Are you looking to buy a home but not sure if you should get pre-approved or pre-qualified for a mortgage? Pre-approval and pre-qualification are two important steps in the home-buying process, and understanding the difference will help you make the best decision for your financial situation. In this article, we’ll explain what mortgage pre-approval and pre-qualification are, how they differ, and what benefits they offer. Read on to learn more and make the right choice for you.

What is the Difference Between Mortgage Pre-Approval and Pre-Qualification?

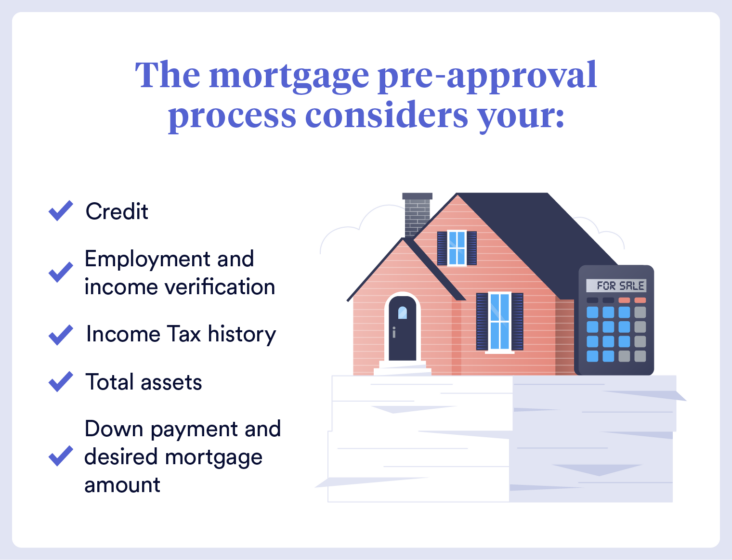

The main difference between mortgage pre-approval and pre-qualification is that pre-approval involves a more in-depth look at your creditworthiness, while pre-qualification only requires basic information. Mortgage pre-approval is an important step in the home buying process, as it gives you a better idea of your budget and helps you determine which homes you can afford. When you get pre-approved, your lender will check your credit score, employment history, income, and other financial information to determine how much you’re eligible to borrow. This is a detailed process that can take several days, so it’s important to begin the mortgage pre-approval process well in advance of your home search. On the other hand, pre-qualification is a much more streamlined process. It involves providing basic information such as your income, assets, and debts to your lender. Your lender will then use this information to provide you with a rough estimate of how much you may be able to borrow. While pre-qualification can give you a ballpark figure, it doesn’t guarantee that you’ll actually receive a loan. Mortgage pre-approval is the more reliable option, as it gives you a better idea of how

Benefits of Obtaining Mortgage Pre-Approval

Obtaining mortgage pre-approval comes with many benefits. One of the most important is the ability to know exactly how much house you can afford and what kind of loan you qualify for. This allows you to narrow down your house search to only those within your price range. Knowing your borrowing power also gives you the confidence to make an offer when you find a house you love. Having an approved pre-approval letter from a lender can also give you an edge in a competitive market, as it shows the seller that you are serious about buying and that you are financially qualified to do so. Additionally, having a pre-approval letter can help speed up the loan process once you find a house and make an offer. All of these benefits can save you time and money and give you the upper hand in the home buying process.

Steps to Take When Obtaining Pre-Qualification

When obtaining pre-qualification for a mortgage, there are several steps you should take to ensure the process is successful. First, you’ll need to gather all the necessary documents. This includes pay stubs, bank statements, tax returns, and other documents related to your financial situation. You’ll also need to provide information on any other debt you have and provide details on any other real estate properties you own. Once you’ve gathered all the documents, you’ll need to contact a lender to begin the pre-qualification process. The lender will use the documents to assess your financial situation and determine the loan amount and terms. They will also look at your credit report to determine your creditworthiness. From there, the lender will provide you with a pre-qualification letter that outlines the loan amount and terms for which you’ve been pre-qualified. This letter will also explain the lender’s expectations for the loan, including down payments and other closing costs. Knowing your pre-qualification details will help you to make informed decisions when shopping for a mortgage.

Common Mistakes to Avoid When Obtaining Pre-Approval

When obtaining a mortgage pre-approval it is important to avoid making common mistakes that could cause delays or even prevent you from obtaining the loan. One common mistake to avoid is applying for pre-approval with multiple lenders at once. Doing this can result in multiple hard inquiries on your credit report, which can lower your credit score. Additionally, it can also make it difficult to determine which lender is offering the best terms. It is best to choose one lender, and work with them to get the best deal. Another mistake to avoid is not providing the required documents. The lender will need documents such as pay stubs, tax returns, and bank statements to verify your income and financial situation. If you don’t provide the necessary documents, the lender won’t be able to process your loan. It is important to make sure you provide all the documents requested by the lender as soon as possible. Finally, it is important to keep your credit score in check when applying for pre-approval. If your credit score drops during the pre-approval process, it can lead to a denial of the loan. Make sure to pay bills on time and avoid taking on any new debt during the pre-approval process.

How to Use Pre-Approval and Pre-Qualification to Your Advantage When Shopping for a Home

Shopping for a home can be a daunting task, but it can be made easier if you take advantage of the tools available to you. Pre-approval and pre-qualification are two useful tools when it comes to finding the right home for you, as they can help you determine the best price range for you, and also give you an idea of what lenders are willing to offer you. Pre-approval is the process of obtaining an official loan estimate from a lender, based on your credit history and financial situation. Pre-qualification, on the other hand, is a less formal process, in which a lender estimates how much you can borrow based on your self-reported income and expenses. Knowing what you can afford in advance can help you narrow down your search for a home, and also give you an edge when it comes to making an offer. With both pre-approval and pre-qualification, you can ensure that you are shopping within your price range and put yourself in the best position to get the home of your dreams.