Discover the ins and outs of the Freedom Mortgage pre-approval process and unlock the doors to your dream home with ease. Our comprehensive guide will help you navigate this crucial first step on your home-buying journey, providing you with invaluable insights and tips to ensure a smooth experience. Whether you’re a first-time buyer or a seasoned homeowner, understanding the Freedom Mortgage pre-approval process is key to securing the best mortgage rate and terms tailored to your unique needs. So, let’s dive in and start exploring the secrets to mastering this essential aspect of home financing.

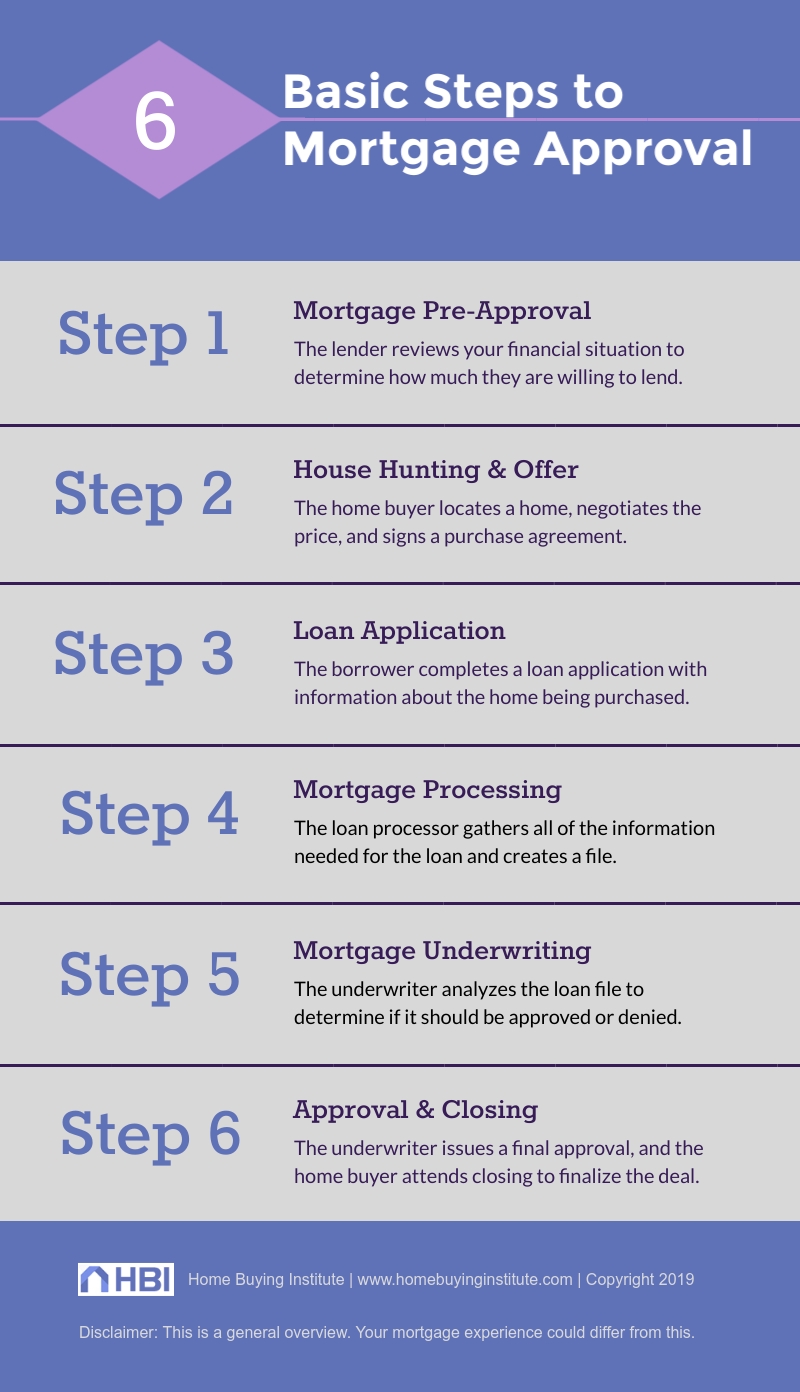

Research Freedom Mortgage’s offerings.

