If you’re a college student struggling with finances, you’ve probably heard about payday loans. Taking out a payday loan can help cover your expenses when you’re running low on money, but it’s important to understand the pros and cons before making a decision. In this article, I’ll discuss the advantages and disadvantages of payday loans and provide some tips for making the most of them if you decide to take one out.

An Overview of Payday Loans

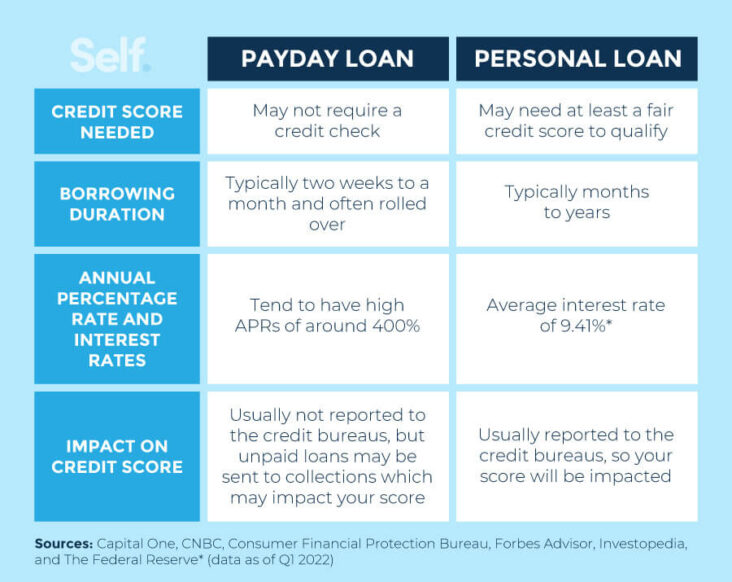

Payday loans are a type of short-term loan and are a great way for 18-year-olds to get the money they need fast. Payday loans are typically for amounts up to $500 and are usually due on your next payday. The application process is usually quick and easy. The lender will typically take a few minutes to verify your information and then transfer the money to your bank account. The downside to payday loans is that they tend to come with high interest rates and hefty fees. This means that it can be difficult to repay the loan on time. It’s important to make sure you understand the terms and conditions of the loan before taking one out.

Exploring the Benefits of Payday Loans

Payday loans can be a lifesaver when you’re in a pinch and need money quickly. They offer quick, easy access to cash without having to jump through hoops like applying for a traditional loan. Plus, the interest rates are often lower than other forms of credit. With payday loans, you can get the funds you need without having to worry about waiting weeks or even months to get approved. Plus, you don’t need to have perfect credit or have a co-signer to qualify. If you’re in a jam, payday loans can offer a solution and provide you with the money you need in a timely manner.

