Are you looking for a faster way to pay off your mortgage and build equity in your home? A 15-year mortgage may be the perfect solution! Not only will you pay off your mortgage faster, but you’ll also save money in interest and build equity in your home faster than with a traditional 30-year mortgage. In this article, we’ll discuss the many benefits of a 15-year mortgage and how it can help you reach your long-term financial goals. Read on to find out how a 15-year mortgage can help you become a homeowner faster and start building wealth today.

Lower Interest Rates: Because 15-year mortgages are paid off quicker than 30-year mortgages, lenders often offer lower interest rates for 15-year mortgages than 30-year mortgages

Lower interest rates are one of the major benefits of a 15-year mortgage. A 15-year mortgage is paid off faster than a 30-year mortgage, and as a result lenders often offer lower interest rates on 15-year mortgages than on 30-year mortgages. This can lead to significant savings over the course of the loan. The lower interest rate means that more of each payment goes toward paying off the principal balance, which can shorten the loan length and reduce the total amount of interest paid. Additionally, borrowers may be able to qualify for a 15-year mortgage even if they can’t qualify for a 30-year mortgage due to the lower interest rate. If you’re considering refinancing or taking out a new mortgage, you should explore the option of a 15-year mortgage to see if it could lower your monthly payments and save you money in the long run.

This can save borrowers thousands of dollars over the life of the loan.

A 15-year mortgage provides homeowners with a number of benefits, not least of which is the ability to save thousands of dollars over the life of the loan. Compared to a traditional 30-year mortgage, where borrowers are locked into making payments over a longer period of time, a 15-year mortgage offers the potential to take ownership of your home much faster. This can help you build equity more quickly, freeing up funds that can be used for other projects or investments. By paying off the loan faster, you can also save on interest payments, as the loan is typically paid off at a lower interest rate. This can provide a financial boost for those looking to get out of debt or build an emergency fund. Finally, a 15-year mortgage offers a sense of security, as you know that the loan will be paid off much faster than with a traditional loan, giving you peace of mind that your financial future is secure.

Accelerated Equity: Paying off a mortgage adds to the homeowner’s equity in the home faster

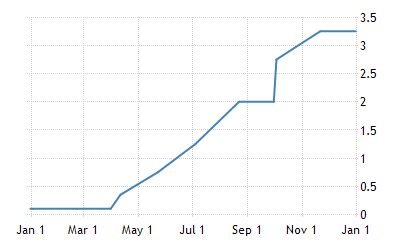

Paying off a mortgage faster with a 15-year mortgage plan can be a great way to build equity in a home. Over the course of 15 years, homeowners can build up equity in their home at an accelerated rate, allowing them to increase the value of their home quickly. By focusing on paying off the mortgage, homeowners can pay down their principal balance faster and build up their home’s equity more quickly. Homeowners who opt for this type of mortgage plan can be assured of having a larger portion of their home’s value tied to their equity instead of debt. This can make it easier to access the home’s equity in the future, if needed. Additionally, the faster payoff can mean that homeowners can access the full value of their home sooner, making it possible to move up or downsize in a shorter time span. A 15-year mortgage plan is an attractive option for homeowners who want to build home equity faster.

With a 15-year mortgage, the homeowner will build up equity in the home much faster than with a 30-year mortgage.

With a 15-year mortgage, the homeowner will build up equity in the home much faster than with a 30-year mortgage. This is because the monthly payments are higher and the loan term is shorter. With a 15-year mortgage, homeowners can pay off their mortgage faster and begin to accrue more equity in the home. The 15-year mortgage also comes with a lower interest rate than a 30-year mortgage, which helps to reduce the amount of interest paid over the life of the loan. This also results in a lower monthly payment and a faster payoff. Ultimately, the 15-year mortgage is a great option for homeowners looking to build up equity in their home faster, while also avoiding the high interest rates of a 30-year mortgage.

Lower Total Cost: Despite the higher monthly payments, the total cost of a 15-year mortgage is typically lower than a 30-year mortgage due to the lower interest rate and accelerated equity.

When it comes to the total cost of a 15-year mortgage, it is often much lower than a 30-year mortgage. This is due to the fact that a 15-year mortgage typically has a lower interest rate and will help to build equity faster. By paying down a loan in a shorter period of time, you can save money on interest payments and have more equity in your home more quickly. Additionally, since the loan is paid off more quickly, there is less time to pay interest, so the overall cost of the loan is lower. This means that even if you have a higher monthly payment than if you had taken out a 30-year loan, the amount you pay in total can be significantly less. As a result, a 15-year mortgage can be a great option for those looking to save money and build equity faster.

Lower Risk: 15-year mortgages have less interest rate risk and less time for market fluctuations to occur

15-year mortgages also offer lower risk than other loans due to their shorter repayment terms. With a 15-year loan, you don’t have to worry about interest rate fluctuations or market changes over a long period of time. In addition, since the loan is paid off in fewer years, you don’t have to worry about a loan balance that could grow larger over time. With a 15-year loan, you have the peace of mind that comes with shorter repayment terms and lower overall risk. Furthermore, by paying off the loan more quickly, you can avoid costly interest payments over a longer period of time, resulting in a lower overall cost of borrowing. This makes 15-year mortgages a great choice for individuals who want to save money and reduce risk.

This makes 15-year mortgages less risky than 30-year mortgages.

15-year mortgages are a less risky option than traditional 30-year mortgages because they provide a shorter loan duration with a lower interest rate. A shorter loan period, such as 15 years, means that homeowners can pay off their mortgage loan faster and gain more equity in their home. Since the loan is paid off faster, the homeowner isn’t exposed to the risks of the interest rate changing drastically over time, which is common with 30-year mortgages. Additionally, the lower interest rate that comes with a 15-year mortgage means that the homeowner can save money on their loan payments in the long-term. With a 15-year mortgage, a homeowner can also benefit from a lower interest rate for the entire loan period, meaning they can save even more money. All of these advantages make 15-year mortgages a great choice for homeowners who are looking to build equity in their home quickly and reduce the amount of time they’re exposed to changing interest rates.

Easier Budgeting: With a 15-year mortgage, the monthly payments are fixed, making budgeting easier and allowing the homeowner to plan ahead.

A 15-year mortgage offers many benefits, and one of the most important is that it makes budgeting easier. With a 15-year mortgage, the monthly payments are fixed, so you know exactly what your payments will be each month and can plan ahead. This makes it easier to create and stick to a budget, which helps you save money and avoid financial surprises. Additionally, the shorter length of the loan means you’ll pay off the loan faster and build equity faster, allowing you to build your financial future more quickly. With the fixed monthly payments of a 15-year mortgage, you can easily plan and budget for the future, giving you the peace of mind and financial security you need.