Are you considering applying for a mortgage? Have you heard of a mortgage underwriter but aren’t sure what they do or how they can help? A mortgage underwriter is a professional who is responsible for assessing and approving or denying mortgage applications. They are an integral part of the mortgage process, as they ensure that borrowers meet the requirements to receive a loan. In this article we’ll explore what mortgage underwriters do, how they review applications, and what you need to know when applying for a mortgage.

What Does a Mortgage Underwriter Do?

A Mortgage Underwriter plays a crucial role in the loan approval process. They review the borrower’s loan application to determine if they meet the lender’s requirements. They examine all the documents associated with the loan application, such as income, credit reports, bank statements, and other financial information. The underwriter also verifies the accuracy of the information in the loan application and makes sure it complies with the lender’s guidelines. They assess the borrower’s creditworthiness and determine the ability of the borrower to repay the loan. The underwriter also evaluates the property being purchased to ensure it meets the lender’s standards. Once the underwriter has reviewed all the information, they will either approve or deny the loan application. If the loan is approved, the underwriter will issue an approval letter, which will contain the terms and conditions of the loan. The underwriter is an important part of the loan process and plays a key role in determining whether or not a loan will be approved.

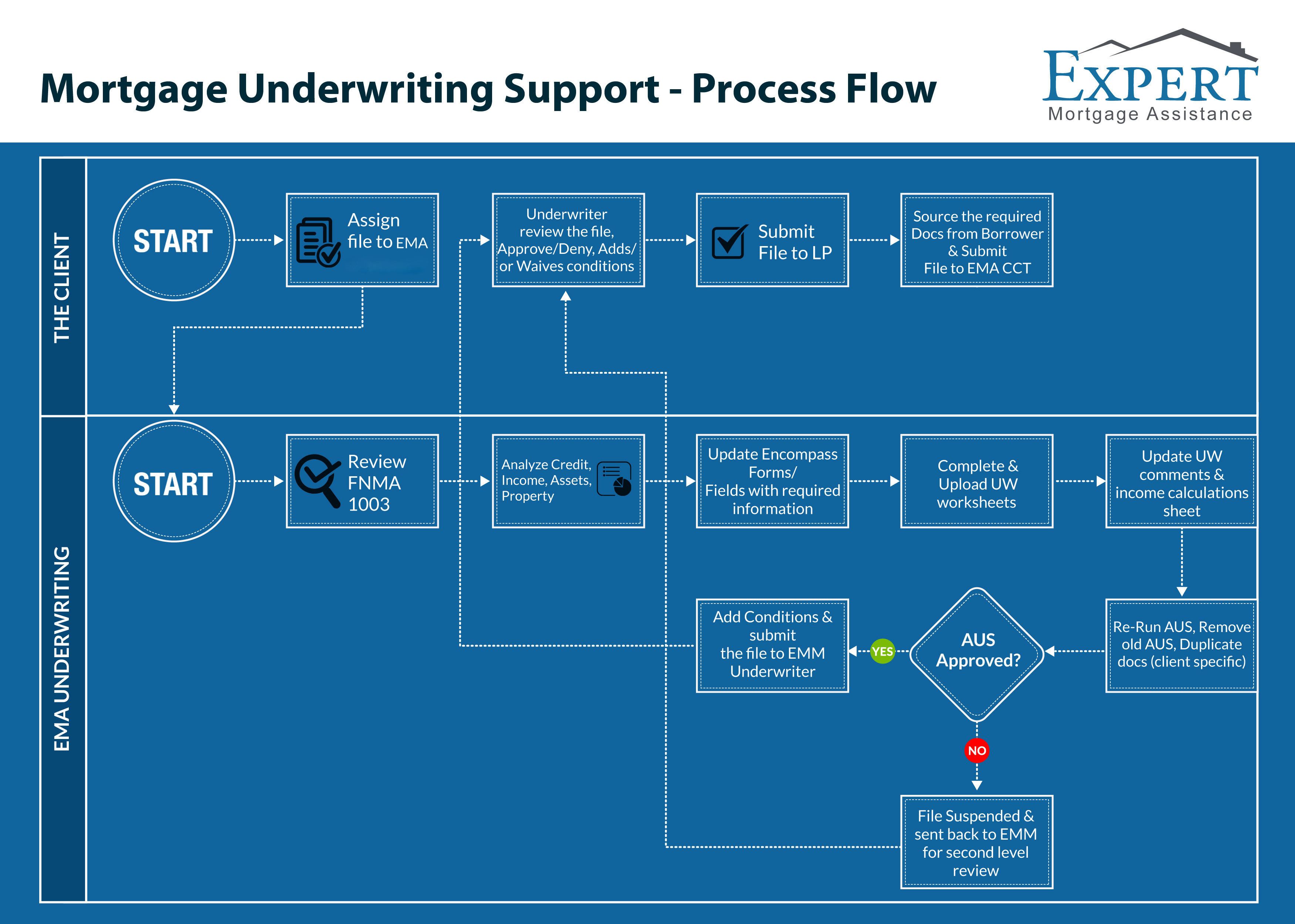

The Steps of the Mortgage Underwriting Process

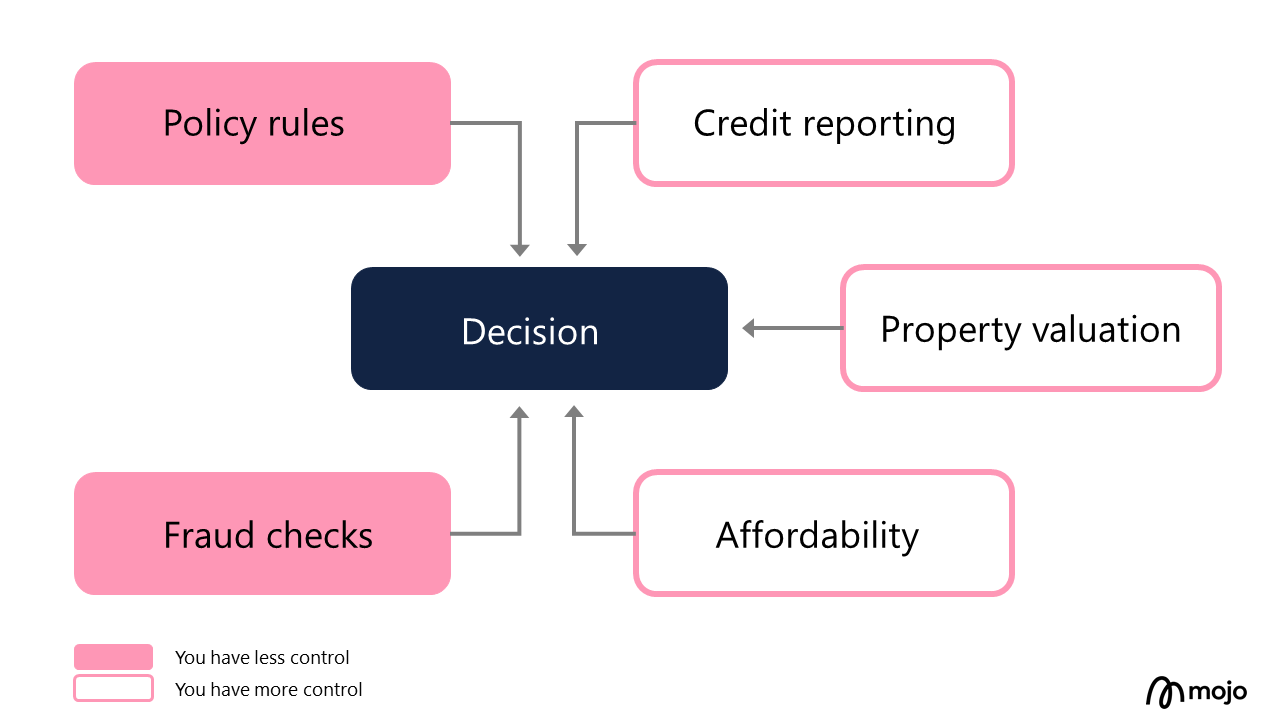

The mortgage underwriting process is an essential part of obtaining a mortgage loan. It’s the process by which a lender evaluates the loan application and decides whether or not to approve it. The process consists of four main steps. The first step is a preliminary review. During this step, the lender will look at the loan application and credit reports of the borrower to determine whether the borrower is qualified for the loan. The lender will