Examining the Drawbacks of Payday Loans

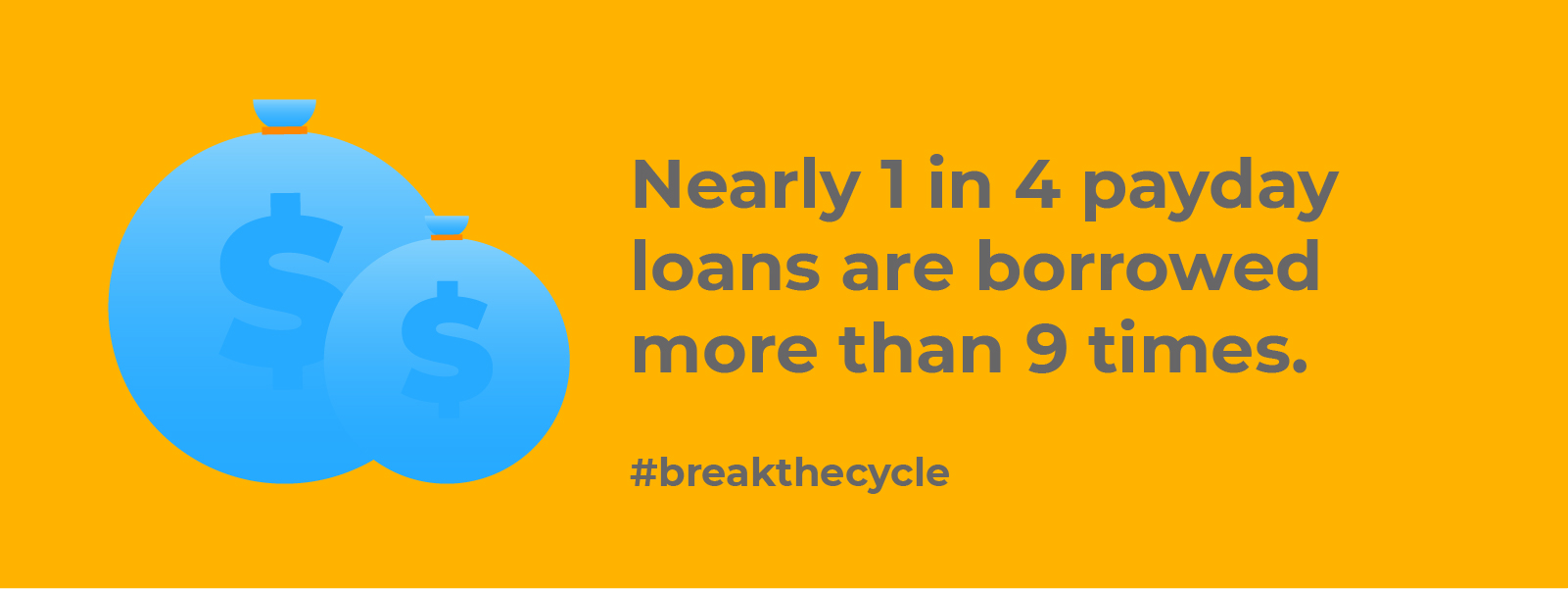

When it comes to payday loans, there are definitely a few drawbacks that you should consider before taking one out. Firstly, the interest rate is usually much higher than a traditional loan, meaning you’ll be paying back much more than you borrowed. Plus, once you take out a payday loan, it can take a long time to pay it off due to the high interest rate. Additionally, the terms of payday loans can be confusing and hard to understand, leaving you vulnerable to being taken advantage of. Lastly, if you’re unable to make payments on time, there may be hefty fees and penalties which could make repaying the loan even harder. All in all, payday loans can be a risky option and it’s important to consider all your options before making a decision.

Considering Alternatives to Payday Loans

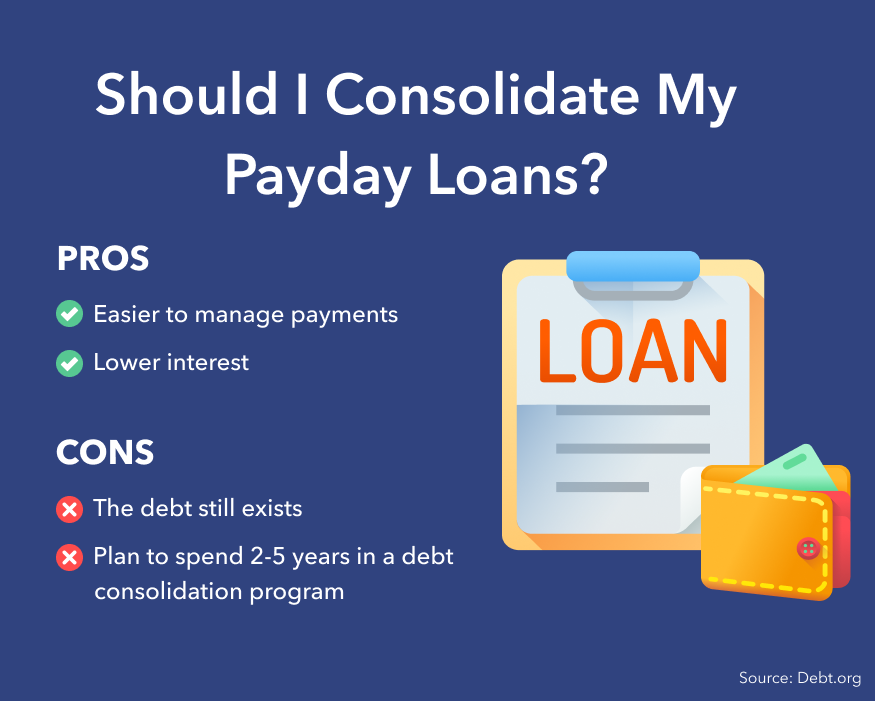

If you’re considering alternatives to payday loans, it’s important to look at all your options. There are a variety of short-term loan options available, such as taking out a line of credit or a personal loan, or even asking a friend or family member for help. These options can provide you with short-term relief, but be sure to consider the costs, risks, and interest rates associated with each one before making a decision. Additionally, if you have a steady source of income, you can look into budgeting and saving to help get you through any financial hiccups.

Tips for Making an Informed Decision About Taking Out a Payday Loan

When it comes to taking out a payday loan, it’s important to do your research and make an informed decision. Here are some tips to help you make the best decision. First, make sure you understand all the terms and conditions associated with the loan. Second, compare different lenders to get the best interest rate and terms. Third, check out reviews from other customers to make sure the lender is reputable. Finally, talk to a financial advisor to make sure the loan is right for you. With these tips, you can make a decision that you are comfortable with and that will help you get the money you need.