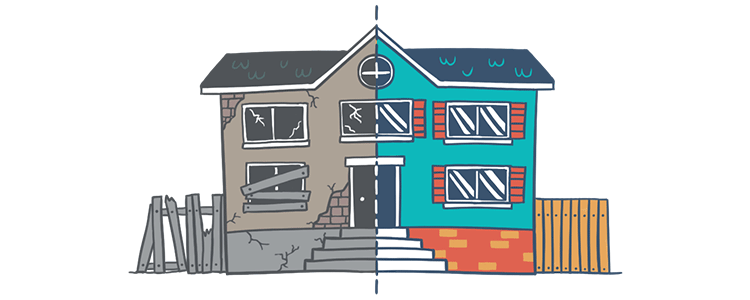

Are you 18 years old and looking for information on how to get a rehabilitation mortgage? Well, you’ve come to the right place! In this article, you’ll learn the ins and outs of getting a rehabilitation mortgage, the benefits of doing so, and the steps you need to take to make it happen. With this information, you can make an informed decision on whether or not a rehabilitation mortgage is the right choice for you. So let’s get started!

Research lender requirements.

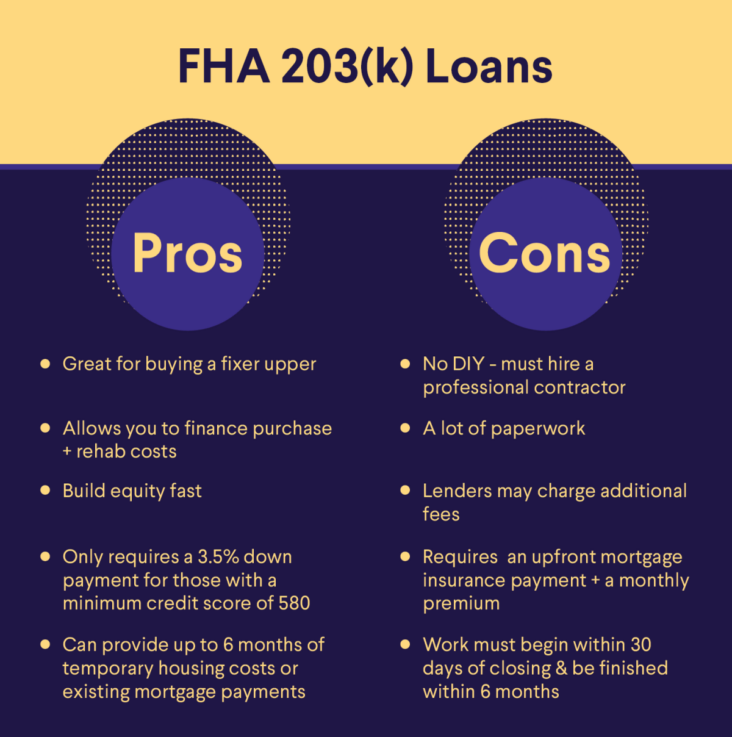

Researching lender requirements for a rehabilitation mortgage can be overwhelming. To make it easier, use online resources to compare different lenders and the requirements they have. Ask questions, such as what kind of mortgage they offer and what kind of credit score you need. Additionally, consider the interest rates and payment terms before making a decision. Doing your research will help you find the best lender for your needs.

Collect documents.

Collecting documents for a rehabilitation mortgage can be a daunting task. However, if you take it one step at a time, it can be fairly simple. Make sure you have your ID, proof of income, credit report, and any other documents the lender might request. Gather these documents and make copies of them for the lender. With a bit of organization and planning, you can get your rehabilitation mortgage in no time!

Consult mortgage broker.

.Consulting a mortgage broker is a great way to get started on your search for a rehabilitation mortgage. With a broker’s help, you can gain access to more loan options, compare rates, and get tailored advice to fit your specific needs. Plus, they can help you understand the loan process and make sure you get the best possible deal. It’s worth taking the time to talk to a mortgage broker before you make any decisions.

Apply for loan.

Applying for a rehabilitation mortgage loan can seem daunting, but with the right research, it’s totally doable! Start by getting pre-approved by a lender and collecting all the documents you need to make your case. Make sure you have a solid credit score and make sure to compare rates to get the best deal. Finally, make sure to ask as many questions as you need to feel comfortable before signing off on the loan.

Meet lender criteria.

When looking for a rehabilitation mortgage, it’s important to meet lender criteria. This usually includes having good credit, sufficient income, and enough funds to make a down payment. As an 18-year-old, it can seem like a daunting task, but with the right research and planning, you can meet the criteria and get the mortgage you need.

Submit application.

Submitting an application for a rehabilitation mortgage can be tricky, but it’s not impossible. All you need to do is find the right lender and submit the necessary paperwork. It’s helpful to have a co-signer or guarantor to help you get approved. Make sure to have all your documents ready such as bank statements, tax returns, credit reports, and proof of income. It also helps to have a good credit score to ensure your application is approved. Good luck!