also look at the borrower’s income and assets to determine if they can afford the loan. The second step is a verification of the borrower’s information. The lender will verify the borrower’s employment, assets, income, and other information provided on the loan application. This step is important to make sure the borrower is being truthful about their circumstances. The third step is to calculate the borrower’s debt-to-income ratio. The debt-to-income ratio is an important factor in determining whether or not the borrower can afford the loan. The lender will consider the borrower’s monthly debt payments and compare them to their monthly income to determine the ratio. The fourth step is to make a decision. The lender will review the borrower’

Qualifications for Becoming a Mortgage Underwriter

In order to become a successful mortgage underwriter, there are certain qualifications that must be met. Candidates must have a strong understanding of the loan process and be knowledgeable in topics such as credit, income, and assets. This includes having a degree in finance, banking, accounting, or a related field. Additionally, experience in the banking industry, customer service, or loan processing is highly beneficial. Mortgage underwriters must also possess excellent written and verbal communication skills and be able to present information in a clear and concise manner. Furthermore, they must demonstrate a high level of attention to detail, be able to work independently and efficiently, and have the ability to work quickly and accurately. Finally, knowledge of the mortgage underwriting software, tools, and technologies is essential for success in this role. To ensure the best possible results, mortgage underwriters must possess the qualifications listed above and demonstrate their commitment to the job.

How Automated Underwriting Systems Impact the Mortgage Industry

