Are you looking for a mortgage that can adjust to your ever-changing needs? A Graduated Payment Mortgage, or GPM, could be the perfect solution for you. A GPM mortgage allows you to make lower payments at the beginning of the loan period, with the payments increasing gradually over time. This type of mortgage can provide much-needed flexibility and help you manage your finances in a way that works best for you. In this comprehensive guide, we’ll explain everything you need to know about GPM mortgages, including the pros and cons, eligibility requirements, and more.

Overview of Graduated Payment Mortgages

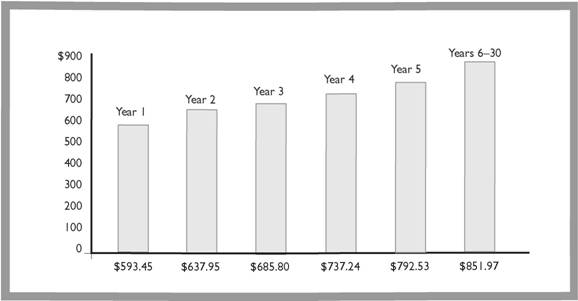

A Graduated Payment Mortgage (GPM) is a great option for those looking for a mortgage with a low down payment, but one that can adjust over the life of the loan. With a GPM, the payments start low and then increase by a predetermined amount each year. This makes it easier to manage your payments since they are adjustable and can fit your budget. The great thing about GPMs is that they can be used for both primary residences and investment properties. Plus, you can use a GPM to purchase a new home or refinance an existing one. So, if you’re looking for a mortgage that won’t break the bank, a GPM could be the perfect fit for you.

Benefits of Graduated Payment Mortgages

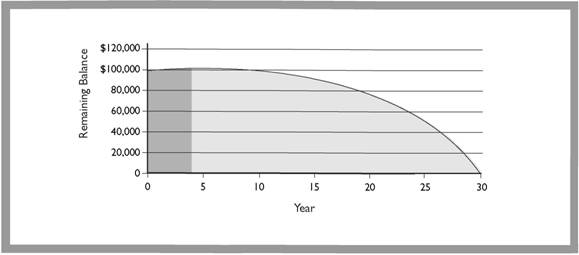

Graduated payment mortgages are an awesome way to get into a home without breaking the bank. They offer a number of great benefits that make them a great option for first time homebuyers or those who are on a tight budget. One of the most attractive benefits of a graduated payment mortgage is that it allows you to start with a lower payment and then gradually increase it over time as your income increases. This makes it an ideal loan option if you’re expecting to see a bump in your salary or other income in the future. Plus, many lenders offer flexible payment plans that let you adjust the amount of your payment or the length of the loan if you need to. Another great benefit of a graduated payment mortgage is that it’s a great way to build equity faster. With the lower initial payments, you’ll have more money left over each month to put towards principal, which can help you build equity faster. And since you’ll be paying off the principal faster, you can build equity more quickly and be in a better position to refinance or sell your home in the future.

How to Choose the Right Graduated Payment Mortgage

When it comes to choosing the right graduated payment mortgage, there are a few key things to consider. First, think about how long you plan on staying in the home. If you’re looking for a short-term solution, then a graduated payment mortgage might not be the best choice. On the other hand, if you’re looking to stay in the home long-term, then a graduated payment mortgage could be a great way to save on interest and get more equity in the home over time. Additionally, it’s important to make sure you understand the terms and conditions of the loan, as well as any potential fees or penalties associated with the mortgage. Lastly, make sure to compare rates from a few different lenders to ensure you’re getting the best deal possible. By doing your research and considering all your options, you’ll be able to find the right graduated payment mortgage for you and your financial needs.

