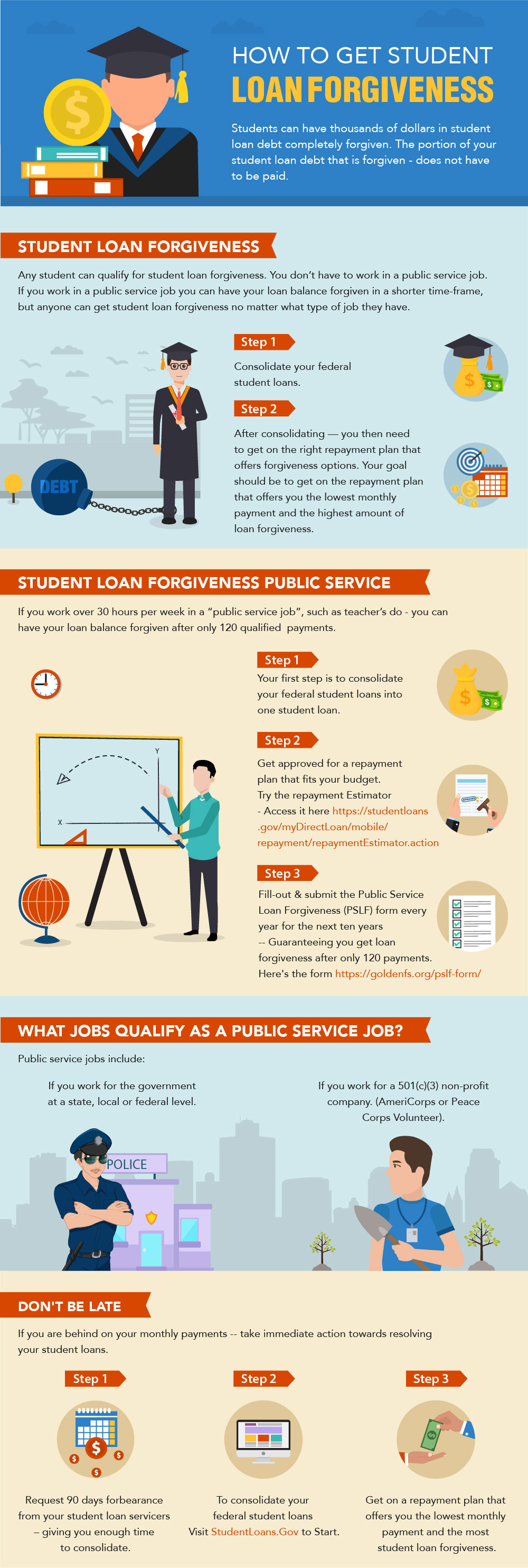

Unlock the secrets to successfully navigating the student loan forgiveness application process with our comprehensive, step-by-step guide. Say goodbye to overwhelming paperwork and confusing jargon as we break down the essentials to help you achieve financial freedom from your student loans. Don’t miss out on the opportunity to potentially wipe out a significant portion of your student loan debt – read on and master the art of applying for student loan forgiveness like a pro!

Understanding the Different Types of Student Loan Forgiveness Programs: A Comprehensive Guide

Discover the various student loan forgiveness programs available to ease your financial burden with our comprehensive guide. Familiarize yourself with the diverse range of options, including Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, Income-Driven Repayment (IDR) Forgiveness, and more. Learn about eligibility criteria, application processes, and potential benefits tailored to suit your professional field and unique circumstances. This knowledge will empower you to make informed decisions and optimize your chances of successfully navigating the student loan forgiveness application process. Unlock the potential for a debt-free future by understanding the ins and outs of these life-changing programs.

