Are you dreaming of owning a home but feeling overwhelmed by the multitude of home loan options available? Don’t worry, we’ve got you covered! In this comprehensive guide, we’ll explore the top 5 home loan types to help you identify the perfect mortgage solution for your unique needs. Discover the key benefits and potential drawbacks of each loan type, empowering you to make an informed decision and confidently embark on your exciting journey towards homeownership. So, let’s dive in and unlock the door to your dream home with the ideal home loan tailored just for you!

Fixed-Rate Mortgage: This is the most common type of home loan, in which the interest rate remains the same throughout the entire repayment period

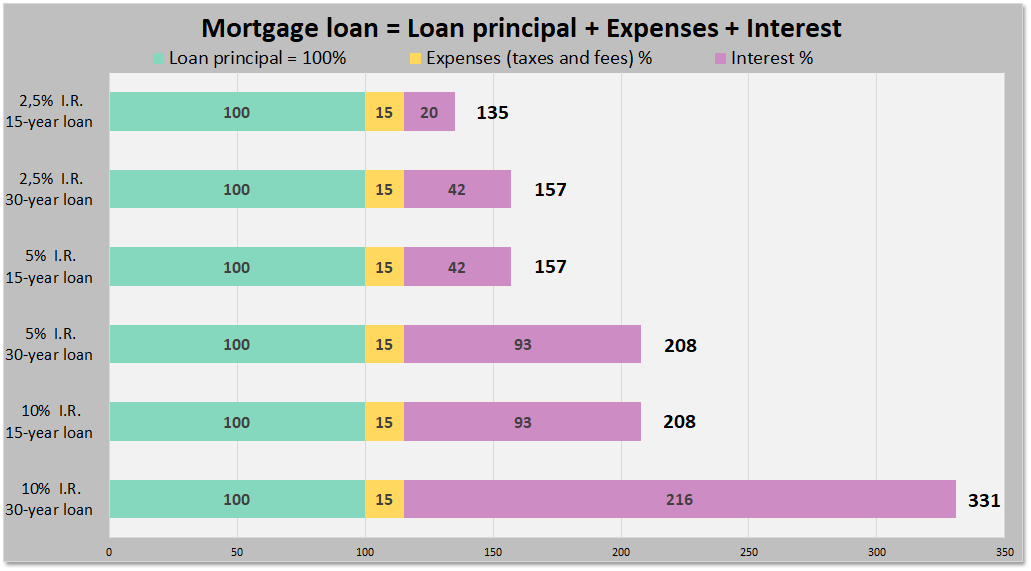

A Fixed-Rate Mortgage is the top choice for many homebuyers, offering stability and predictability throughout the entire repayment period. With this home loan type, the interest rate remains constant, enabling you to accurately budget your monthly payments without any surprises. This financial security appeals to a wide range of borrowers, including first-time homebuyers, families, and those looking to refinance their current loans. As you consider your home loan options, keep in mind that fixed-rate mortgages come in various term lengths, such as 15, 20, or 30 years. Choosing the right term length for your needs can help you achieve your homeownership goals while keeping your finances in check.

This provides stability and predictability, as your monthly payments will not change over time

When searching for the perfect home loan, one option that offers both stability and predictability is a fixed-rate mortgage. With this type of loan, your interest rate remains constant for the entire loan term, ensuring that your monthly payments stay the same throughout the life of the mortgage. This can provide peace of mind and make budgeting for your future a much simpler task. In a volatile market or uncertain economic times, a fixed-rate mortgage can be an ideal choice for those who value long-term financial security. However, it is essential to carefully consider your individual circumstances and goals before committing to a specific home loan type.

Fixed-rate mortgages are ideal for borrowers who plan to stay in their home for a long time and want the security of knowing their payments will remain constant.

Fixed-rate mortgages provide long-term stability for homeowners seeking a consistent monthly payment throughout the life of their loan. This popular home loan option is ideal for borrowers who intend to settle down in their property for an extended period, as it offers protection against unpredictable interest rate fluctuations. With a fixed-rate mortgage, you can easily budget for your monthly expenses and avoid any sudden payment increases that may arise with adjustable-rate loans. As a result, this type of mortgage offers peace of mind and financial predictability for those who want to establish a secure foundation for their future home investment. Explore the benefits of a fixed-rate mortgage today and find the perfect fit for your long-term homeownership goals.

Adjustable-Rate Mortgage (ARM): With an adjustable-rate mortgage, the interest rate is initially fixed for a specific period (usually 3, 5, 7, or 10 years), after which it adjusts periodically based on market conditions

An Adjustable-Rate Mortgage (ARM) offers flexibility and potential savings for homeowners looking to minimize their initial monthly payments. During the fixed-rate period (typically 3, 5, 7, or 10 years), the interest rate remains constant, allowing for predictable monthly payments. After this period, the rate adjusts based on market conditions, which could lead to lower payments if interest rates decrease. However, it’s essential to consider the potential for rate increases, as this may result in higher monthly payments over time. ARMs are an excellent option for those who plan to sell or refinance their home before the rate adjustment or anticipate a rise in income to handle potential payment fluctuations.

This means your monthly payments can increase or decrease over time

Adjustable-rate mortgages (ARMs) offer a unique feature where the interest rate can fluctuate throughout the loan term. This means your monthly payments can increase or decrease over time, providing potential savings and flexibility. However, it also brings an element of uncertainty, as market changes may impact your budget. ARMs typically have lower initial interest rates compared to fixed-rate mortgages, making them an attractive option for homebuyers who plan to refinance or sell within a few years. To ensure that an ARM suits your needs, carefully consider your financial situation, future plans, and risk tolerance before committing to this type of home loan.

ARMs can be a good option for borrowers

Adjustable-rate mortgages (ARMs) can be an ideal home loan option for borrowers seeking flexibility and potential savings on interest rates. With an ARM, the interest rate changes periodically, typically in relation to an index, such as the prime rate. This allows borrowers to benefit from lower rates during economic downturns, thus reducing overall borrowing costs. Moreover, ARMs often come with an initial fixed-rate period, providing homeowners with stability before the rate adjustments begin. This makes them particularly appealing to those who plan to sell or refinance their home within a few years. By carefully considering the rate caps, adjustment intervals, and market conditions, borrowers can find the right ARM to suit their financial goals and homeownership plans.