If you are looking to buy a home, hiring a mortgage broker can be a great way to simplify the process. A mortgage broker is a professional who specializes in finding the best loan options for their clients. They have access to numerous lenders and are familiar with the terms, conditions, and requirements of each loan. With a mortgage broker on your side, you can rest assured that you are getting the best deal possible and avoid any potential pitfalls.

An Overview of Mortgage Brokers

Mortgage brokers are important professionals in the home-buying process. They specialize in finding the right home loan for borrowers and helping them navigate the complicated and often confusing process. In order to become a mortgage broker, one must complete a certification program and pass a licensing exam. Mortgage brokers are responsible for finding the best loan options for their clients, as well as helping them complete the necessary paperwork and negotiate with lenders. They must keep up-to-date with the latest developments in the mortgage industry and be able to explain the various terms and conditions of a loan. Furthermore, they must ensure that the borrower’s credit score meets the lender’s criteria and that the loan meets the borrower’s financial goals. Mortgage brokers can be invaluable in helping borrowers to find the best loan for their situation and save time and money.

The Benefits of Using a Mortgage Broker

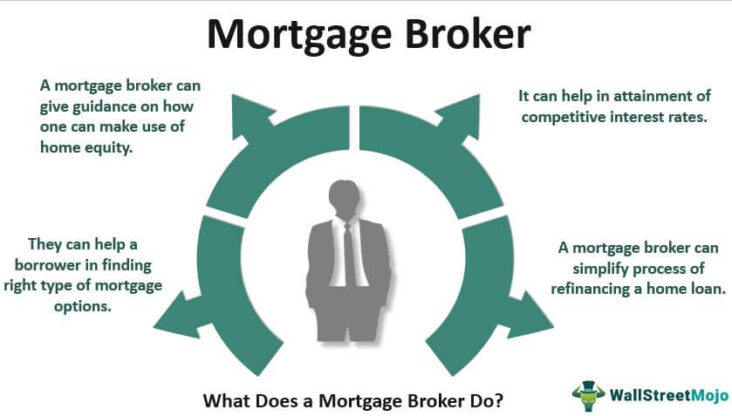

Using a mortgage broker has many advantages. They’re knowledgeable about the home loan market and can provide you with a range of options from multiple lenders. A mortgage broker can also help you to compare products and assess which loan best meets your needs and objectives. Brokers can also provide advice on available interest rates and help you to understand the features and benefits of different loans. They can also help to guide you through the loan application process and negotiate on your behalf with lenders to get the best possible rates and terms for your loan. A broker’s experience and expertise can be invaluable in the loan application process and can save you time and money. They can also provide you with tailored advice to meet your individual needs and objectives. Working with a mortgage broker can help you to make a more informed decision when it comes to choosing the right home loan.

How to Choose the Right Mortgage Broker

Choosing the right mortgage broker is essential when looking for a new mortgage. First, you should do some research on the different mortgage brokers available. Looking into their qualifications, credentials, and experience in the industry is a great place to start. Additionally, you should ask for references from past clients and research reviews online. The more information you can find, the better informed you can be when selecting the right broker for your needs. It is also important to compare fees, terms and conditions, and interest rates between different brokers. Once you have chosen the best mortgage broker for you, you can then discuss your individual requirements and needs with them. They can then provide you with advice and assistance on the type of mortgage product that best suits your needs. This will ensure that you are getting the best deal possible.

The Role of Mortgage Brokers in the Loan Process

Mortgage brokers are essential players in the loan process and can make a huge difference in the outcome of a loan. They act as a liaison between borrowers and lenders, advising borrowers on the best loan products available and helping them navigate the complexities of the loan process. They may also be able to get their clients better terms than a borrower could get on their own. Mortgage brokers have access to a variety of lenders, allowing them to compare and contrast loan options and find the best option for their clients. In addition, mortgage brokers are knowledgeable about the various types of mortgages and loan programs available, and are able to explain and guide their clients through the process. By utilizing a mortgage broker, borrowers can rest assured that they are in good hands, finding the best loan product to meet their needs and ensuring they get the best terms possible.

Common Mistakes to Avoid When Working with a Mortgage Broker

When working with a mortgage broker, it is important to avoid making common mistakes that can lead to costly errors. One of the biggest mistakes to avoid is not properly communicating your financial information to the broker. It is important to provide accurate and up-to-date information about your income, credit score, and assets to the broker. Additionally, be sure to provide the broker with any documentation of any changes in your financial situation that could affect your loan. Another mistake to avoid is not comparing the services and fees charged by different mortgage brokers. Different brokers have different terms and fees associated with their services, so it is important to shop around and compare prices to get the best deal. Additionally, make sure you understand the terms of the loan and any hidden fees and costs associated with it before signing any paperwork. Finally, it is important to avoid rushing into a mortgage agreement without taking the time to understand all of the details. Ask questions and make sure you understand the terms and conditions of the loan before signing any documents. A mortgage is a long-term commitment, so take your time and make sure you are making the right decision.