Retirees and seniors often struggle with managing their finances, especially as they age and their income dwindles. A reverse mortgage can provide a much-needed financial lifeline and can be a great way to help supplement retirement income and cover unexpected expenses. This article will explore the advantages of a reverse mortgage for seniors and retirees, highlighting how it can help ease financial worries and provide the stability and security they need.

Increased Financial Security: A reverse mortgage can provide seniors and retirees with a more secure retirement by supplementing their existing income.

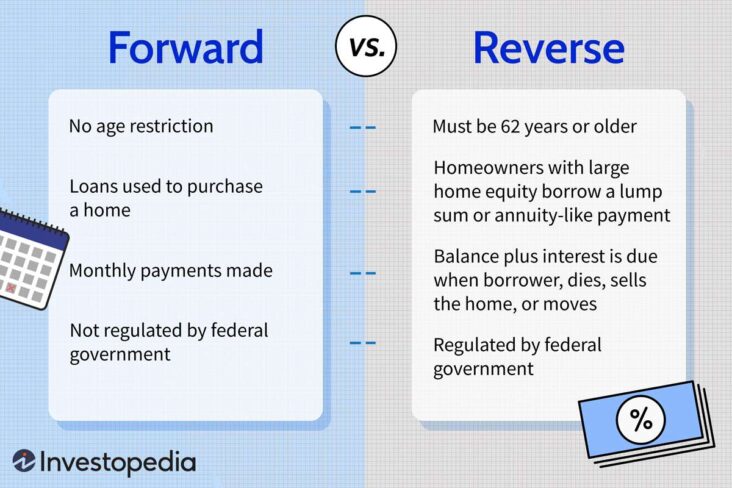

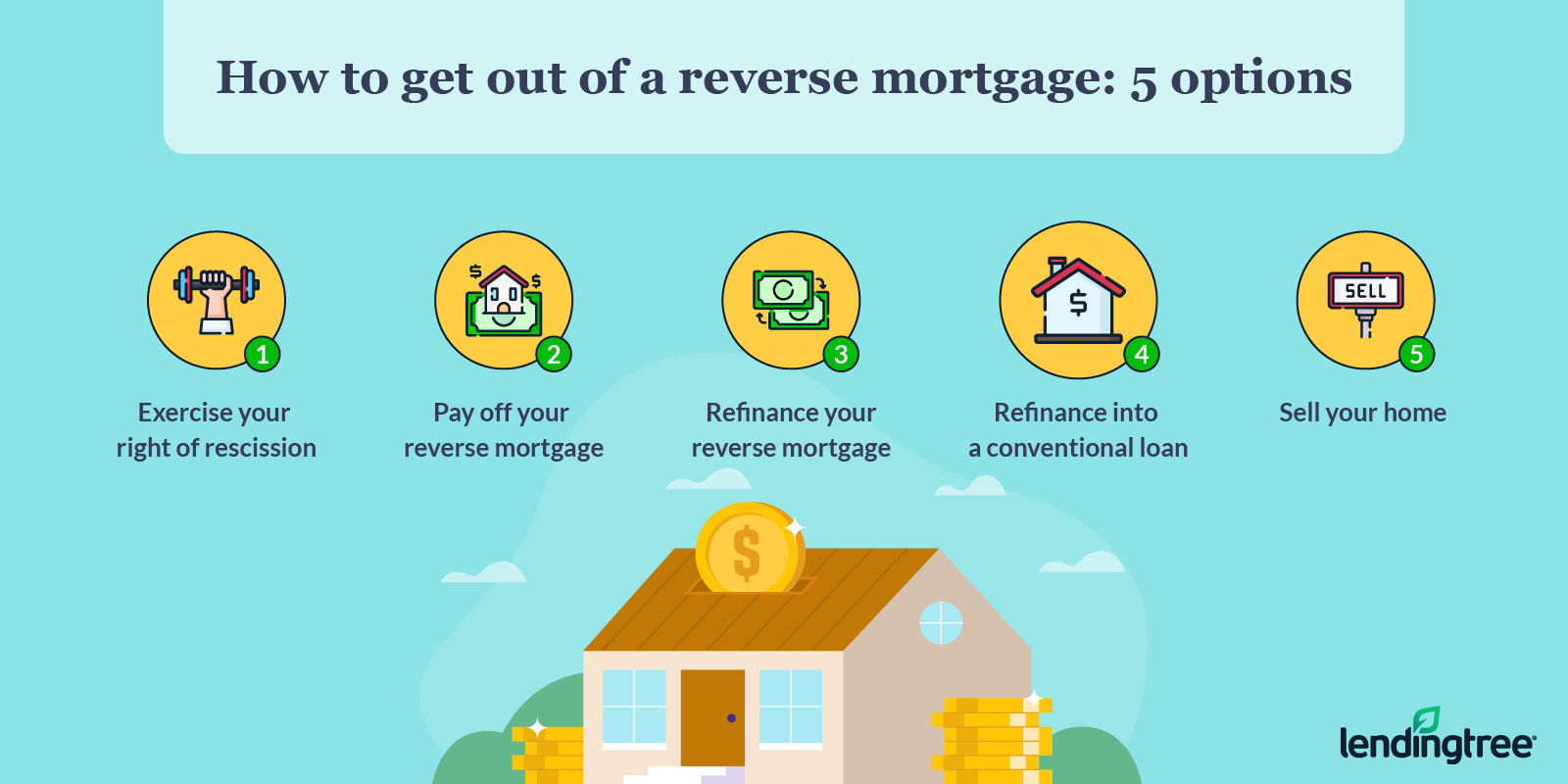

A reverse mortgage can be a great way to secure a retirement and provide seniors and retirees with increased financial security. Essentially, a reverse mortgage allows homeowners aged 62 or older to access the equity in their home, providing them with a lump sum of money or a line of credit. These funds can be used to supplement existing retirement income and provide greater financial security. This type of loan also offers flexible repayment options, meaning seniors and retirees can decide how they want to pay back the loan. They can choose to make monthly payments or wait until the home is sold. This flexibility can be incredibly beneficial for those living on fixed incomes. Additionally, the loan does not need to be repaid until the home is sold or the borrower dies. This means seniors and retirees can continue to live in the home for as long as they would like without having to worry about repayment. With a reverse mortgage, seniors and retirees can enjoy greater peace of mind and increased financial security.

Access to Funds Without Selling Home: A reverse mortgage allows seniors and retirees to access funds without having to sell their home.

Seniors and retirees can use a reverse mortgage to access the funds that are tied up in their home. This allows them to use those funds to pay for living expenses, medical bills, and other life expenses without having to sell their home. With a reverse mortgage, seniors and retirees can keep their home and enjoy their retirement years without the worry of having to sell their home to access funds. Additionally, with a reverse mortgage, seniors and retirees can access larger amounts of funds than they could with other forms of borrowing, such as a home equity loan. This can give seniors and retirees the financial flexibility they need to live comfortably and securely during retirement.

No Monthly Mortgage Payments: Seniors and retirees are not required to make monthly mortgage payments on a reverse mortgage.

