Mortgage insurance is a great way to protect yourself, and your home, from the financial risks of owning a house. It covers a variety of things, from personal liability to accidental property damage. But what exactly does mortgage insurance cover? Read on to learn more about what you can expect from your mortgage insurance policy and how it can help protect you and your home.

What Is Mortgage Insurance and How Does It Work?

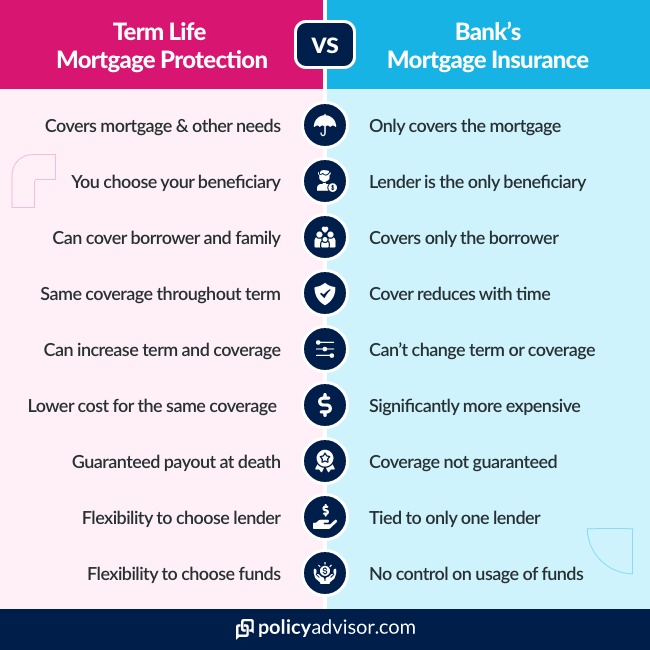

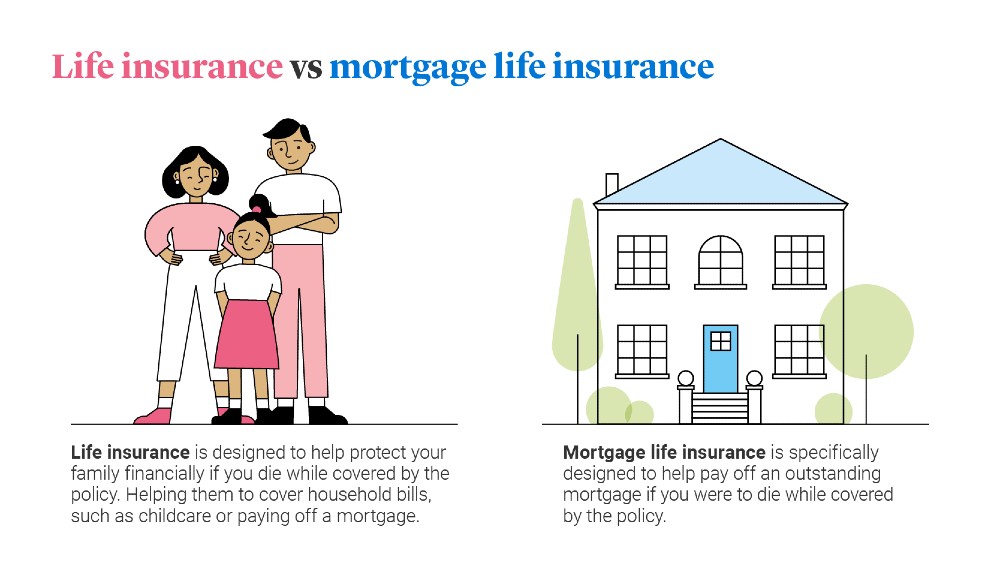

Mortgage insurance is a type of insurance that covers your mortgage payments if you are unable to make them due to job loss, disability, or death. It is usually required when you take out a mortgage, but it can also be optional in certain situations. Mortgage insurance works by paying a premium to the lender that protects the lender from any potential losses if you are unable to make your payments. The premium is typically paid month-to-month, but it can also be paid in a lump sum at the time of closing on the loan. Mortgage insurance can be a great way to protect yourself and your family in case of unexpected financial hardship. It also helps to keep your mortgage payments low by allowing you to put less money down on the loan. So if you’re looking for a way to protect your home and your family, it’s worth considering mortgage insurance.

What Does Mortgage Insurance Cover?

Mortgage insurance is an important part of your home loan. It covers the lender in the event of a default, and can help you get into a home even if you don’t have a huge down payment. Mortgage insurance covers things like the lender’s losses if you can’t make your payments, and it can also help you get a lower interest rate. It can also cover some of the costs associated with foreclosure and other foreclosure-related expenses. Knowing what mortgage insurance covers can help you make an informed decision when applying for a home loan.

Who Pays for Mortgage Insurance?