Common Questions and Answers about Graduated Payment Mortgages

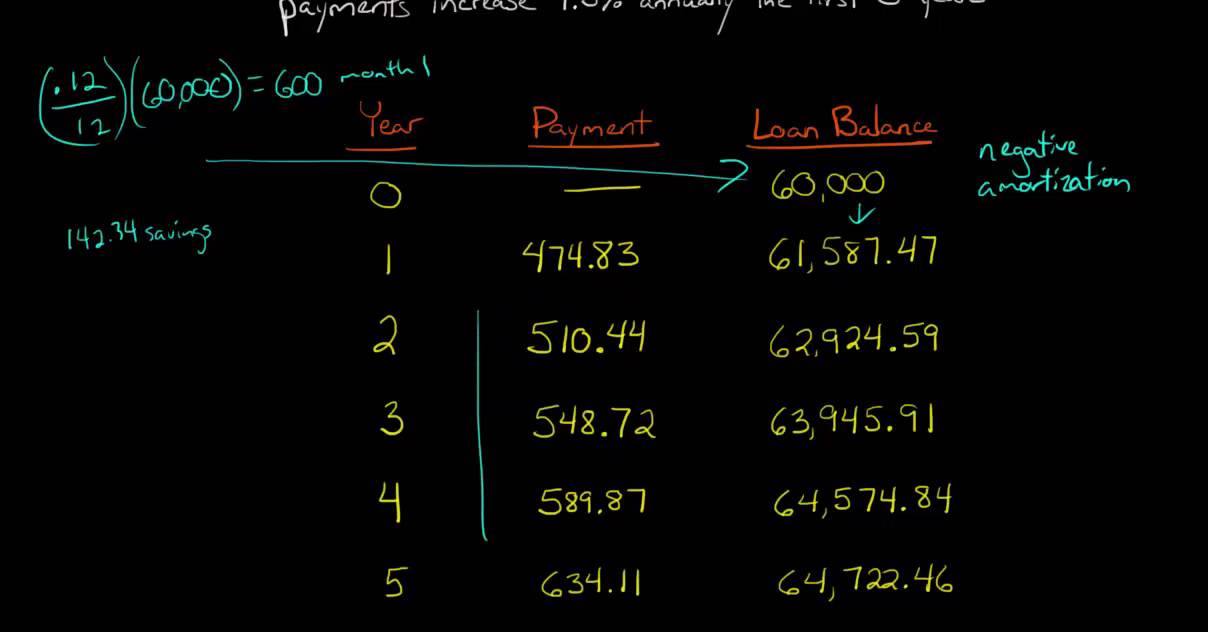

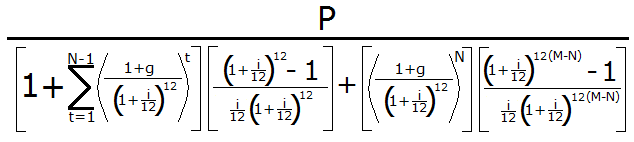

Graduated payment mortgages (GPMs) can seem a bit complicated and intimidating, but they don’t have to be! A GPM is a type of mortgage where the payments start low and increase over time. This type of mortgage can be a great way to keep your payments low in the beginning while also helping to build equity and prepare you for larger payments down the road. With the right information and guidance, GPMs can be a great financial tool for anyone looking to own a home. Common questions about GPMs include how long the payments remain low, what happens when the payments increase, and what flexibility the borrower has when it comes to mortgage payments. The answers to these questions depend on the individual lender, but most GPMs have payments that remain low for the first few years before increasing. The payments can increase at a set rate or can increase based on other factors such as changes in the income or interest rate. Borrowers usually have some flexibility when it comes to making payments, such as the ability to make larger payments when possible or to switch to a fixed-rate mortgage when the payments start to increase. With the right information and guidance, GPMs can be a great way to help you achieve homeownership.

Tips to Avoid Plagiarism When Writing About Graduated Payment Mortgages

:When writing about graduated payment mortgages, it’s important not to plagiarize. Plagiarism is taking someone else’s work and passing it off as your own. To avoid plagiarism, make sure to cite any sources you use and give credit where it’s due. Don’t just copy and paste information from other sources, instead summarize and explain the information in your own words. Additionally, use a plagiarism checker before you submit your work. This will help make sure all of your content is original and not copied from somewhere else. Having original content is key to making sure you can trust the information you’re presenting to your readers. With these tips, you can avoid plagiarism and write content that is completely original.