If you’re a homeowner with bad credit, you may think that you don’t have many options when it comes to getting a loan. But that’s not true! There are still plenty of great loan offers out there specifically tailored to those with bad credit. Finding the right loan can be a daunting task, so I’m here to help. In this article, I’ll discuss the best loans for homeowners with bad credit, their features, and how you can apply. So, if you’re looking to get a loan despite your bad credit score, this article is for you!

Understanding the Difference between Home Loans and Bad Credit Loans

If you have bad credit, it’s important to understand the difference between home loans and bad credit loans. Home loans are typically offered by banks and other financial institutions, and are usually secured by the property you’re buying. Bad credit loans, on the other hand, are unsecured loans offered by lenders who specialize in helping people with low credit scores. The terms of these loans are typically more expensive, with higher borrowing limits and interest rates. It’s important to understand the risks and benefits of each option before deciding which loan is best for you.

What to Look for When Shopping for Home Loans with Bad Credit

When shopping for home loans with bad credit, it is important to look for lenders with competitive rates and flexible terms. Additionally, it is important to find a lender that is willing to work with you despite your credit score. You should also consider the fees associated with the loan, such as closing costs, and make sure that you understand the terms of the loan before signing any paperwork. Finally, be sure to comparison shop and find the best loan for your needs and budget.

