A hard money mortgage is a type of loan that may be the perfect solution for you if you are looking for an alternative financing option for your real estate project. This type of loan is not as widely known as traditional mortgages, but it can be an effective and reliable way to finance a real estate investment. Here, we’ll discuss the benefits of hard money mortgages, who is eligible for them and what you need to know when you are considering this type of loan.

What are the Benefits of a Hard Money Mortgage?

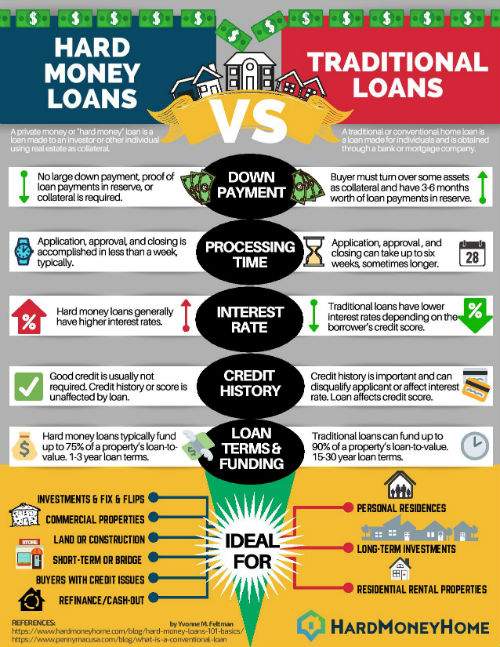

Hard money mortgages can be a great option for people who need to secure funding for a property purchase fast. There are so many benefits to taking out a hard money mortgage, like having access to funds quickly and the ability to get approved for larger amounts. Another great benefit is that hard money mortgages are often easier to be approved for than traditional mortgages, since the lender is more flexible and willing to provide funds for risky investments. Additionally, because these mortgages are secured against the property, you can often get lower interest rates than traditional mortgages. This makes it easier to pay back the loan and can help you save money over time. Finally, the terms of hard money mortgages are usually shorter than traditional mortgages, so you’ll have more freedom to invest in other properties or use the money for other purposes. All of these benefits make hard money mortgages a great option for those who need to secure funding quickly.

What are the Risks Associated with Hard Money Mortgages?

When it comes to hard money mortgages, there are a few risks you should know about. First, the interest rates are higher than traditional mortgages. This means that you’ll be paying more in interest over the course of the loan. Second, hard money lenders may require borrowers to pay hefty points up-front in order to secure the loan. Lastly, the loan term is usually shorter than a traditional mortgage, so you’ll need to pay off the loan quickly or risk defaulting on the loan. It’s important to weigh the risks of hard money mortgages with the benefits before deciding if it’s the right move for you.

How to Qualify For a Hard Money Mortgage?

If you’re looking to qualify for a hard money mortgage, you need to know what this type of loan is and how it differs from conventional mortgages. Hard money mortgages are short-term loans secured by real estate and typically used in situations when an asset is needed quickly and the borrower does not have perfect credit. To qualify for a hard money mortgage, you must have enough equity in the property to secure the loan, and you must have a source of income to repay the loan. Additionally, you must also provide a clear title that shows you are the rightful owner of the property. While the qualifications for a hard money mortgage can be strict, they are often more lenient than those of a conventional loan. If you meet the requirements, a hard money mortgage can be a great option for those who need to secure a loan quickly.

How to Find the Right Hard Money Lender?

Finding the right hard money lender can be tricky, but it’s essential for getting the best terms for your loan. The most important thing to consider is the lender’s reputation. Look for lenders with a proven track record of successful deals. You should also make sure they have experience in the specific type of loan you’re seeking. Additionally, you should read reviews from previous customers and make sure they have a positive rating. You can also ask friends and colleagues who have obtained similar loans for their recommendations. Finally, you should ensure that the lender is reputable and compliant with state and federal regulations. Taking your time to research the right lender can save you a lot of hassle and money in the long run.

How to Compare Hard Money Mortgage Rates?

Comparing hard money mortgage rates is essential if you want to make sure you’re getting the best deal. Before you start looking for a hard money mortgage, you should research different lenders and compare their rates to make sure you’re getting the best deal. Make sure to look at the total cost of the loan, not just the interest rate, to get a full picture of the loan. Consider factors like prepayment penalties, loan origination fees, and other fees that could add to the total cost of the loan. It’s also important to look at the terms of the loan, such as the length of the loan and what kind of collateral is required. By comparing all of these factors, you can make sure you’re getting the best hard money mortgage rate for your situation.