Are you looking to buy a home but don’t have the funds to cover the entire purchase upfront? Cross-collateralization mortgages may be the perfect solution for you. This type of loan allows homebuyers to use the equity in their existing property to secure a loan for the purchase of a second property. By utilizing this form of financing, buyers can minimize the amount of money they need to borrow and save money on interest payments. Read on to learn more about what is cross-collateralization mortgage and how it can help you purchase your dream home.

What Is Cross-Collateralization Mortgage?

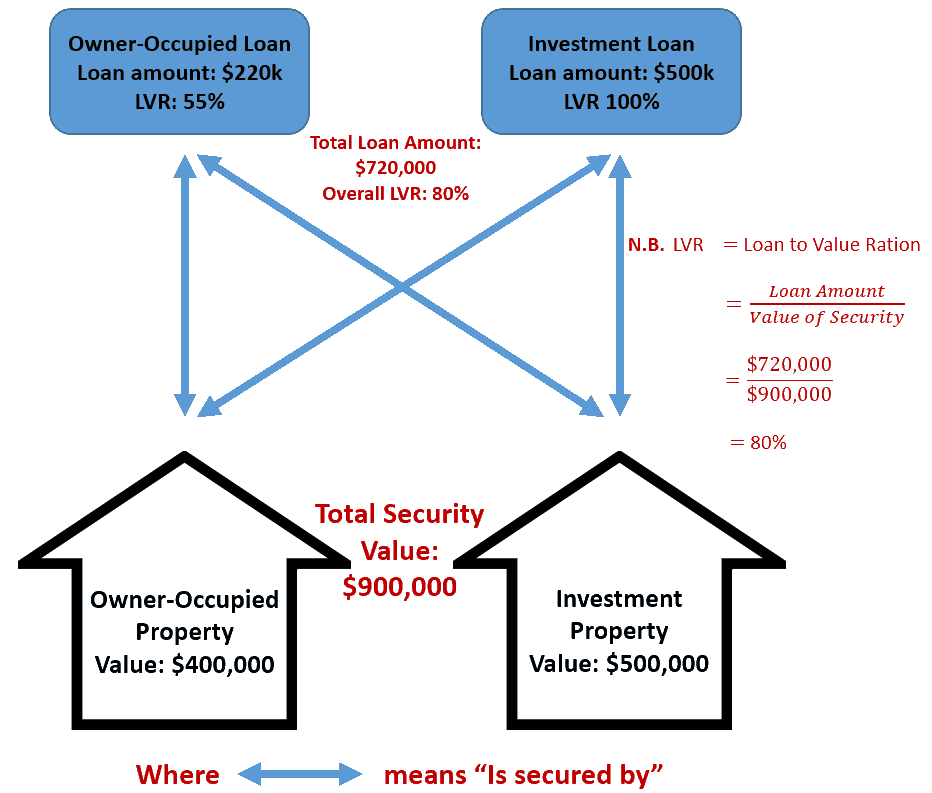

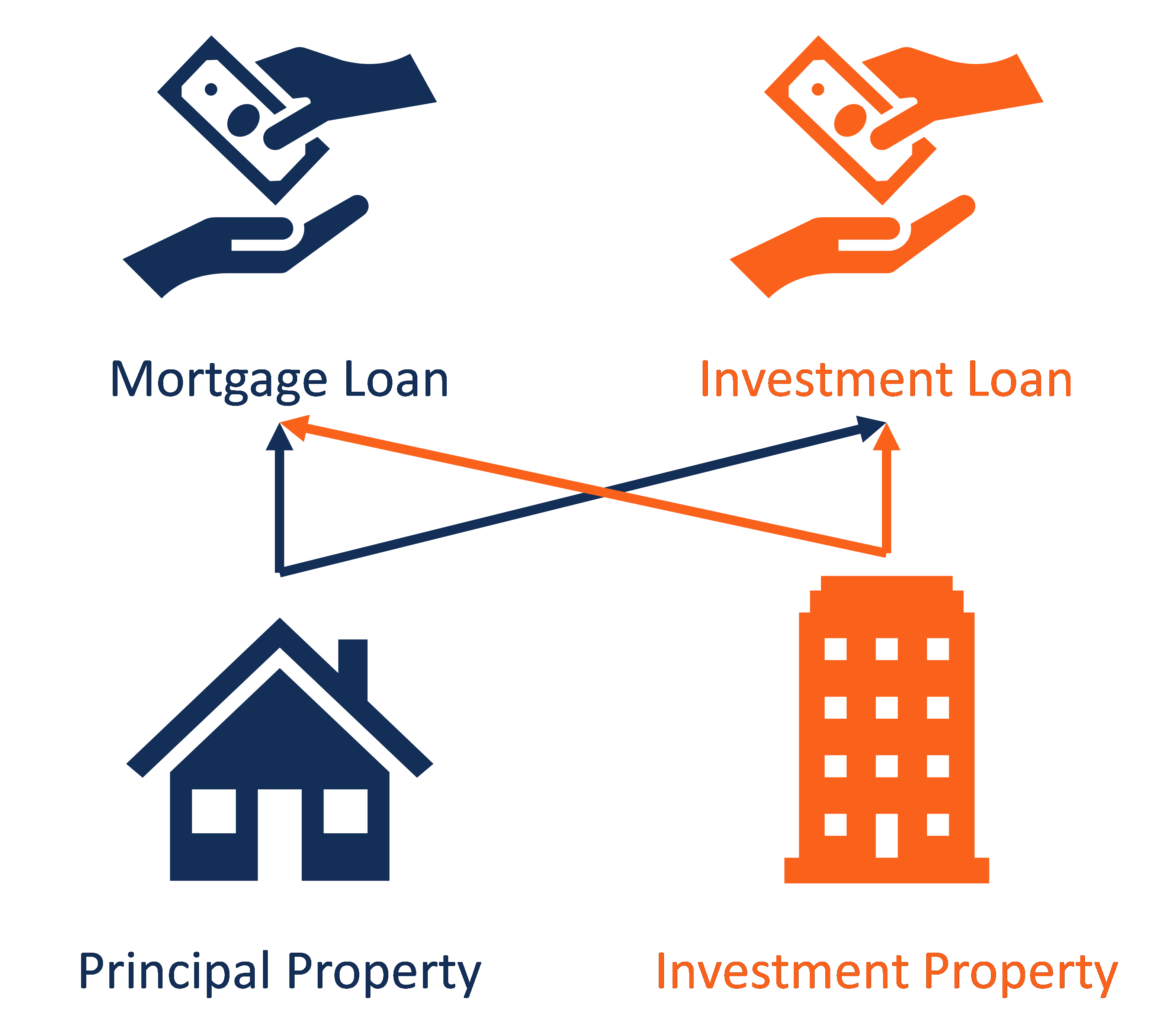

Cross-collateralization mortgage is one of the most popular forms of secured lending. It’s a way for lenders to protect themselves in the event of a borrower defaulting on their loan. With cross-collateralization, the lender can use multiple pieces of collateral to secure the loan. This means that if one piece of collateral fails to pay off the loan, the lender can use the other pieces of collateral to still be able to recover the money they have loaned out. Cross-collateralization can be used in any type of loan situation, whether it’s a home loan, car loan, business loan, or personal loan. It’s a great way to secure a loan and give the lender peace of mind that they won’t be left holding the bag if the borrower fails to pay.

Benefits of Cross-Collateralization Mortgage

Cross-collateralization mortgages are a great option for those looking to get more out of their money. Not only do they allow for more flexibility when it comes to loan amounts and repayment options, but they also offer a number of benefits to those who take advantage of them. One of the biggest benefits of cross-collateralization mortgages is that they can help borrowers secure a lower interest rate. By using two assets as collateral on a loan, lenders can offer more favorable terms, allowing borrowers to save money over time. Additionally, cross-collateralization mortgages can help borrowers reduce their overall loan amount by using the value of the assets as leverage. This can be especially beneficial for those who are looking to reduce their loan balance as quickly as possible. In addition to lower interest rates and reduced loan amounts, cross-collateralization mortgages can also help borrowers to improve their credit score by demonstrating their ability to successfully manage debt. Lastly, by using two assets as collateral, borrowers can be more confident in their ability to access funds, should they need them. Cross-collateralization mortgages offer a great deal of flexibility and can be a great option for those looking to get more out of their money.

