Are you ready to embark on the exciting journey of homeownership? Using a mortgage payment calculator is a crucial first step to help you successfully plan your home purchase. In this comprehensive guide, we will explore how to accurately leverage these handy online tools to estimate your monthly mortgage payments, assess affordability, and ultimately make an informed decision on the perfect property for you. Say goodbye to financial stress and uncertainty, as we unveil the secrets to mastering the mortgage payment calculator and getting one step closer to owning your dream home.

Find a reliable calculator online.

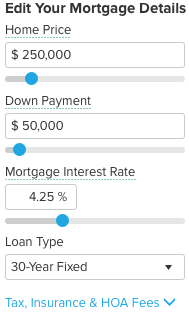

Discover the perfect mortgage calculator online to simplify your home buying journey. A reliable tool will accurately estimate your monthly payments, factoring in various elements like interest rates, loan terms, and property taxes. Conduct thorough research and read reviews to find a user-friendly, trustworthy calculator that meets your needs and helps you make informed decisions.

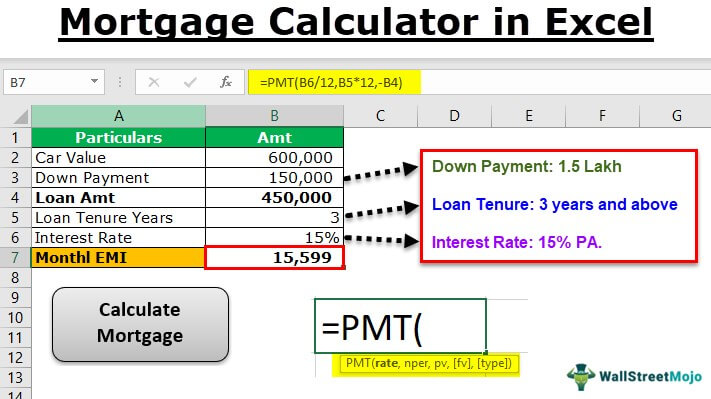

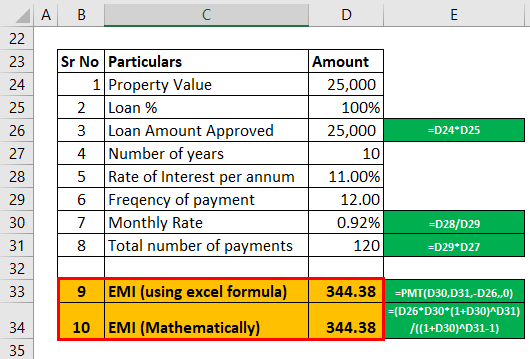

Input mortgage amount and interest rate.

Kickstart your home buying journey by accurately inputting your desired mortgage amount and interest rate into the calculator. This essential step gives you a clear picture of your potential monthly payments, helping you narrow down home options and budget efficiently. Say goodbye to financial stress and confidently plan your dream home purchase.

Set loan term and start date.

Kickstart your home-buying journey by setting the loan term and start date on a mortgage payment calculator. This crucial step helps you understand your monthly payments and visualize your financial future. By carefully selecting your loan term and start date, you can take control of your homeownership goals and make informed decisions. Nail down these details for a smooth and stress-free home purchase experience.

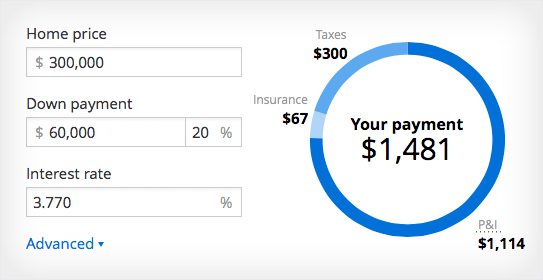

Add property taxes and insurance fees.

Don’t forget to factor in property taxes and insurance fees when using a mortgage payment calculator! These costs can significantly impact your monthly payments, so it’s essential to include them for an accurate estimate. A reliable calculator will have options to input these expenses, giving you a clearer picture of your future home purchase.

Review and analyze monthly payment results.

Dive into the deets of your monthly payment results with a keen eye! A mortgage payment calculator lets you see the breakdown of principal, interest, taxes, and insurance (PITI) for your dream home. Analyzing these results helps you make smarter decisions, ensuring you choose a home that won’t break the bank. Stay woke, future homeowners!

Adjust variables to plan purchase accordingly.

Adjust your home buying game plan by tweaking variables in a mortgage payment calculator! Discover how changing factors like interest rates, down payment, and loan term impact your monthly payments. Stay ahead of the curve by strategically planning your purchase and securing a mortgage that fits your budget like a glove. Don’t settle; optimize!