Rehabilitation mortgages can be a great way to finance the purchase of a fixer-upper property. Whether you’re looking to buy a home to renovate and flip, or simply want to make some improvements to an existing property, a rehabilitation mortgage can help you secure the funds you need. In this comprehensive guide, we’ll explain what a rehabilitation mortgage is, how it works, and the steps you need to take to get one. We’ll also cover the pros and cons of a rehabilitation mortgage and what to consider when applying. With this information in hand, you’ll be able to make an informed decision about whether a rehabilitation mortgage is right for you.

What is a Rehabilitation Mortgage?

A rehabilitation mortgage is a type of financial product that is designed to help people purchase and improve properties that need work. It’s a great way to get into a fixer-upper property if you don’t have the funds to cover the full purchase price or the renovation work that needs to be done. With a rehabilitation mortgage, you can purchase the property, complete the repairs, and then refinance the loan to pay off the construction costs. The loan is secured by the property so you don’t have to worry about putting up any additional collateral. It’s a great way to build up your equity in a property and increase its value over time.

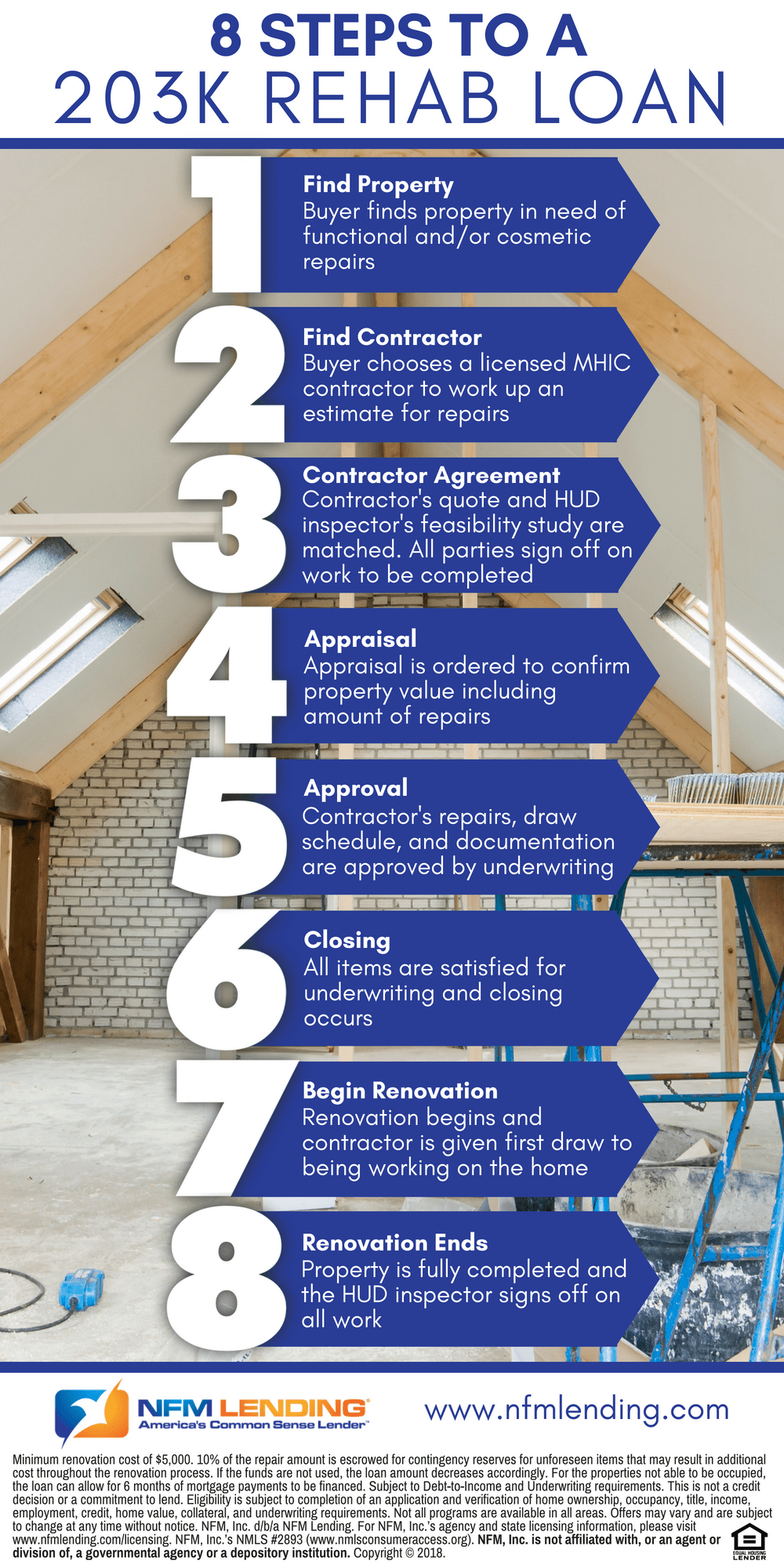

How Does a Rehabilitation Mortgage Work?

Rehabilitation mortgages are a great way to get your finances back on track. They work by providing you with the funds to repair or renovate your home while also letting you pay off any debt you have. This way, you can get back on your feet and make sure your home is in good shape. With a rehab mortgage, you can make sure that you’re able to afford the repairs and renovations you need without having to worry about taking out a huge loan. Plus, the funds are usually provided at a much lower interest rate than a traditional loan, making them more affordable. So if you’re in need of repairs or renovations, a rehab mortgage might be the perfect solution for you.

