Are you considering taking out a mortgage? It’s an exciting process, but it can also come with some unique challenges. From navigating the application process to understanding the rules and regulations, there are a lot of potential hurdles to overcome. In this article, we’ll discuss the most common mortgage challenges and how to overcome them so you can get the best deal and secure your dream home.

Poor Credit: Poor credit can make it difficult to qualify for a mortgage, as lenders often have strict credit score requirements

For those with poor credit, applying for a mortgage can seem daunting. Fortunately, there are some steps you can take to give yourself the best chance of being approved. Firstly, it’s important to understand your credit score and how it affects your eligibility. If you have a low credit score, take steps to improve it. Pay down your debts, check for errors, and dispute them with the credit bureau if you find any. Additionally, you should try to pay bills on time, and maintain a low debt-to-income ratio. You might also consider putting a larger down payment on the home, which could help you get approved. Finally, partner with a reputable mortgage broker who can help you find the best mortgage for your situation. With some hard work and dedication, you can improve your credit and ultimately get approved for a mortgage.

To overcome this challenge, borrowers should work to improve their credit score by making payments on time, paying down existing debt, and avoiding taking on any new debt.

Improving your credit score is the best way to overcome any mortgage challenges. To do this, be sure to make all payments on time, pay down existing debt, and avoid taking on any new debt. Additionally, make sure to check your credit reports regularly for any inaccuracies. Dispute any mistakes you find and make sure to keep your credit utilization ratio low. This will help you to build a solid credit history, which will make it easier to qualify for a mortgage. Lastly, if you’re having trouble making payments on existing debt, consider speaking to a financial advisor who can help you create a budget and offer solutions to help you manage your debt. With a little effort and planning, you can overcome any mortgage challenges you face and make the dream of homeownership a reality.

High Debt-to-Income Ratio: A high debt-to-income ratio can make it hard to qualify for a mortgage, as lenders may not want to take on the risk of a borrower who is already carrying a lot of debt

A high debt-to-income ratio (DTI) is a major obstacle for those looking to qualify for a mortgage. Your DTI is the percentage of your monthly income that goes toward paying off debt. A high DTI can be a warning sign to lenders that you may not be able to afford a mortgage, and they may not want to take on the risk of a borrower who is already carrying a lot of debt. Fortunately, there are ways to reduce your DTI and make yourself a more attractive candidate for a mortgage. The first step is to pay off as much debt as possible. Consider consolidating your debts into one loan with a lower interest rate, or look for ways to cut expenses in order to free up more money for debt repayment. You should also try to increase your income, either by taking on a second job or asking for a raise at your current job. Finally, you should look into programs like HARP or FHA loans, which are designed to help people with high DTIs get approved for mortgages. With a little effort, you can overcome a high DTI and make yourself a viable candidate for a mortgage.

To reduce their debt-to-income ratio, borrowers should focus on paying down as much debt as possible to free up more income for a mortgage payment.

When looking to improve your debt-to-income ratio, it’s important to focus on paying down debt. This is the best way to free up more income for a mortgage payment. Prioritize paying down credit card debt, especially high-interest debt, as this can help you save money in the long run. Additionally, consider consolidating or refinancing your debt if you can get a better rate or payment plan. Reducing your monthly expenses, such as cutting back on entertainment or dining out, can also help you free up more money for mortgage payments. Finally, look for ways to increase your income, such as taking on a second job or selling unused items. By taking these steps, you can get your debt-to-income ratio in order and be better prepared to take on a mortgage.

Lack of Funds for a Down Payment: A down payment is often required to qualify for a mortgage, and if a borrower doesn’t have the funds available, they may not be able to move forward with their home purchase

One of the most common mortgage challenges is the lack of funds for a down payment. A down payment is an important part of the mortgage process, and if a borrower does not have the funds available, they may be unable to secure a loan. Fortunately, there are a few ways to help overcome this challenge. Borrowers can save up and put aside money until they have enough to cover the down payment. They can also consider a gift from a family member or friend, or a loan from their employer. Additionally, there are loan programs that allow borrowers to put less than 20% down, such as the FHA, USDA, and VA loans. By exploring all of these options, borrowers can increase their chances of being approved for a mortgage.

To overcome this challenge, borrowers should look into grants and assistance programs that may be available in their local area, or consider taking out a loan from family or friends to help with the down payment.

When borrowers are struggling to come up with a large down payment, there are several options available to help. Grants and assistance programs can be a great way to reduce the amount needed for a down payment. These programs are offered by local, state, and federal governments, as well as various non-profit organizations. Additionally, borrowers may want to consider taking a loan from family or friends to help cover the cost of the down payment. This can be a great way to get the necessary funds without having to take on a large amount of debt. Finally, those who are eligible for a VA loan may have the option of taking out a no-down payment loan. With the help of these options, borrowers can successfully overcome the challenge of coming up with a large down payment for their mortgage.

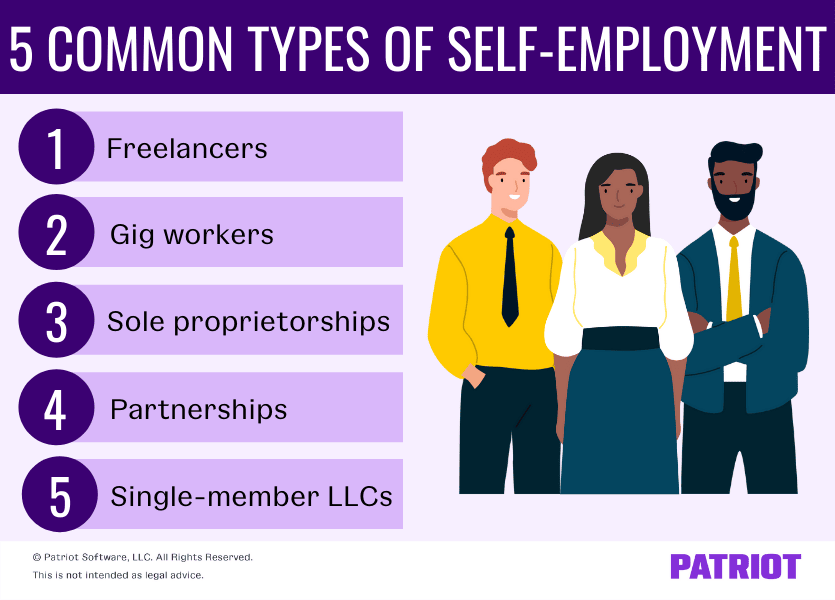

Self-Employment Income: Self-employment income can be harder to verify for a lender,

Self-employed individuals can find it difficult to get approved for a mortgage as lenders may have difficulty verifying their income. Some lenders may require a minimum of two years’ worth of tax returns to verify income, but this isn’t the only way to prove your self-employment income. If you’ve been self-employed for less than two years, you may be able to provide additional forms of documentation such as bank statements, profit and loss statements, and business balance sheets. You can also provide other forms of evidence such as letters of reference from clients or customers, and invoices for goods or services sold. Another option is to provide a statement from an accountant that outlines your business income. By being prepared and providing these documents and statements, self-employed individuals can increase their chances of being approved for a mortgage.