Stay up-to-date with the latest student loan forgiveness updates and news that could potentially save you thousands of dollars and ease your financial burden. Our comprehensive guide delves into the most recent developments in government policies, application processes, and eligibility criteria for various loan forgiveness programs. Don’t miss out on these valuable insights that could help you navigate the ever-evolving landscape of student loan forgiveness and lead you one step closer to financial freedom. Read on to empower yourself with the knowledge and resources you need to make informed decisions and conquer your student loan debt.

Exploring New Legislation: The Impact of Recent Student Loan Forgiveness Policies on Borrowers

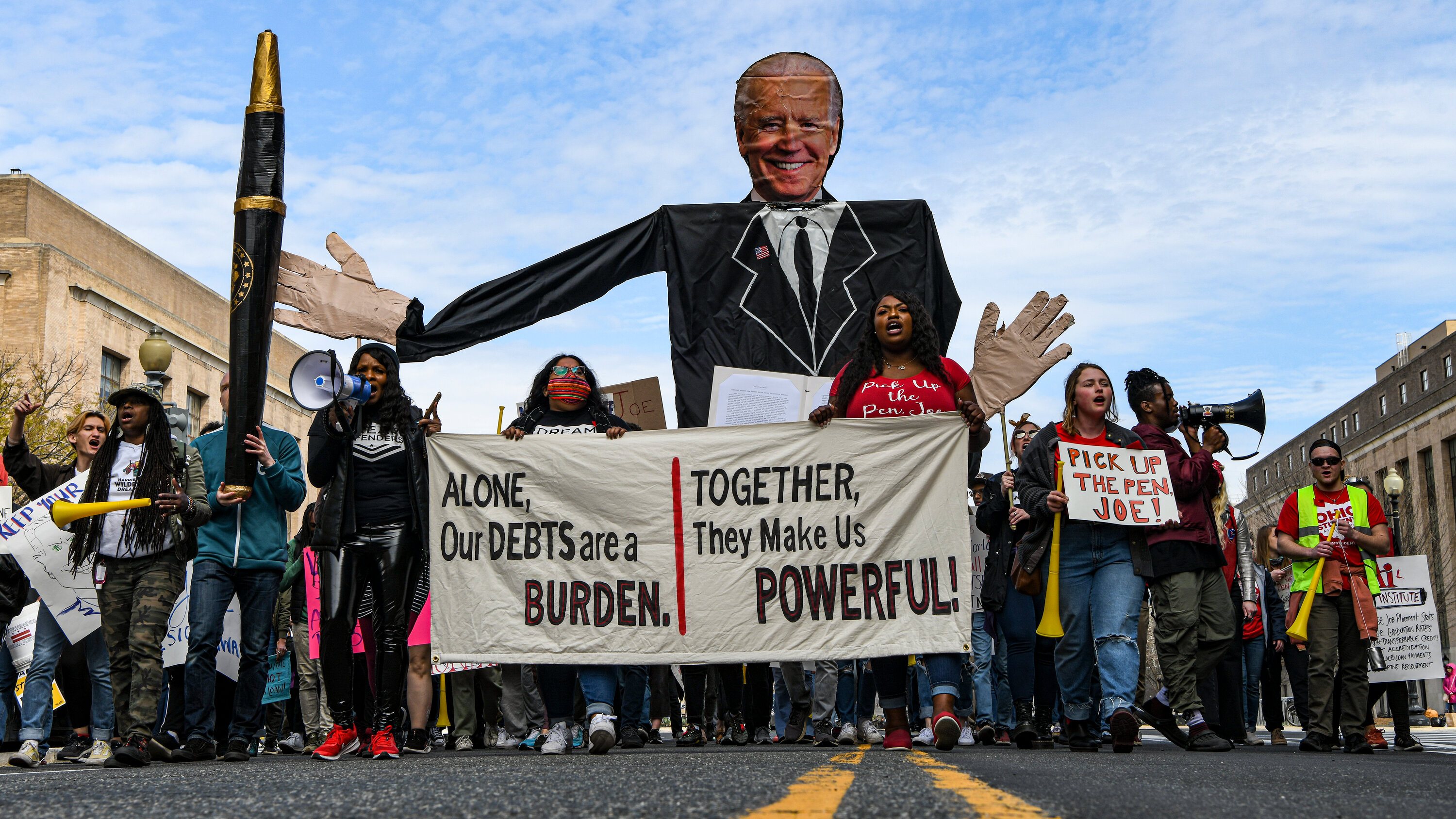

In recent years, student loan forgiveness has become a hot topic, with new legislation being proposed to provide relief to borrowers. These policies, such as the Public Service Loan Forgiveness (PSLF) program and income-driven repayment plans, have the potential to significantly impact the financial burdens faced by millions of Americans. As we continue to explore the latest updates and news surrounding student loan forgiveness, it’s crucial to remain informed about the effects of these policies on borrowers. The ever-evolving landscape of student loan forgiveness highlights the importance of staying up-to-date on new developments, ensuring you can make informed decisions regarding your own student loan repayment strategies.

Navigating the Public Service Loan Forgiveness (PSLF) Program: Essential Tips for Qualifying and Maximizing Benefits

Navigating the Public Service Loan Forgiveness (PSLF) Program can be a daunting task for many borrowers seeking relief from their student loan debt. However, by staying informed and following essential tips, you can maximize your benefits and increase your chances of qualifying for this sought-after program. To ensure you’re on the right track, it’s crucial to understand the PSLF eligibility criteria, maintain accurate employment records, enroll in a qualifying repayment plan, and diligently submit required forms on time. Staying proactive in these areas will not only provide peace of mind but also help you make significant strides towards achieving financial freedom from student loans.

Income-Driven Repayment Plans: Understanding Their Role in Student Loan Forgiveness and Choosing the Best Option for Your Situation

Income-Driven Repayment Plans (IDR) play a critical role in student loan forgiveness, providing borrowers with a manageable and affordable way to repay their loans. By adjusting monthly payments based on income and family size, IDR plans offer a personalized approach to loan repayment. Staying updated on the latest news and developments in IDR plans is essential to maximizing the potential for loan forgiveness. In this blog section, we’ll delve into the various IDR options, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), and discuss how to choose the best plan to suit your individual financial situation.

Student Loan Forgiveness for Teachers, Nurses, and Other In-Demand Professions: A Comprehensive Guide to Eligibility and Application Procedures

In our recent article, “Student Loan Forgiveness for Teachers, Nurses, and Other In-Demand Professions: A Comprehensive Guide to Eligibility and Application Procedures,” we delve into the latest updates and news regarding student loan forgiveness programs for these essential professionals. As the demand for skilled teachers and nurses continues to rise, it’s critical that aspiring and current professionals in these fields understand their options for reducing their student loan burdens. Our SEO-optimized guide covers the various loan forgiveness programs available, eligibility requirements, and step-by-step application procedures, ensuring that those dedicated to serving our communities can access the financial relief they need and deserve.

The Future of Student Loan Forgiveness: Analyzing Proposed Changes and Their Potential Effects on Borrowers and the Economy

The Future of Student Loan Forgiveness has recently garnered significant attention as proposed changes by lawmakers and policymakers stand to impact borrowers and the economy. These potential adjustments aim to streamline forgiveness programs, expand eligibility, and promote economic growth by alleviating the financial burden on millions of Americans. As we closely monitor the evolving landscape of student loan forgiveness, it’s crucial to analyze how these proposed changes could affect borrowers, their repayment strategies, and the overall economy. Stay informed on the latest updates and news surrounding student loan forgiveness to ensure you’re prepared for any shifts in policy and can make well-informed decisions about your financial future.