Dive into Freedom Mortgage’s diverse offerings and discover the perfect home loan tailored to your needs! With their competitive rates and flexible loan options, you’ll be on your way to homeownership in no time. So, get ready to explore and compare their amazing mortgage deals and find your dream home with ease.

Gather necessary financial documents.

Kickstart your Freedom Mortgage pre-approval journey by assembling all essential financial documents beforehand. Save time and avoid hiccups by collecting records such as your pay stubs, W-2 forms, tax returns, bank statements, and proof of assets. Stay organized and ready to impress lenders with your financial prowess!

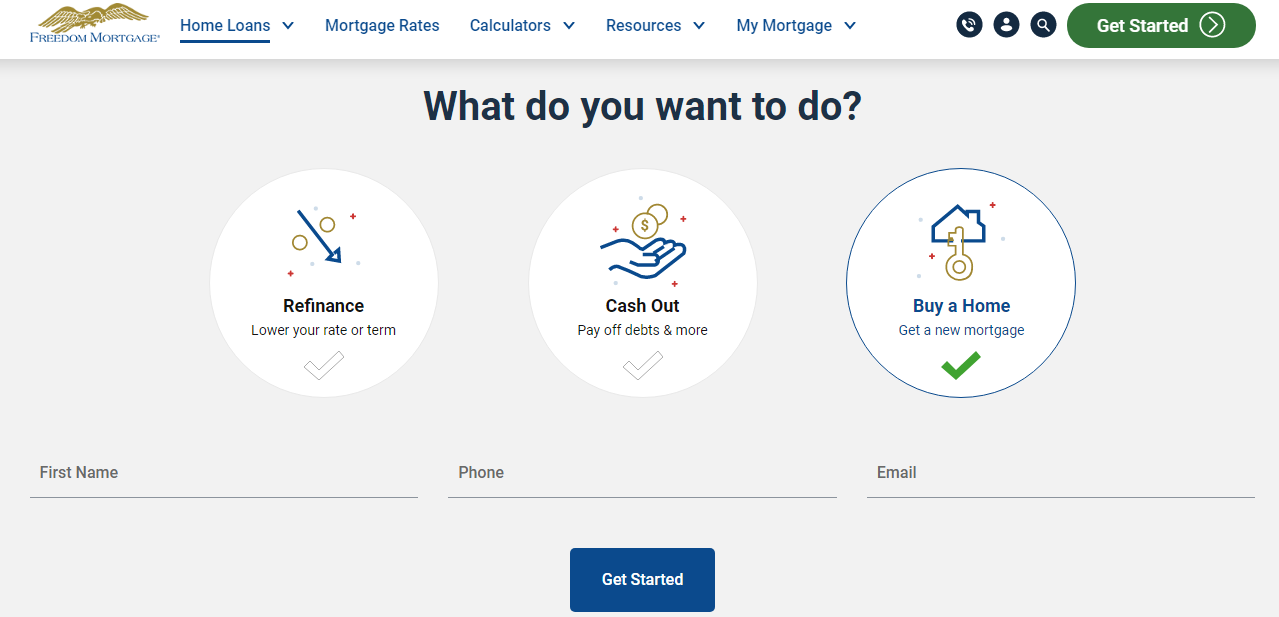

Complete pre-approval application online.

Easily navigate the Freedom Mortgage pre-approval process by completing your application online! With just a few clicks, you’ll be on your way to securing your dream home. Say goodbye to lengthy paperwork and hello to a hassle-free, digital experience that’s both fast and efficient. Don’t wait, start your pre-approval journey now!