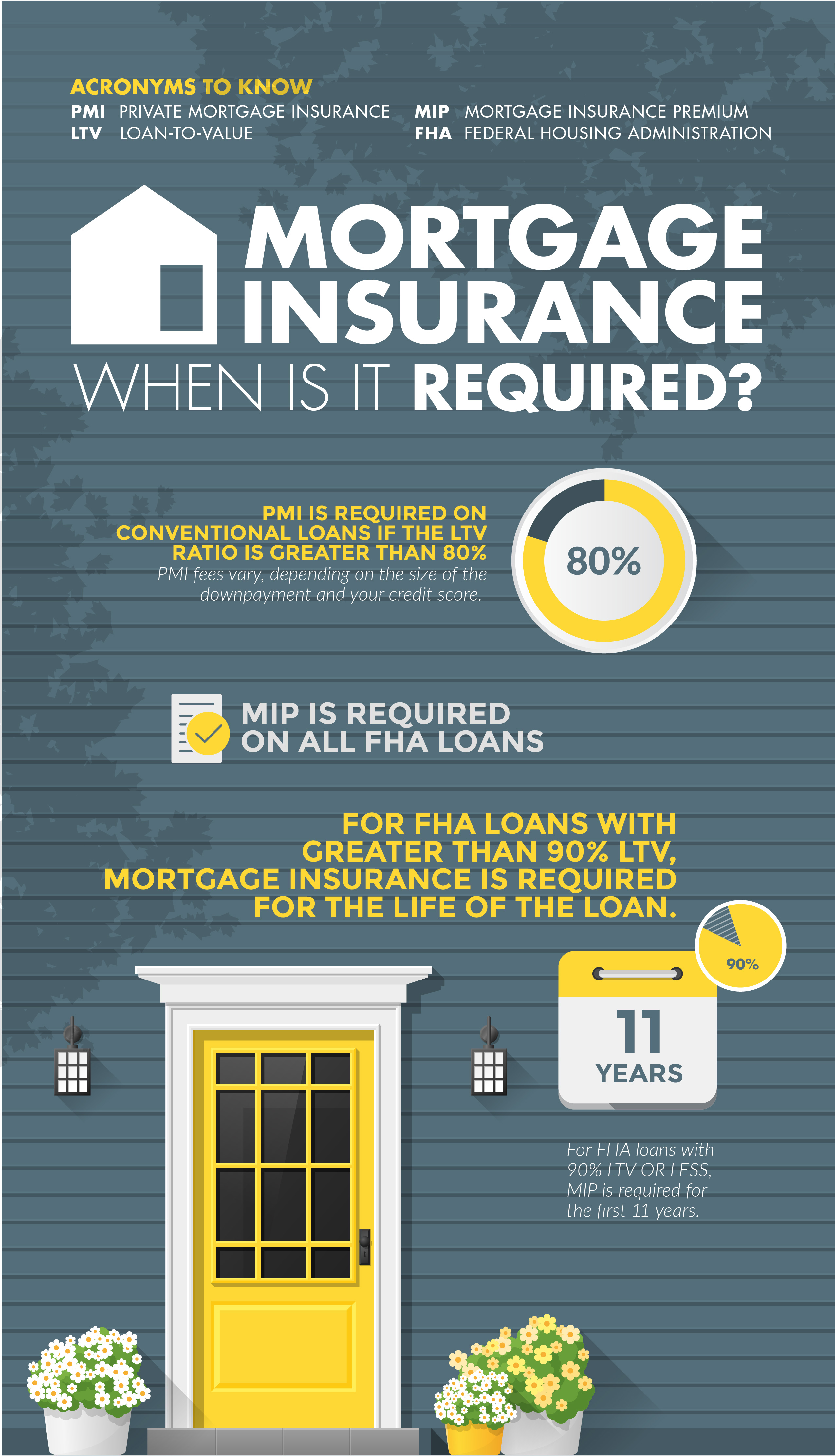

Mortgage insurance can be a tricky subject. It’s important to know who pays for it and what it covers. The short answer is that mortgage insurance premiums are paid by the borrower and the insurance covers the lender in the event of a default. Typically, the borrower will pay a one-time premium at closing or a monthly premium that is added to the loan payment. The amount of the premium depends on the size of the loan and the lender’s requirements. Mortgage insurance is usually required for loans with a loan-to-value ratio of more than 80%. This means that the borrower has less than 20% equity in the home. Mortgage insurance helps protect the lender because if the borrower defaults on the loan, the lender can use the insurance money to cover losses. It’s important to understand your mortgage insurance requirements to ensure that you are adequately covered and that you are not paying more than necessary.

How Much Does Mortgage Insurance Cost?

Mortgage insurance can be a costly addition to your monthly payments, but it also has some advantages. Mortgage insurance is typically paid as a one-time fee at closing, or in monthly installments over the life of the loan. The cost of mortgage insurance depends on the size of the loan, the loan-to-value ratio, the type of loan, and the borrower’s credit score. The cost of mortgage insurance can range from 0.5% to 2.5% of the loan amount. For example, a $300,000 home loan at a 4% rate will require an annual mortgage insurance premium of about $1,500. Monthly payments for mortgage insurance may be included in the loan amount or paid separately, depending on the type of loan. It’s important to understand the cost of mortgage insurance before signing on the dotted line, as it can add up to a large sum over the life of the loan.

How Can I Protect Myself from Unforeseen Expenses with Mortgage Insurance?

Mortgage insurance can be a great way to protect yourself from unforeseen expenses. It can provide you with a financial cushion if you are ever unable to make your mortgage payments due to unexpected expenses or a job loss. With mortgage insurance, you can rest assured that any costs associated with your mortgage will be covered, allowing you to focus on other financial matters. Not only will mortgage insurance provide you with peace of mind, it can also save you money in the long run, by protecting you from the costs associated with foreclosures or other costly processes. It is important to do your research and speak to a financial advisor to determine which type of mortgage insurance is best for you and your situation.