When seniors and retirees consider taking out a reverse mortgage, one of the most attractive benefits is that they do not have to make monthly mortgage payments. This can be a huge relief for those on a fixed income, who may be struggling to make ends meet. Furthermore, a reverse mortgage can provide a senior with immediate access to their home equity, which can be used to cover living expenses, pay off existing debts, or make home improvements. The lack of monthly mortgage payments also makes reverse mortgages an attractive option for seniors and retirees who are looking to supplement their retirement income. Additionally, the flexibility of a reverse mortgage allows the homeowner to stay in their home for as long as they wish with no worry of a mortgage payment. These benefits make a reverse mortgage an ideal option for seniors and retirees who want to remain in their home and continue to enjoy their retirement.

Tax-Free Income: Withdrawals from a reverse mortgage are generally tax-free, making them a great way to supplement existing retirement income.

Retirement can be a time of financial uncertainty. Many seniors and retirees struggle to make ends meet on a fixed income. If you are looking for additional income to supplement your retirement, a reverse mortgage could be an ideal solution.A reverse mortgage allows seniors to access their home equity without having to sell their home or make monthly payments. The best part is that, unlike a traditional loan or mortgage, withdrawals from a reverse mortgage are generally tax-free. This means that you can access extra funds without having to worry about the extra burden of taxes. As an added bonus, you can use the funds for any purpose you like, such as paying for home repairs, medical bills, or even taking a vacation.A reverse mortgage can be an excellent way to supplement your retirement income without the added worry of taxes. With a reverse mortgage, you can access the equity in your home without sacrificing your lifestyle and enjoy your retirement years with financial security.

Flexible Terms: Reverse mortgages can be tailored to meet specific needs and can provide seniors and retirees with greater flexibility when it comes to accessing funds.

Reverse mortgages offer seniors and retirees a great deal of flexibility when it comes to accessing funds. This type of loan is designed to provide financial freedom and security to those in retirement, giving them access to the equity in their home without needing to sell it. Reverse mortgages have flexible terms, allowing borrowers to customize the loan to best suit their individual financial needs. With a reverse mortgage, seniors and retirees can choose a lump sum or a line of credit to draw from, and can set a monthly payment schedule that works best for their budget. This flexibility means that seniors and retirees can access the funds they need when they need it, giving them greater peace of mind and financial security.