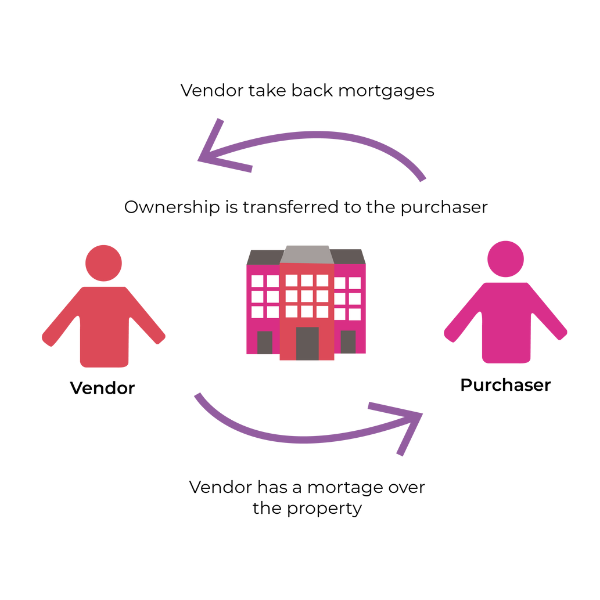

A Seller take-back mortgage, also known as a “seller-financed” mortgage, is an alternative to traditional lending that allows a seller to provide part or all of the financing for a home purchase. It can be a great option for buyers who can’t get traditional financing, or who need to purchase a home quickly. With a Seller take-back mortgage, buyers can save money, get a better interest rate, and purchase a home with less hassle. Read on to learn more about Seller take-back mortgages and why they might be a good fit for you.

What Are the Benefits of Seller Take-Back Mortgages?

Seller take-back mortgages are an attractive option for buyers and sellers who are looking for a flexible financing solution. Not only do seller take-back mortgages offer buyers the ability to purchase a property without having to go through the traditional mortgage process, but they also provide sellers with an attractive way to make a sale without having to wait for a bank to approve the loan. One of the biggest benefits of seller take-back mortgages is that they reduce the risk of a buyer defaulting on their loan, since the seller is essentially guaranteeing the loan. Additionally, seller take-back mortgages can be tailored to fit both the buyer and the seller’s needs, allowing them to create an agreement that works best for them. Finally, seller take-back mortgages can be a great way to avoid closing costs, which can add up quickly. With all these advantages, it’s no wonder why seller take-back mortgages are becoming increasingly popular.

Is a Seller Take-Back Mortgage Right For You?

Is a seller take-back mortgage right for you? This is a great question to ask yourself before committing to this type of loan. A seller take-back mortgage can be a great way to buy a home without having to deal with a traditional lender. However, it is important to understand the risks associated with this type of loan. For example, you may not have the same protection you would with a traditional mortgage, including the ability to refinance or modify the loan in the future. Additionally, you may not have the same access to tax deductions and other benefits. It is also important to consider the long-term implications, such as the fact that the seller may still have a claim on the property if you default on the loan. Ultimately, it is important to do your research and understand the pros and cons of a seller take-back mortgage before making a decision.

Understanding the Terms of a Seller Take-Back Mortgage

A seller take-back mortgage is a great way for a seller to get their property sold quickly. It allows the seller to act as the lender and provide the buyer with a loan for the purchase of the property. This type of loan has some special terms that buyers should understand before agreeing to it. Firstly, the seller will usually require the buyer to put a down payment of at least 10-20% of the purchase price. Secondly, the interest rate on the loan is usually higher than what a buyer could get from a traditional lender. Lastly, the seller may require the buyer to make periodic payments to the seller, often with balloon payments due at the end of the term. Knowing the details of a seller take-back mortgage can help buyers make an informed decision when considering this type of loan.

How to Qualify For a Seller Take-Back Mortgage

So, you’re interested in a seller take-back mortgage, but how do you qualify? Well, the process is fairly simple. First, you need to be pre-approved by a lender and demonstrate to the seller that you have the financial capacity to take out the loan. You also need to make sure your credit score is in good standing. Additionally, you’ll need to provide proof of stable employment as well as proof of income. Last, but not least, you should have a down payment of at least 10% of the purchase price. Taking these steps will help ensure that you get the best deal possible when it comes to a seller take-back mortgage.

Seller Take-Back Mortgages: Risks and Challenges

When considering a seller take-back mortgage, it’s important to be aware of the risks and challenges. One of the most common challenges is that the seller may not have enough money to pay back the mortgage if the buyer defaults. Additionally, there is a risk of the seller overcharging the buyer for the mortgage amount, as they may not be aware of current market rates. As a result, it’s important to do your research and shop around when looking for a seller take-back mortgage. It’s also important to consult with a qualified professional to ensure you understand the risks and challenges associated with this type of mortgage. Doing your due diligence can save you from potential financial and legal headaches down the line.