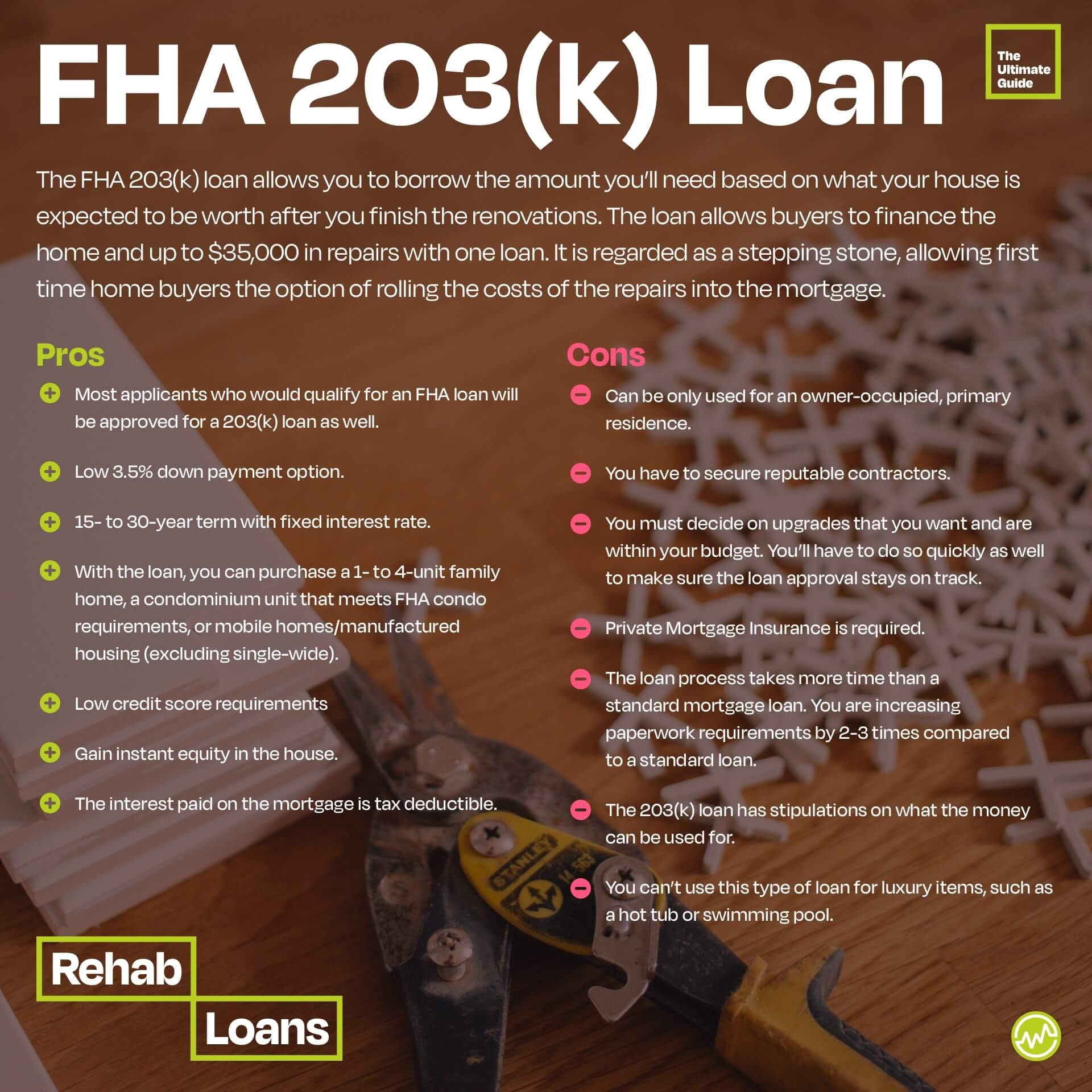

Benefits of a Rehabilitation Mortgage

If you’re thinking about taking out a rehabilitation mortgage, you should know about the numerous benefits that can come with this type of loan. With a rehab loan, you can finance the purchase of a fixer-upper property and pay for necessary repairs. This makes fixer-uppers an attractive proposition, as they can be bought at a fraction of their full market value, and you can use a rehab loan to bring it up to its full potential. Additionally, you can use the loan to purchase and improve a property that you already own, making it easier to maintain and improve the value of your home. Furthermore, rehab loans often come with better rates than traditional mortgages, so you can save money in the long run. Lastly, these loans are designed to be flexible, so if you need to make changes to the scope of work, you can easily do so. With all these benefits, it’s easy to see why rehabilitation mortgages are a great option for anyone looking to get into the real estate market.

Qualifying for a Rehabilitation Mortgage

If you’re looking to score a rehab loan, you need to know what it takes to qualify. First, you must have a good credit score, since rehab loans are generally considered to be riskier than other types of mortgages. You’ll also need to show proof of income, and you might need to present an appraisal of the home you’re looking to rehab. Additionally, you’ll need to provide a detailed plan of the rehab project, including estimated costs and timelines. Lastly, you’ll need to prove that you have enough cash reserves to cover the cost of the project. If you think you have all the necessary pieces, you’re ready to apply for a rehab loan!

Strategies for Avoiding Plagiarism When Writing About a Rehabilitation Mortgage

When it comes to writing about a rehabilitation mortgage, it’s important to make sure you’re avoiding plagiarism. Plagiarism is a form of cheating that can have serious consequences. To make sure you don’t end up in hot water, here are some key strategies to follow: cite your sources, use your own words and ideas, and provide your own analysis. As a writer, always make sure you’re properly citing any sources you use and providing your own unique take on the subject. Doing so will ensure you’re staying on the right side of the law and helping to make your work stand out from the crowd.