Reverse annuity mortgages are becoming increasingly popular as a way to fund retirement living expenses. They provide seniors with the ability to access the equity in their home without having to sell it, giving them the financial freedom to stay in their homes and enjoy their golden years. With a reverse annuity mortgage, seniors can convert some of the equity in their home into a steady stream of income, while continuing to own and live in their home. This guide will explain how reverse annuity mortgages work and the advantages and disadvantages of using them.

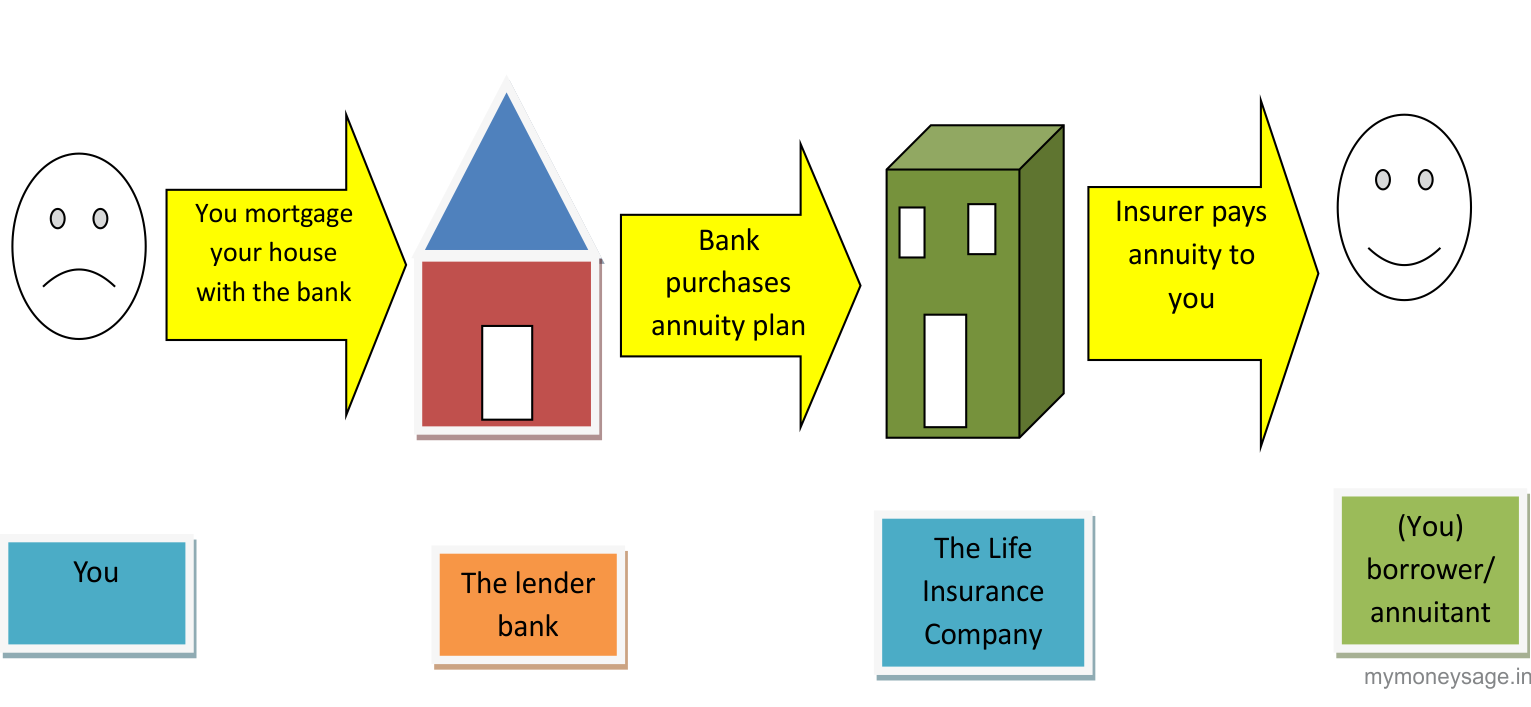

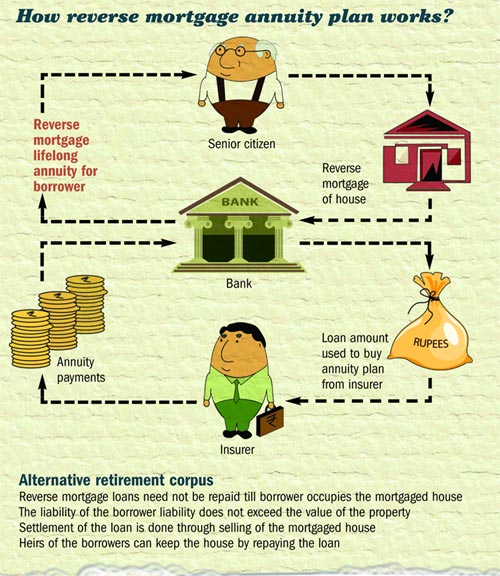

Overview of Reverse Annuity Mortgages: What They are and How They Work

Reverse annuity mortgages (RAMs) are a great way to tap into the equity of your home and use it for retirement or other financial needs. RAMs are a type of loan in which a lender pays the borrower a set amount each month in exchange for a portion of the equity in the borrower’s home. Unlike other loans, there is no monthly repayment required. Instead, the borrower receives a monthly payment, and the lender recovers their investment when the loan is paid off, usually upon the borrower’s death or the sale of the home. With a RAM, the borrower gets the cash they need now and can use it to supplement their income or pay for long-term care. Plus, the loan is secured by the home, so the borrower is not at risk of default. RAMs can be a great way for seniors to enjoy financial freedom in their retirement years.

Benefits of Reverse Annuity Mortgages

Reverse annuity mortgages are an amazing financial tool that can help retirees take advantage of their home equity to secure a steady source of income. There are many benefits to taking out a reverse annuity mortgage, including the fact that it doesn’t require any monthly payments. Instead, the lender collects a portion of the home’s equity and the borrower is able to access the remaining funds as a lump sum or as a steady stream of income. With a reverse annuity mortgage, the borrower doesn’t need to worry about interest payments or any other fees associated with a traditional mortgage. Plus, the funds are only taken out as they’re needed, so the borrower can keep the rest of their equity for retirement. Additionally, the funds can be used for any purpose and the lender will never take ownership of the home, so the borrower can keep the peace of mind that their home is safe. Ultimately, reverse annuity mortgages offer retirees and other homeowners a convenient way to access their home equity in order to supplement their income.