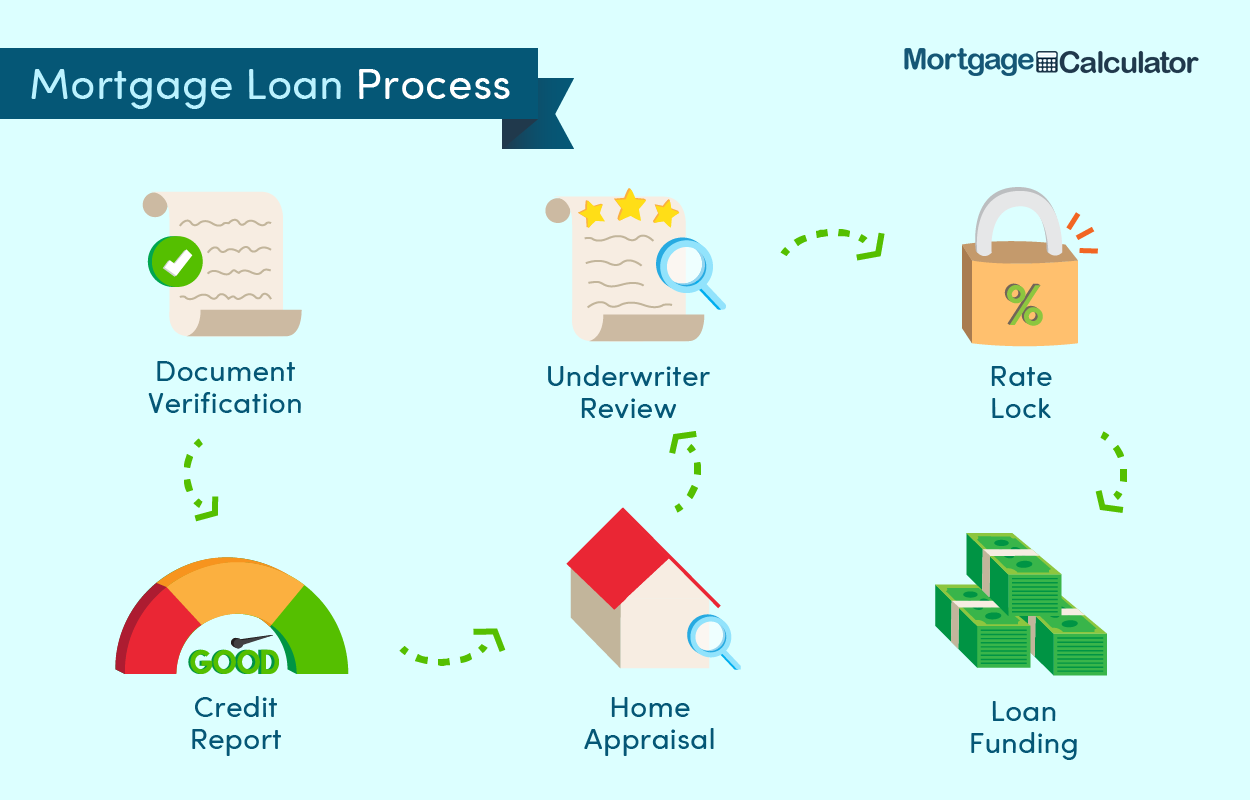

Await credit check and review.

The credit check and review step is crucial in the Freedom Mortgage pre-approval process. Lenders assess your creditworthiness to ensure you’re a reliable borrower. Having a good credit score can significantly impact your interest rates, loan terms, and approval odds. Stay patient and be prepared, as this evaluation will pave the way for your dream home.

Review pre-approval letter and terms.

Dive into your pre-approval journey by thoroughly reviewing your Freedom Mortgage pre-approval letter and its terms. Knowing the deets – like interest rates, loan amounts, and potential closing costs – can make a huge difference in your home buying game. Stay woke and make informed decisions, cuz knowledge is power, fam!

Consult loan officer for clarification.

Consulting your loan officer for clarification is a crucial step in the Freedom Mortgage pre-approval process. They can provide insights on your financial situation, assist with paperwork, and answer any questions you may have. Communicate openly with them to ensure a smooth, hassle-free experience and increase your chances for a successful mortgage application.