Discover the powerful connection between student loan forgiveness and income-based repayment plans in our comprehensive guide. As staggering student loan debt continues to burden millions of Americans, savvy borrowers are increasingly seeking relief through these two intertwined strategies. Experience financial freedom by understanding how these game-changing options can work together to reduce your monthly payments and potentially wipe out your remaining balance. Delve into the intricacies of income-driven repayment plans, and learn how they can unlock the door to a debt-free future with student loan forgiveness.

Exploring the Connection between Student Loan Forgiveness and Income-Based Repayment Plans: A Comprehensive Overview

In today’s increasingly competitive job market, many individuals are burdened with massive student loan debt. The intersection of student loan forgiveness and income-based repayment plans provides a viable solution for easing this financial strain. This comprehensive overview explores the connection between these two essential components, offering valuable insights into eligibility criteria, benefits, and application processes. By understanding the various income-driven repayment plans and their correlation with loan forgiveness programs, borrowers can make informed decisions to manage their debt effectively. Delve into this in-depth analysis to uncover the secrets of navigating the complex world of student loan repayment and forgiveness, ultimately paving the way for financial freedom and long-term success.

The Synergy of Student Loan Forgiveness and Income-Driven Repayment Strategies: Maximizing Your Debt Relief Potential

Discover the powerful synergy of student loan forgiveness and income-driven repayment strategies to maximize your debt relief potential. Combining these approaches can help borrowers efficiently navigate the complexities of student loan repayment while lowering monthly payments and working towards eventual loan forgiveness. By understanding the intricacies of income-based repayment plans and loan forgiveness programs, you can create a tailored financial plan that aligns with your unique needs and goals. Don’t let the burden of student loan debt hold you back – explore the intersection of these debt-relief options and unlock the door to financial freedom today.

Navigating the Complex World of Student Loan Forgiveness and Income-Based Repayment Plans: Key Insights and Expert Tips

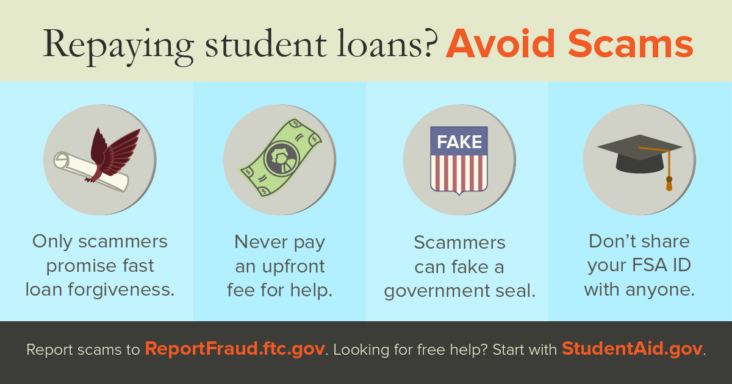

Navigating the complex world of student loan forgiveness and income-based repayment plans requires careful research and strategic planning. Key insights and expert tips can help borrowers make informed decisions to maximize their benefits. By understanding the eligibility criteria, application process, and potential savings, borrowers can select the most suitable plan for their financial situation. With the right knowledge and guidance, managing student loan debt becomes less daunting and more achievable. Emphasizing the importance of staying up-to-date with federal policies, exploring public service options, and seeking professional advice can significantly impact your journey towards financial freedom and student loan forgiveness.

Achieving Financial Freedom through the Convergence of Student Loan Forgiveness and Income-Based Repayment Programs: A Step-by-Step Guide

Achieving financial freedom is possible when leveraging the power of student loan forgiveness and income-based repayment plans. With a strategic approach, borrowers can significantly reduce their monthly payments and potentially have their remaining balance forgiven. To navigate this financial crossroads, follow our step-by-step guide, which outlines eligibility criteria, enrollment processes, and key considerations. By understanding the nuances of various forgiveness programs and repayment options, borrowers can ultimately make informed decisions that align with their financial goals. Stay tuned as we explore the intersection of these two powerful debt-relief strategies, empowering you to take control of your student loans and achieve long-term financial success.

The Ultimate Guide to Leveraging Income-Based Repayment Plans for Maximum Student Loan Forgiveness: Expert Advice and Real-Life Success Stories

Discover the ultimate guide to leveraging Income-Based Repayment (IBR) plans for maximum student loan forgiveness, featuring expert advice and real-life success stories. In this comprehensive resource, delve into the intricacies of IBR plans and how they can empower borrowers to achieve financial freedom while managing student loan debt. Learn about the various IBR options available, their eligibility criteria, and the potential impact on your monthly payments and overall loan balance. Uncover success stories of individuals who have triumphed over staggering debt through strategic use of IBR plans and gain valuable insights from industry professionals to help guide your own path to student loan forgiveness.