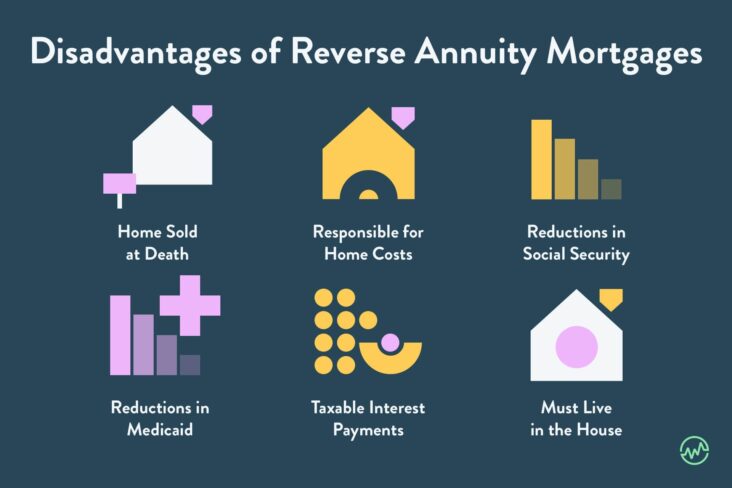

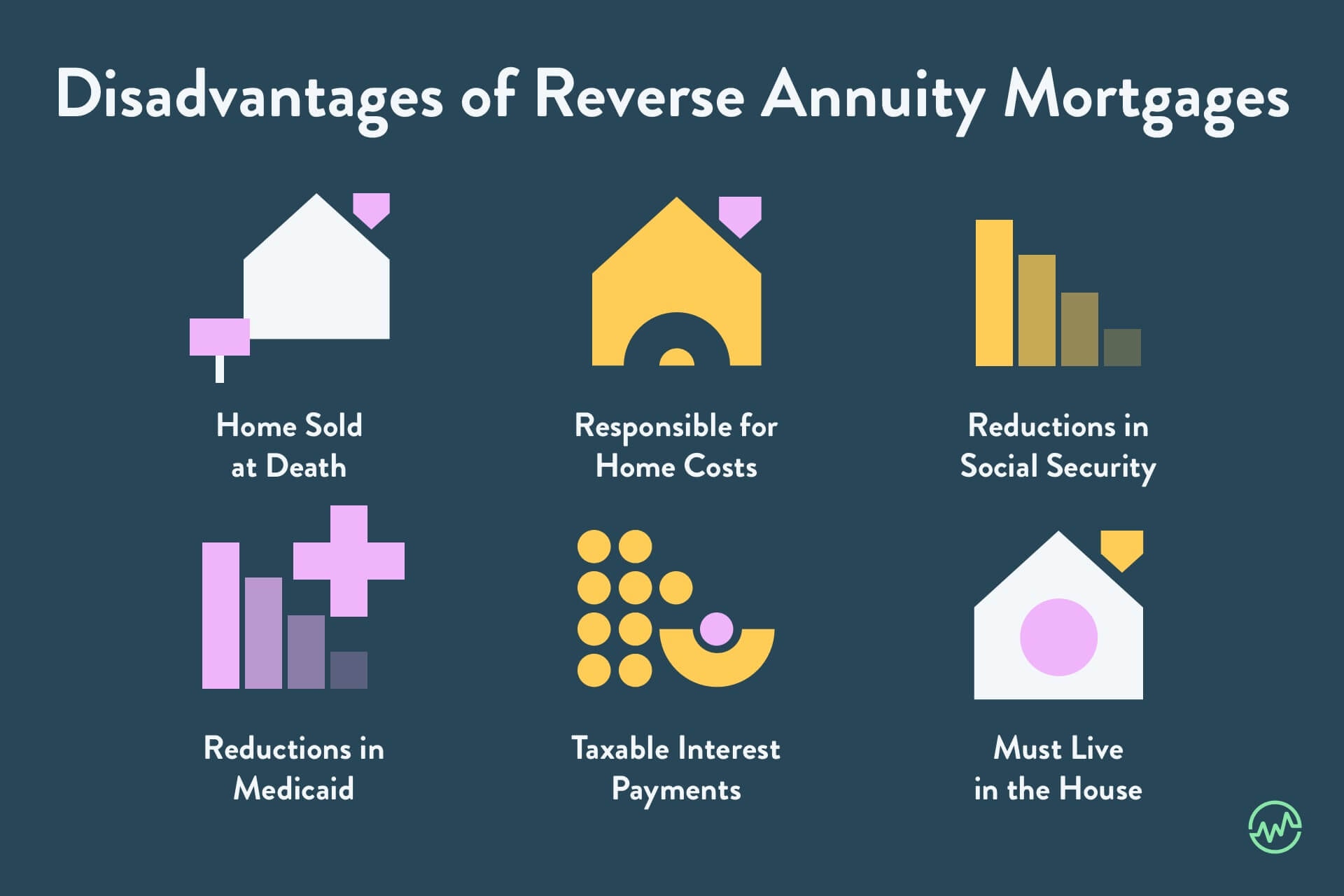

Disadvantages of Reverse Annuity Mortgages

Reverse annuity mortgages can be a great way to leverage the equity in your home, but there are some significant disadvantages that should be considered. One of the biggest drawbacks of reverse annuity mortgages is the fact that they can be very expensive. Because the loan is based on the amount of equity in your home, it can be very expensive to pay back. There is also the risk of outliving the loan, as the loan is only given out until the borrower reaches a certain age. Additionally, the interest rate on a reverse annuity mortgage can be higher than traditional mortgages, so it’s important to make sure you understand all of the terms and conditions before signing any contracts. Finally, reverse annuity mortgages can also be difficult to qualify for, as lenders will look at your credit score and financial situation before approving you for the loan.

Qualifying for a Reverse Annuity Mortgage

Qualifying for a Reverse Annuity Mortgage can be a little tricky, so it’s important to know what you need to do to make sure you’re eligible. The most important thing to remember is that you must be at least 62 years old, and own your home outright or have a small mortgage balance. You must also have a steady source of income, whether that be Social Security, pension payments, or other income sources. It’s also important to have a good credit score and a financial situation that shows you can handle the loan payments. To make sure you qualify, it’s a good idea to talk to a financial advisor or a qualified loan officer to find out if a Reverse Annuity Mortgage is right for you.

Alternatives to Reverse Annuity Mortgages

Reverse annuity mortgages (RAMs) might not be the best option for everyone. Depending on your situation, you might want to consider other alternatives. One of the more popular alternatives is a home equity loan. A home equity loan allows you to borrow money against the value of your home, without having to sell it. You can use the money to pay off debts, finance home improvements, make large purchases, or use it for other purposes. Another option is a home equity line of credit (HELOC). This type of loan works much like a credit card, allowing you to borrow up to a certain amount and pay it back over time. Unlike a RAM, you don’t have to worry about your payments getting bigger over time. If you own a home, these options might be better for you than a RAM.