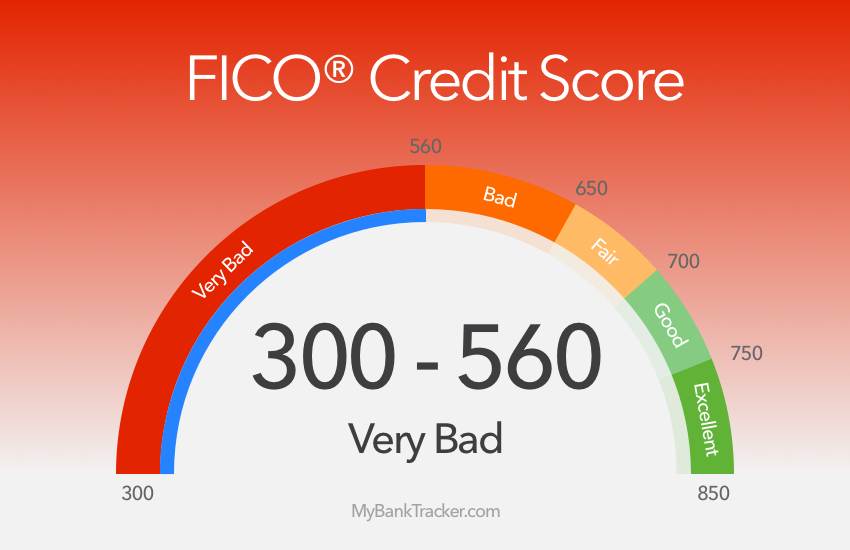

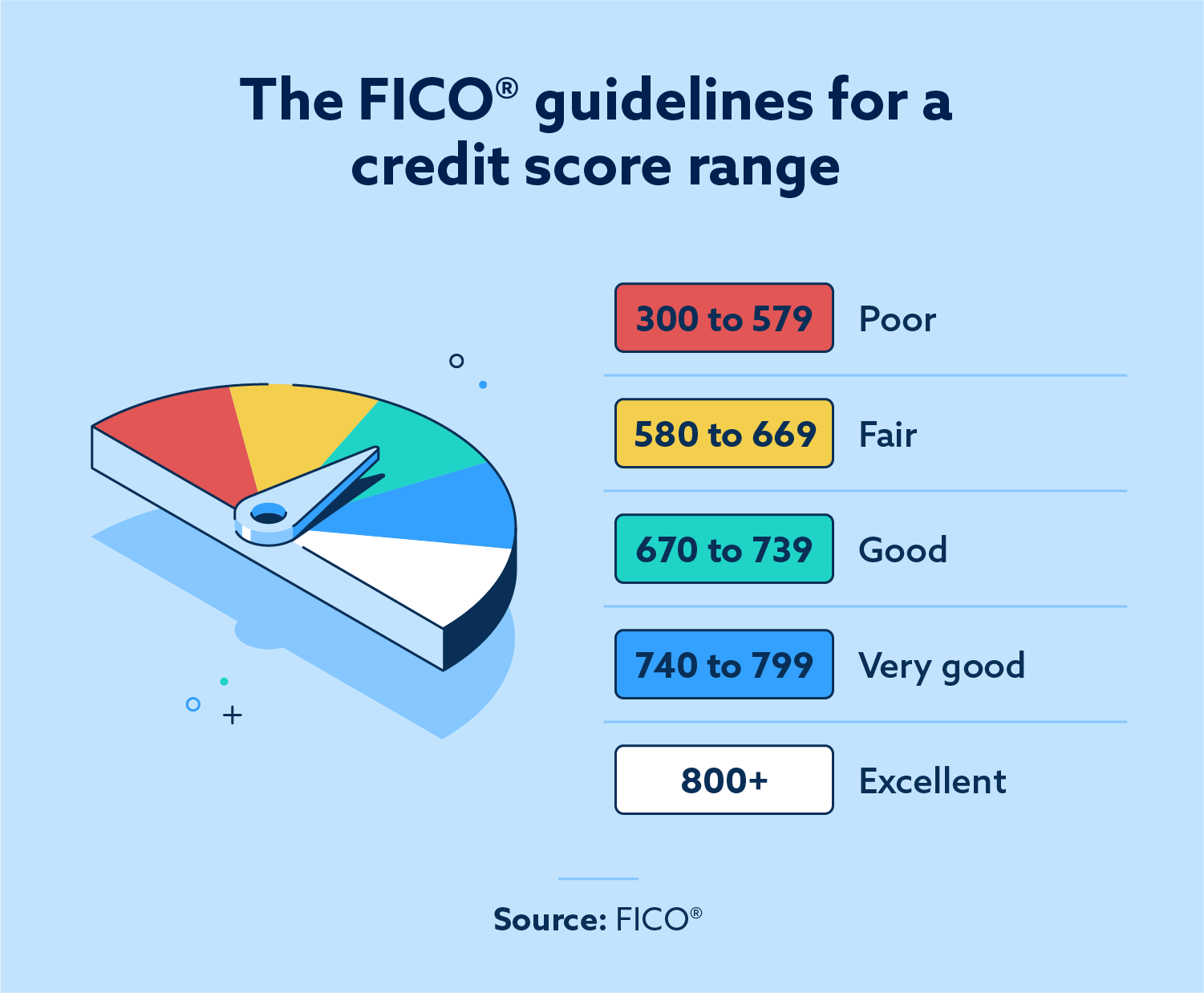

Tips for Improving Your Credit Score to Qualify for Home Loans

If you’re a homeowner with bad credit and want to qualify for a home loan, improving your credit score is a must. Here are some tips for doing so: pay all your bills on time, reduce your debt, and check your credit report regularly. To reduce your debt, try to pay down large balances first, and make sure to make your minimum payments on time. Additionally, check your credit report for any errors or discrepancies and contact the credit bureau to have them corrected. Finally, make sure to use credit responsibly, only taking out what you can afford to pay back. With a little patience and effort, you can improve your credit score and qualify for a home loan.

Exploring Alternatives to Traditional Home Loans with Bad Credit

Exploring alternatives to traditional home loans with bad credit can be a daunting task, especially if you have bad credit. However, there are lenders out there that are willing to work with you. One great option is to look into government-backed FHA loans, which allow for lower credit scores and down payments. Another option is to look into portfolio lenders, which will consider a variety of factors when making their decision. Finally, there are online lenders, which offer loans with no credit check and often have competitive interest rates. With some research and patience, you can find the best loan for your situation.

The Benefits of Secured Home Loans for Homeowners with Bad Credit

Secured home loans are a great option for homeowners with bad credit. They give you access to the funds you need to make repairs or upgrades to your home, and you can use the loan to consolidate debt or even pay for a vacation. The best part about secured home loans is that your home is used as collateral, meaning you don’t have to worry about your credit score affecting your loan terms. This makes it easier to get approved, as well as giving you access to lower interest rates and more favorable repayment terms. Secured home loans also give you more control over your financial situation since you are able to structure the repayment plan to fit your budget. With the right loan and a good plan, you can make your dream of owning a home a reality.