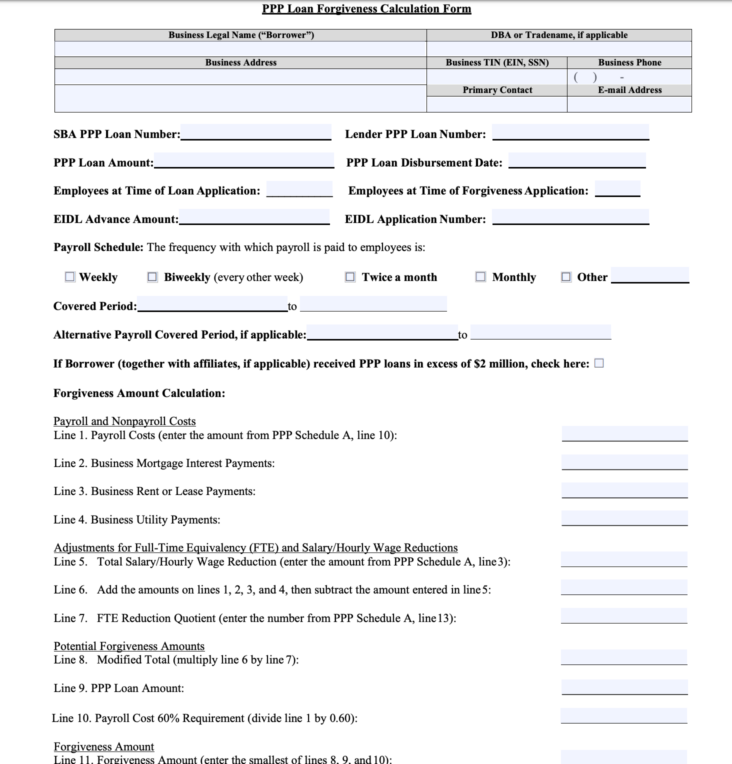

Essential Documentation and Eligibility Criteria: Preparing for a Successful Student Loan Forgiveness Application

Embarking on the journey towards student loan forgiveness requires thorough preparation and understanding of the essential documentation and eligibility criteria. To ensure a successful application, you must gather all vital paperwork, including your loan details, income proof, and employment certification. Familiarize yourself with the specific requirements of your chosen forgiveness program, such as the Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. By diligently assessing your eligibility, organizing your documents, and staying informed about the latest updates, you’ll be well-equipped to navigate the student loan forgiveness process and achieve financial relief.

Demystifying the Public Service Loan Forgiveness (PSLF) Application Process: Tips and Best Practices

Demystifying the Public Service Loan Forgiveness (PSLF) application process can be the key to unlocking a financially stable future for qualifying borrowers. Navigating this process involves understanding eligibility requirements, submitting the right forms, and consistently tracking your progress. To ensure you’re on the right path, follow these essential tips and best practices: research your loan type and repayment plan, work closely with your loan servicer, and maintain detailed records of your qualifying payments. By staying informed and proactive, you’ll be better equipped to make informed decisions and ultimately achieve success in your student loan forgiveness journey.

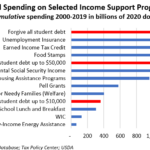

Income-Driven Repayment Plans and Forgiveness: How to Maximize Your Benefits and Minimize Your Debt

Navigating Income-Driven Repayment (IDR) plans is a crucial aspect of maximizing student loan forgiveness benefits and minimizing debt. With various IDR plans available, it’s essential to determine the best option for your unique financial situation. These plans tailor monthly payments to your income and family size, offering affordable solutions and potential forgiveness after 20-25 years of consistent payments. To optimize your benefits, start by researching different IDR options, estimating your monthly payments, and staying informed about potential changes to the programs. Remember, timely recertification and communication with your loan servicer are vital steps in ensuring your progress towards student loan forgiveness.

Overcoming Common Roadblocks in the Student Loan Forgiveness Journey: Expert Advice and Real-Life Success Stories

Navigating the student loan forgiveness application process can seem overwhelming, but you can overcome common roadblocks with expert advice and real-life success stories. Our blog post will delve into essential tips and techniques to tackle issues such as consolidating loans, verifying employment, and maintaining eligibility for forgiveness programs. You’ll hear firsthand accounts of how borrowers have successfully navigated these challenges, giving you the confidence and motivation to pursue loan forgiveness. By understanding these potential obstacles and learning from others’ experiences, you’ll be better prepared to manage and ultimately conquer your student loan debt. Don’t let roadblocks deter you; take control of your financial future today!