Welcome to the ultimate guide on mastering the art of homeownership with Freedom Mortgage! As a leading and trusted mortgage provider, Freedom Mortgage offers a wide range of options to make your homeownership dreams a reality. Whether you’re a first-time homebuyer, seeking to refinance your current mortgage, or exploring government-backed loan programs, we’re here to ensure you make informed decisions every step of the way. In this comprehensive article, we’ll delve into the best practices for working with Freedom Mortgage to achieve your homeownership goals, while unlocking the secrets to a smooth and successful mortgage experience. So, let’s turn the key and begin your journey to the perfect home today!

Research Freedom Mortgage’s loan options.

Dive into Freedom Mortgage’s diverse loan options and find your perfect fit! Whether you’re a first-time homebuyer, a military veteran, or seeking to refinance, they’ve got you covered. Explore their low rates, flexible terms, and award-winning support to achieve your homeownership dreams. #FreedomMortgage #homegoals #loansmadeeasy

Evaluate personal finances and eligibility.

Kickstart your homeownership journey by assessing your personal finances and eligibility with Freedom Mortgage. Get a clear picture of your credit score, monthly expenses, and income to determine the loan amount you can afford. By evaluating your financial position, you’ll be better prepared to explore mortgage options and find the best fit for your dream home.

Choose suitable mortgage plan.

Discover your ideal mortgage plan with Freedom Mortgage, designed to fit your homeownership aspirations. Explore various options like fixed-rate, adjustable-rate, FHA, VA, or USDA loans, and let our experienced team guide you to make a smart decision. Together, we’ll tailor a mortgage solution that aligns with your financial goals and lifestyle.

Complete application with required documents.

Kickstart your homeownership journey by efficiently completing the Freedom Mortgage application with all the necessary documents. Gather essential paperwork, such as proof of income, credit history, and asset information, to ensure a seamless process. This vital step paves the way for securing your dream home and achieving financial freedom.

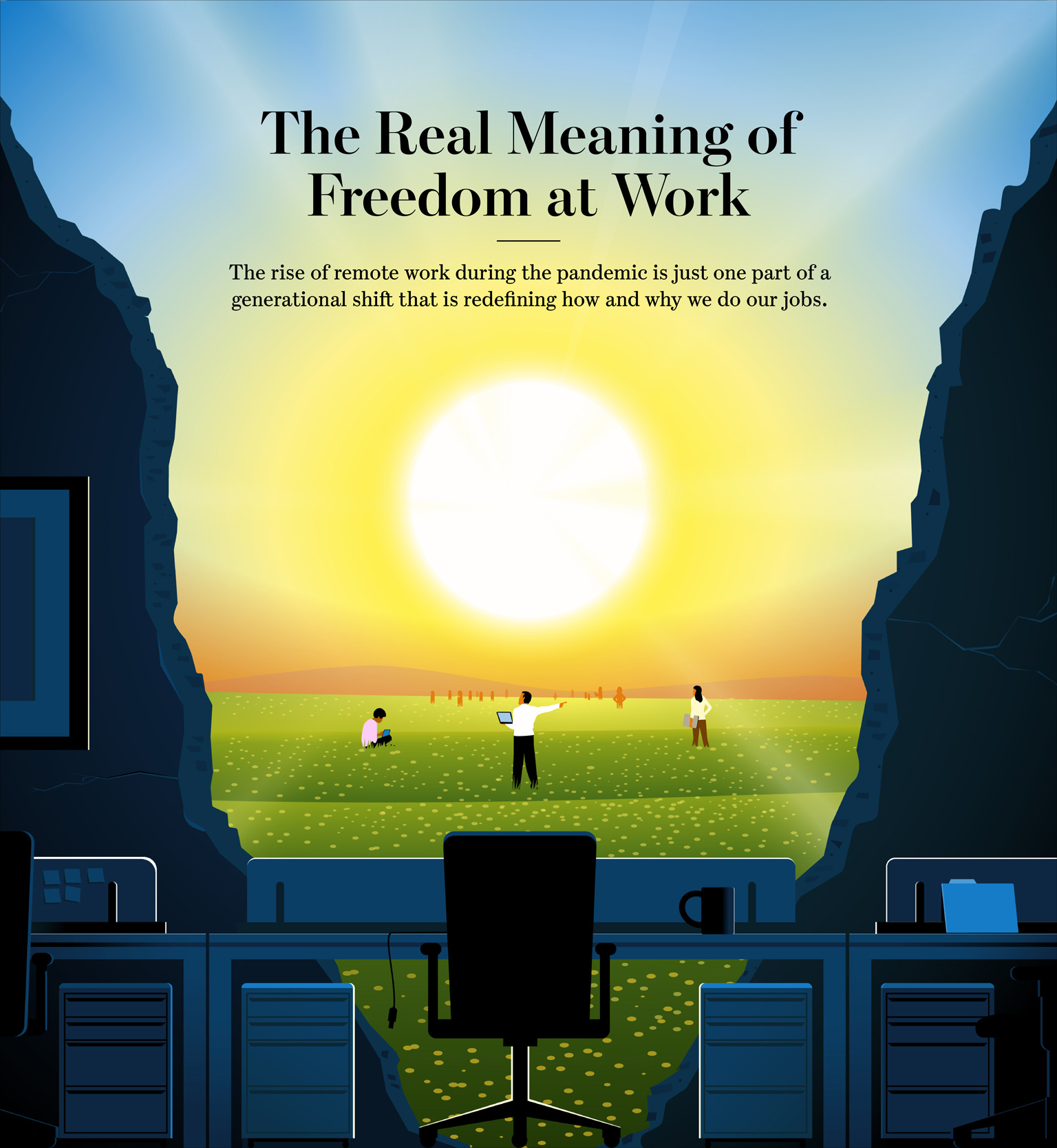

Communicate with loan officer regularly.

Keep in touch with your Freedom Mortgage loan officer consistently to stay on track with your homeownership goals. Regular communication ensures you’re updated on your loan status, helps address any queries, and expedites the approval process. A proactive approach puts you on the fast track to securing your dream home!

Close deal and achieve homeownership.

Finally, it’s time to seal the deal and achieve your homeownership dream! With Freedom Mortgage by your side, you’ll experience a smooth closing process. We’ll guide you through every step, ensuring all documents are in order and you’re fully prepared. Celebrate your new home with the confidence of a hassle-free journey, all thanks to Freedom Mortgage.