Factors to Consider Before Opting for Cross-Collateralization Mortgage

Cross-collateralization mortgages can be a great option for people who need a loan but don’t have enough collateral to secure it. However, it’s important to consider the potential risks before opting for this type of mortgage. One of the biggest risks is that if you fail to make your loan payments, the lender can take control of both the collateralized asset and the asset that was used to secure the loan. Additionally, if you default on the loan, the lender can sell the collateralized asset to help recover its losses. Lastly, if the value of the collateralized asset decreases, the lender may require additional collateral to secure the loan. As such, it’s important to make sure you’re able to make your loan payments before taking out a cross-collateralization mortgage.

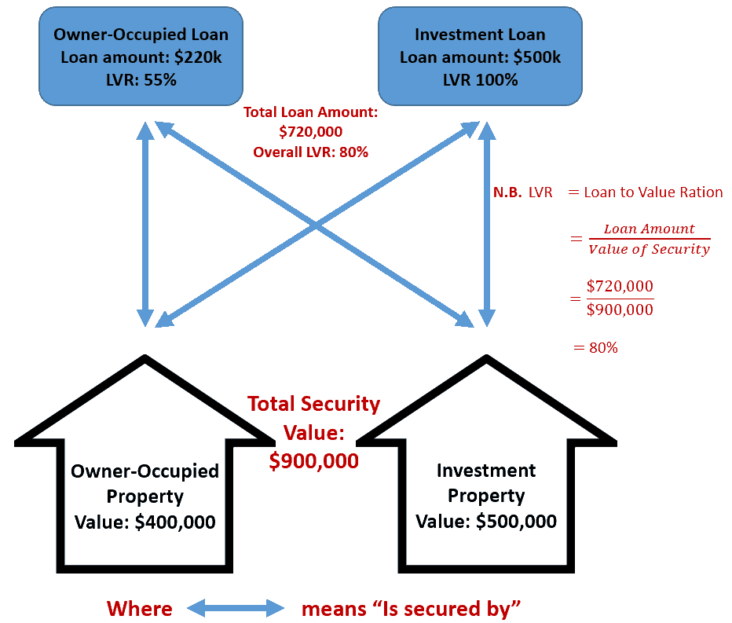

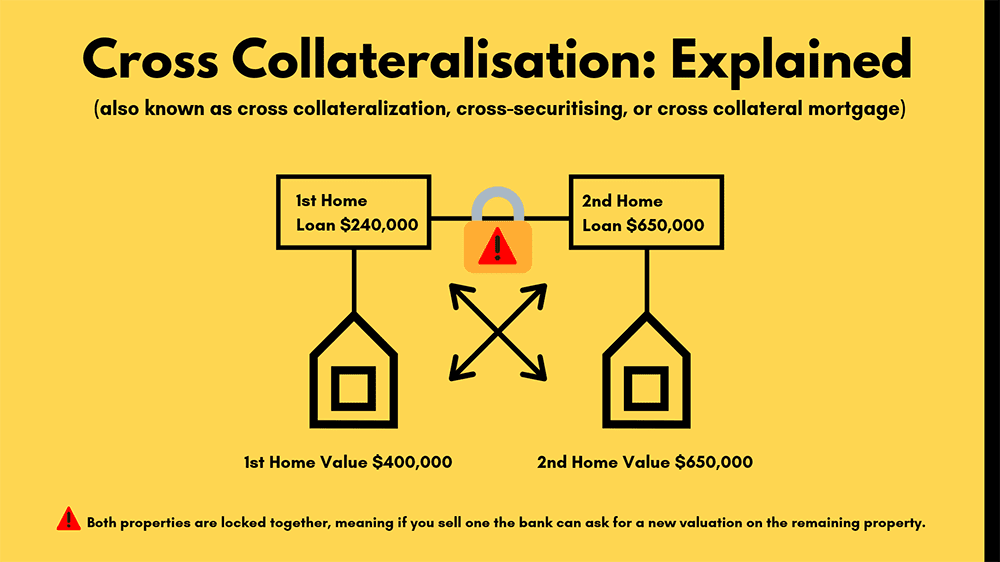

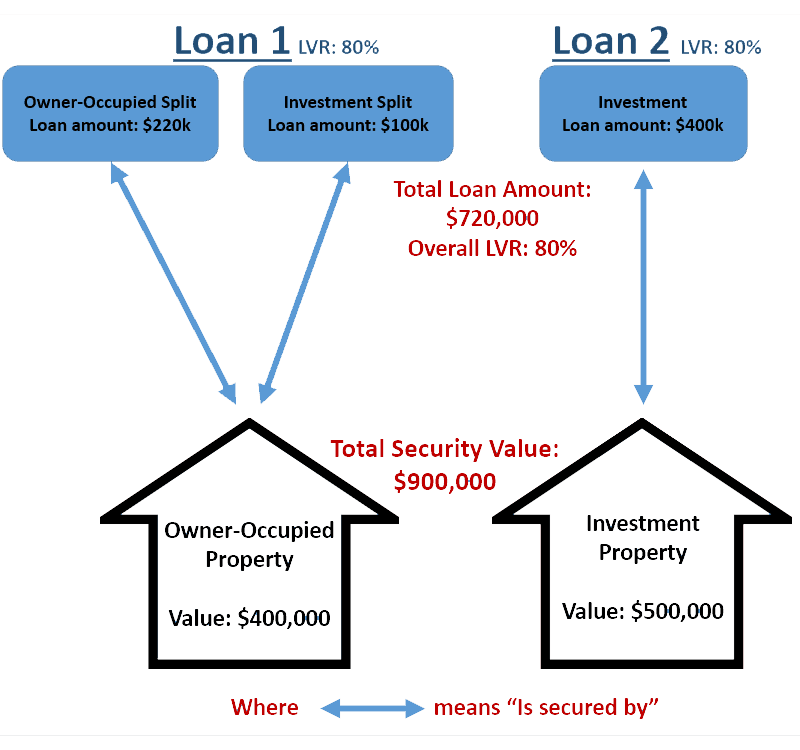

How to Calculate Cross-Collateralization Mortgage?

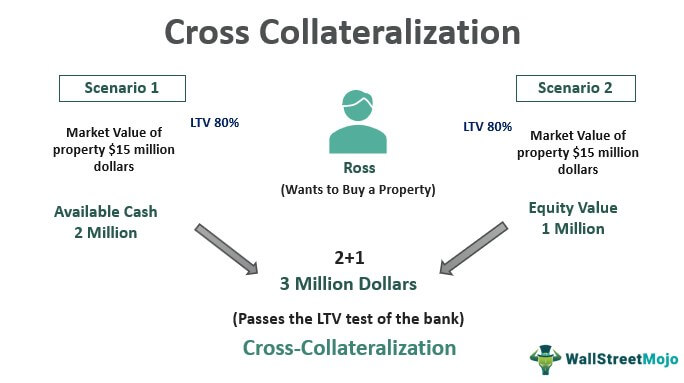

Calculating a cross collateralization mortgage is pretty simple. All you need to do is figure out the value of the collateral you’re using to secure the loan. To do this, you’ll need to add up the value of all the collateral you’re using and then add any fees associated with the loan. Once you have that total, you can figure out your loan amount by subtracting out any fees and other costs associated with the loan. Once you have your loan amount, you can then use that figure to figure out your monthly payment amounts, interest rates, and other loan details. Calculating cross collateralization is important if you want to make sure you’re getting the best rate and terms for your loan. So, make sure to do the math before you sign on the dotted line!

Pros and Cons of Cross-Collateralization Mortgage

Cross-collateralization mortgages can be a great way to borrow money, but there are some pros and cons to consider before taking out this type of loan. On the plus side, cross-collateralization allows borrowers to access a larger loan amount than if they were to just use the equity in one property. This can be beneficial if you want to finance a large purchase or investment. Additionally, cross-collateralization can be used to secure a lower interest rate on the loan. On the downside, cross-collateralization can be risky because if you are unable to pay back the loan, the lender can seize both properties. This can be a major financial setback and leave you without a place to live or use as an investment. Additionally, cross-collateralization can be more expensive due to the higher interest rate associated with the loan and added costs such as closing costs and legal fees. Therefore, it is important to weigh the pros and cons of cross-collateralization mortgages before taking out a loan to make sure it is the right decision for your financial situation.