Understanding the difference between a jumbo and non-jumbo mortgage can seem confusing, but it doesn’t have to be! Whether you’re a first-time homebuyer or an experienced real estate investor, understanding the difference between these two types of mortgages can help you make the best decision for your financial future. In this article, I’ll explain in an easy-to-understand way the difference between jumbo and non-jumbo mortgages, so that you can make an informed decision about which type of loan is right for you.

Research mortgage types.

Doing some research on jumbo and non-jumbo mortgages is important to help you decide which one is best for you. It’s a good idea to read up on different mortgage types and understand the potential pros and cons of each one. Talk to a trusted financial adviser who can explain the different types of mortgages and help you make an informed decision.

Check loan limits.

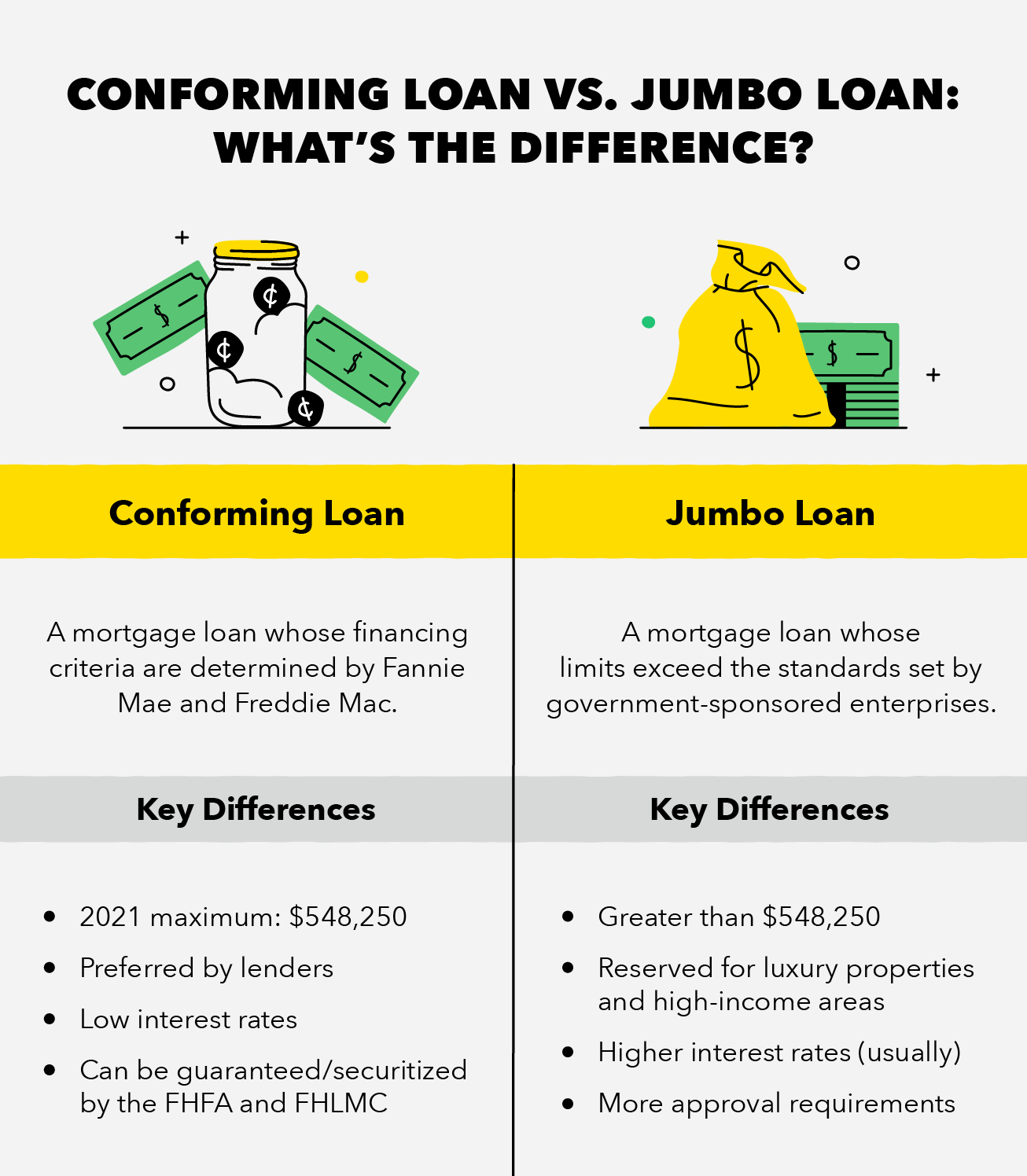

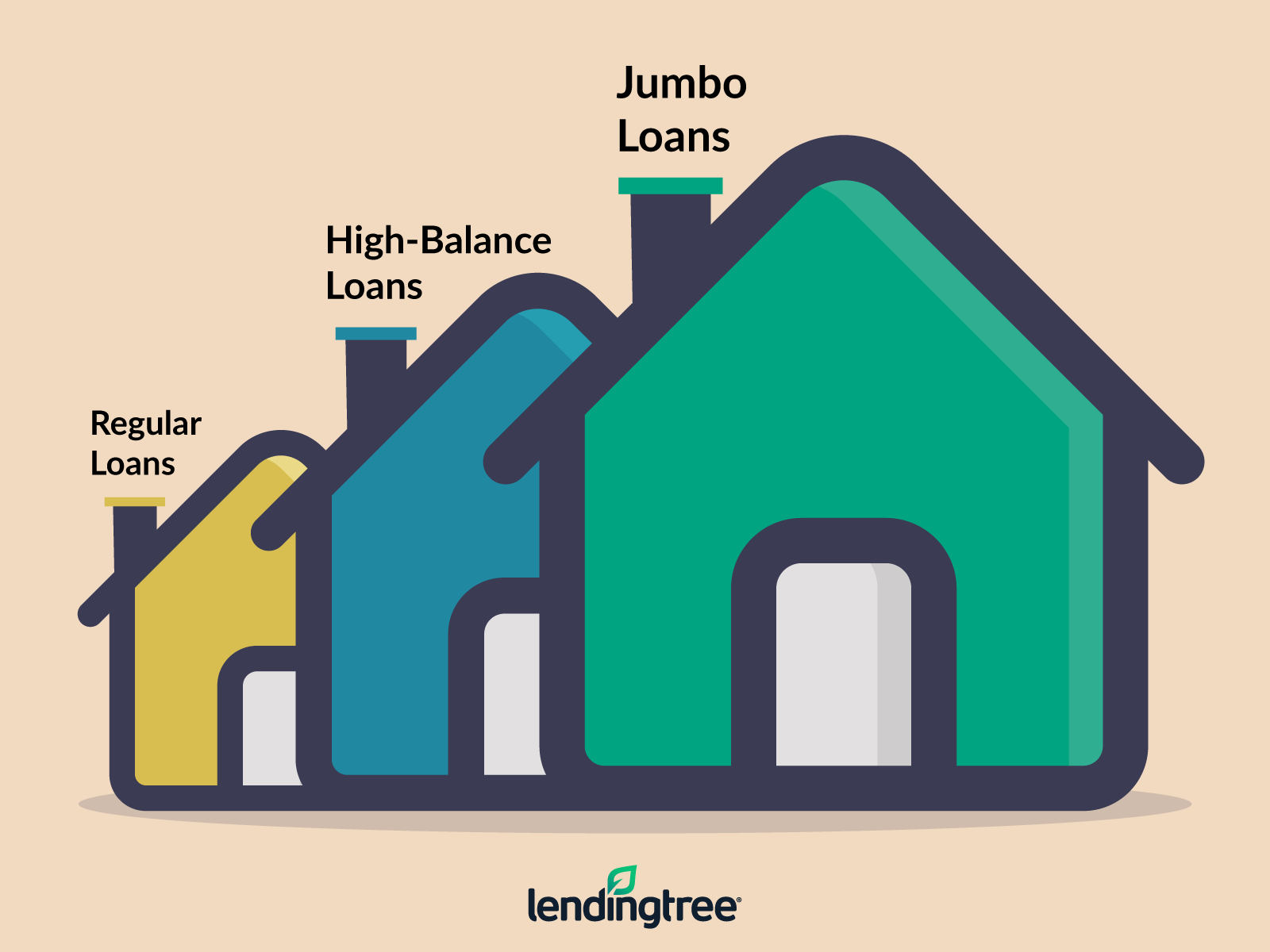

Figuring out whether you need a jumbo mortgage or a non-jumbo mortgage can be a bit confusing. You should always check loan limits to see how much you can borrow. Most lenders decide if you need a jumbo loan based on the loan amount and the area you live in. Generally, if your loan amount exceeds the loan limits set by Fannie Mae and Freddie Mac, you’ll need a jumbo loan. A jumbo loan usually requires a higher credit score and a bigger down payment.

Compare rates/fees.

