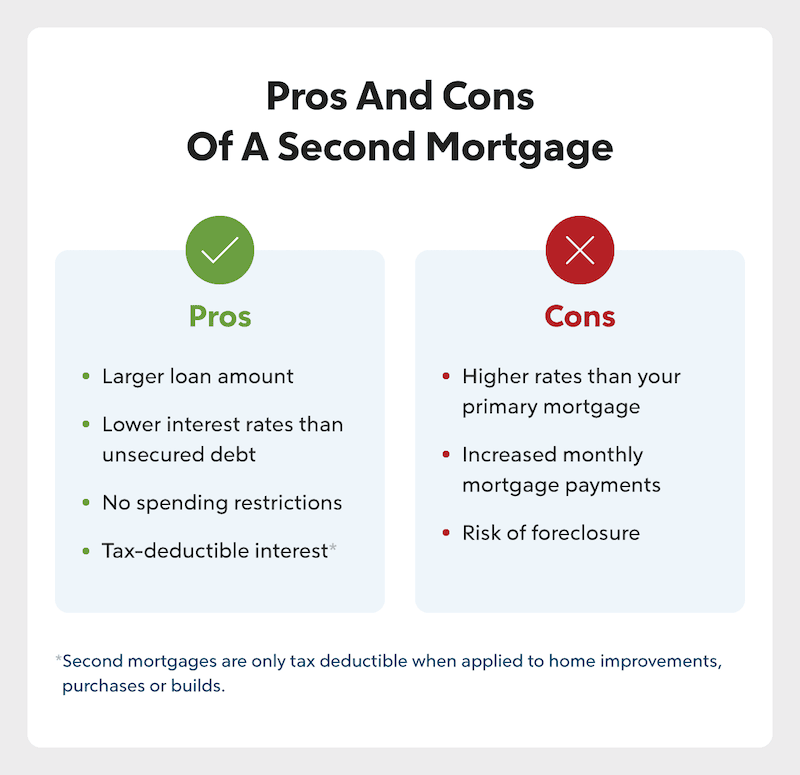

Are you looking to get a second mortgage to help you reach your financial goals? Taking out a second mortgage can be a great way to access the equity in your home and use it to pay for a variety of expenses. From making home improvements to consolidating debt, a second mortgage can be a very useful financial tool. In this article, we’ll discuss some of the important things you need to know before getting a second mortgage, including the requirements and the potential risks. Read on to learn more about how to get a second mortgage and make sure it’s the right move for you.

Research lenders

Researching lenders for a second mortgage can be a daunting task. It’s important to compare interest rates, fees, and terms from a variety of lenders to get the best deal. Don’t be afraid to negotiate with lenders to secure the best rate available.

Compare rates

Comparing rates for a second mortgage is an important step in the mortgage process. Different lenders offer different interest rates and terms so it’s important to shop around and compare rates before making a decision. Getting the best possible rate can save you money on your loan and help you access the funds you need.

Calculate affordability

Calculating affordability for a second mortgage requires careful consideration of your budget. It is important to take into account any additional costs that may be involved in securing a second mortgage, such as closing costs, fees, and interest rate. It is also important to make sure your current financial situation is stable and can support the additional monthly payments associated with a second mortgage.

Gather documents

Gathering documents is a key step in getting a second mortgage. You’ll need documents like pay stubs, bank statements, and tax returns to prove your financial standing. Get organized and be prepared to provide proof of your income and assets. Doing so will help ensure a smooth application process and increase your chances of getting the best rate possible.

Submit application

Submitting an application for a second mortgage can be a daunting task. Before beginning the process, it’s important to be sure you have all the required documents and information ready. Make sure the lender has your full financial picture – credit score, income, existing debts, and assets. Additionally, you may also be asked to provide proof of insurance, as well as bank statements and other supporting documents. Once you have everything ready, you can begin the application process.

Receive approval

Once you have completed the necessary paperwork, it is time to receive approval for your second mortgage. This process involves submitting your documents to a lender and waiting for them to review and approve your request. Keep in mind that this process can take a few weeks so make sure to plan accordingly.