A commercial mortgage is a loan that is used to purchase or refinance an income-producing property, such as an office building, apartment building, retail space, industrial facility, or other real estate investment. Commercial mortgages are typically more difficult to obtain than residential mortgages, as they typically require greater down payments, have shorter loan terms, and the lender may require a personal guarantee from the borrower. Understanding the ins and outs of commercial mortgages can help you decide if this type of financing is the right fit for your business.

Understanding Commercial Mortgages: What They Are and How They Work

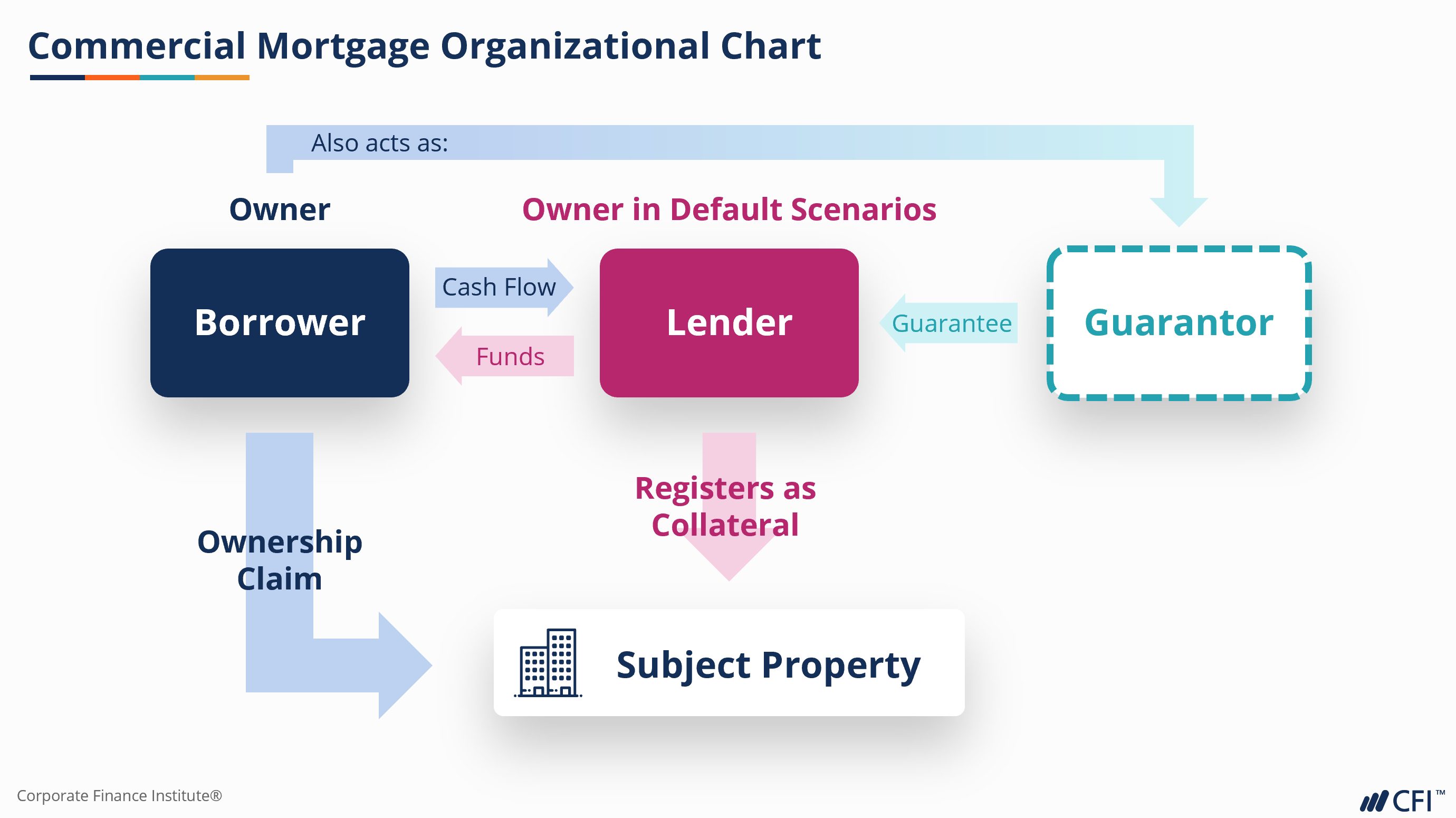

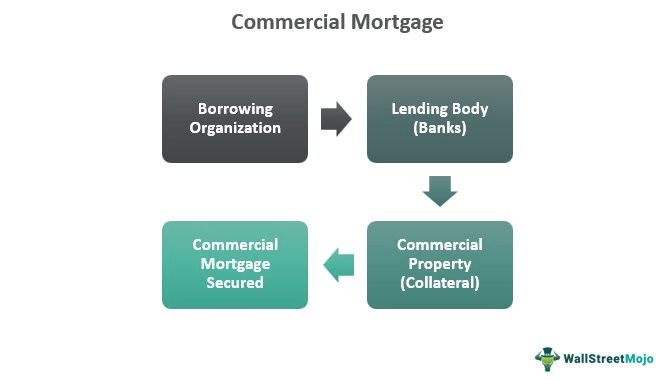

When it comes to commercial mortgages, it’s important to know what they are and how they work. A commercial mortgage is basically a loan taken out by a business to purchase a property. This loan is secured against the commercial property and is typically used to purchase, refinance, or redevelop commercial real estate. The loan can be used to purchase land, a building, or other business-related assets. Commercial mortgages come with a variety of different terms, and the loan can be from a bank, a lender, or a private investor. Depending on the loan terms, the borrower may be responsible for making a down payment and paying interest, as well as additional fees. Knowing how commercial mortgages work can help you make the best decision when it comes to financing your business.

The Benefits of Investing in a Commercial Mortgage

Investing in a commercial mortgage can be a great way to reap the benefits of a lucrative real estate market without the hassles of managing a traditional residential property. Commercial mortgages provide a steady and reliable stream of income, as well as long-term appreciation potential. Additionally, you can often get access to loans with lower interest rates and higher loan-to-value ratios than with residential mortgages, allowing for more flexibility in your investments. With a commercial mortgage, you have the potential to increase your income and build a portfolio of real estate investments that can pay handsome returns for years to come.

Qualifying for a Commercial Mortgage: Requirements and Tips