Comparing rates and fees between jumbo and non-jumbo mortgages can seem daunting and confusing. However, it’s important to take the time to understand the difference. Rates on a jumbo mortgage can be slightly higher than those on a non-jumbo loan, but additional fees can add up quickly. Be sure to ask potential lenders about their fees and compare those to the interest rate to get the best deal.

Assess credit score.

Figuring out what kind of mortgage is right for you is an important step, and understanding your credit score is essential. If you have a good credit score, you can likely qualify for a jumbo mortgage, which has higher loan limits than a conventional mortgage. If your credit score is lower, you’ll need to opt for a non-jumbo mortgage. To assess your credit score, you can get a free report from a credit reporting agency.

Calculate loan-to-value.

When it comes to understanding the difference between a jumbo and non-jumbo mortgage, it’s important to calculate the loan-to-value (LTV). This ratio measures the amount of the loan compared to the property’s value and helps to determine the maximum loan amount. Knowing the LTV can help you determine if you need a jumbo mortgage or a non-jumbo mortgage. It’s important to understand the LTV before you apply for a loan.

Choose best option.

When it comes to choosing the best option for a mortgage, it’s important to understand the differences between a jumbo and non-jumbo mortgage. A jumbo loan is a loan that exceeds the conforming loan limit, while a non-jumbo loan typically has a smaller balance that is within the limit. Knowing the differences between these two types of loans is the key to making an informed decision about which option is best for your financial situation.