The development of automated underwriting systems has drastically changed the way mortgage lenders evaluate and approve loan applications. Automated underwriting systems use algorithms to analyze a borrower’s financial information and credit score to determine their eligibility for a loan. These systems use complex scoring models to assess a borrower’s risk and calculate their ability to repay a loan. This helps lenders make more accurate and efficient decisions when approving mortgage applications. Automated underwriting systems provide lenders with a much faster and more accurate way to evaluate and approve loan applications, resulting in faster closings and a higher rate of loan approvals. In addition, these systems help lenders comply with industry regulations and reduce the risks associated with lending. Automated underwriting systems also play a role in reducing the overall cost of mortgage loans, by streamlining the application process and eliminating unnecessary paperwork. By taking advantage of automated underwriting systems, mortgage lenders are able to provide borrowers with a more efficient and cost-effective way to secure a loan.

The Benefits of Working as a Mortgage Underwriter

Working as a Mortgage Underwriter can offer a variety of great benefits that can make it a career path worth considering. One of the main benefits of working as a Mortgage Underwriter is the potential for career growth. This role offers a variety of opportunities for advancement, including potential promotions to higher-level positions such as Senior Mortgage Underwriter or Loan Officer. Additionally, Mortgage Underwriters are often able to adjust their hours and work flexible schedules to better meet their lifestyle needs. The work of a Mortgage Underwriter is also a great way to enter the real estate and mortgage industry with a steady job. It’s a great way to learn the ins and outs of the industry, and further your ability to work with clients, lenders and more. Mortgage Underwriters are essential to the mortgage process, and are the last step in ensuring that the loan process is accurate and valid. Additionally, the job offers competitive salary and benefits packages. Finally, Mortgage Underwriters have the opportunity to make a real difference in their clients’ lives by helping them to purchase their dream home. It’s a great way to give back and make a positive impact in the lives of others. All in all, a career as a Mortgage Underwriter can be a