If you’re like most college students, you’ve probably heard about debt consolidation and how it can help you manage your debt. But did you know that there are personal loans specifically designed for debt consolidation? It’s true – there are a variety of personal loans available that can help you consolidate your debt into one monthly payment and get you back on the path to financial freedom. In this article, we’ll review the best personal loans for debt consolidation so you can choose the right one for your financial situation.

What is Debt Consolidation and Why is it Beneficial?

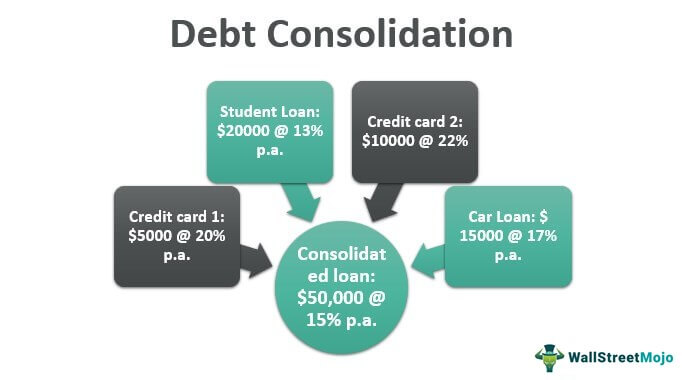

If you’re like me, a 21-year-old college student, you may have multiple debts that seem impossible to pay off. Debt consolidation is the perfect solution. It’s a process of combining multiple high-interest loans into one lower-interest loan, allowing you to pay off your debts faster. Not only that, but you can also save money in the long run since you’re paying one lower interest rate. Debt consolidation also makes it easier to keep track of your payments and budget for them accordingly. All in all, debt consolidation is a great way to reduce your financial burden and make it easier to pay off your debts.

How to Choose the Right Personal Loan for Debt Consolidation

Choosing the right personal loan for debt consolidation can be a daunting task. When it comes to consolidating debt, there are many options that can help you get out of debt faster. It is important to do your research and understand the different loan options available to you. Look for loans that offer competitive interest rates, flexible repayment plans, and no hidden fees. Also, make sure that the loan does not put you in further debt by providing you with more money than you can realistically pay back. Consider the length of the loan, the repayment terms, and the overall cost. Finally, it is important to choose a loan that fits your budget and debt situation. Do not be afraid to shop around and compare different lenders to find the best personal loan for debt consolidation.

Tips for Managing Your Consolidated Debt

When it comes to debt consolidation, taking the time to learn about the best personal loans and how to manage your consolidated debt can make all the difference. To help you out, here are a few tips to keep in mind. First, make sure you know the terms of the loan and understand how much the monthly payments will be. Next, create a budget and stick to it. This will help you stay on top of your payments and avoid any late fees. Finally, set up a plan to pay off your debt as quickly as possible. With a little bit of effort, you can get back to financial security in no time.

Common Pitfalls to Avoid with Debt Consolidation

Debt consolidation can be a great way to help yourself get out of debt, but there are some common pitfalls to keep in mind. First, you can’t consolidate debt that has already been discharged in bankruptcy. Second, you should always compare rates and terms on personal loans to make sure you’re getting the best deal. Additionally, make sure you understand the total cost of the loan, including any fees, before signing. Lastly, you should never be tempted to use debt consolidation loans to pay for non-essential purchases, as this will only add to your debt in the long run.

The Advantages and Disadvantages of Debt Consolidation

Debt consolidation is a great way to get out of debt and save money in the long run. It has its advantages and disadvantages, however. On one hand, you can roll all your debts into one loan with a lower interest rate, meaning you can save money on the interest you pay over time. On the other hand, you may end up paying more in total interest due to the length of the loan and the fact that you’re taking on more debt. Additionally, if you don’t pay off the loan in full and on time, you can end up with a lower credit score. Ultimately, debt consolidation can be a great way to reduce your debt, but it’s important to do your research before making any decisions.