortgage. It’s important to compare different lenders and make sure they are reputable and offer the best deal for you. Look out for reviews online and even from your friends and family. Check the interest rates and fees offered, as well as their terms and conditions. Make sure you understand their policies and procedures so you can make the best decision for your finances.

Compare rates

Comparing mortgage rates is a great way to ensure you get the best deal on your second mortgage. Taking the time to research different lenders and their offers will save you money in the long run. Look for lenders that offer fixed and adjustable rates, and compare the interest rates, points, and closing costs. Also, consider any special discounts or incentives that may be available. Doing your homework now will pay off in the future!

Gather documents

Before you apply for a second mortgage, it’s essential to gather all the documents you’ll need. Start by gathering evidence of your current income and proof of your assets. You’ll also need to provide bank statements, tax returns, and any other financial records. Make sure you have everything ready before applying for a second mortgage.

Apply for loan

Applying for a second mortgage is a big step and requires a lot of research to make sure it’s the right move for you. As a 21-year-old, I recommend researching different lenders, comparing interest rates, and understanding the terms of the loan before you make a decision. You can apply for a loan online, over the phone, or in person depending on your needs. Don’t forget to check your credit report and score before applying to help you get the best rates possible.

Receive approval

Once you’ve gathered all the required documents to apply for a second mortgage, such as bank statements, income tax filings, and credit score, it’s time to get approved. The best way to do this is to contact a broker or lender and explain your situation. They’ll be able to assess your creditworthiness and determine if you qualify. If so, they’ll provide you with the necessary paperwork to complete the process. Good luck!

Sign documents

Signing documents for a second mortgage can be a bit tricky. Before signing anything, make sure to read through the documents thoroughly, ask questions about anything you don’t understand, and understand the implications of the paperwork. You’ll need to have your ID and other documents ready to provide to the lender before signing. It’s important to take the time to understand the documents and the process before signing, as it can have long-term implications.