When it comes to qualifying for a commercial mortgage, there are several requirements to be aware of. First and foremost, you will need to have a strong credit score and financial portfolio. Your credit score should be well above 650, and your financial portfolio should be able to demonstrate that you can handle the loan repayment. Additionally, you will need to provide proof of income and assets, such as tax returns and bank statements. Finally, you should also be able to prove that you have sufficient collateral to secure the loan. These tips will help you maximize your chances of getting approved for a commercial mortgage, so make sure to do your research and get all of your documents in order before applying.

Calculating the Costs of a Commercial Mortgage

Having a good understanding of the costs of a commercial mortgage is essential when taking out a loan. A commercial mortgage loan typically has a higher interest rate than a residential mortgage, so it is important to crunch the numbers and understand how much you will be paying back when taking out a loan. It is also important to factor in other costs such as appraisal fees, loan origination fees, and closing costs. Calculating the total cost of a commercial mortgage can be a difficult process. It is important to take into account all the fees and interest associated with the loan to get a good idea of what to expect when taking out a commercial mortgage loan. Doing your research and getting multiple quotes from different lenders is a great way to ensure that you get the best deal and the best rate possible.

Finding the Right Lender for Your Commercial Mortgage Needs

Finding the right lender for your commercial mortgage needs can be tricky. You need to make sure that the lender you choose is experienced and knowledgeable about the commercial mortgage space so that you can get the best rates and terms possible. The key is to do your research and get multiple quotes to compare. Make sure to ask questions about the lender’s experience, customer service, and fees. You should also make sure that the lender is willing to work with you to customize a loan that fits your needs. Doing your due diligence will help ensure that you get the best commercial mortgage for your business.