Welcome to our comprehensive, step-by-step guide on how to effortlessly navigate the Freedom Mortgage application process! Whether you’re a first-time homebuyer or an experienced homeowner looking to refinance, this article has you covered. With our expert tips and insights, you’ll be able to confidently secure a mortgage tailored to your unique financial needs. So, buckle up and get ready to embark on a journey towards homeownership made easy with Freedom Mortgage, one of the nation’s leading providers of mortgage solutions.

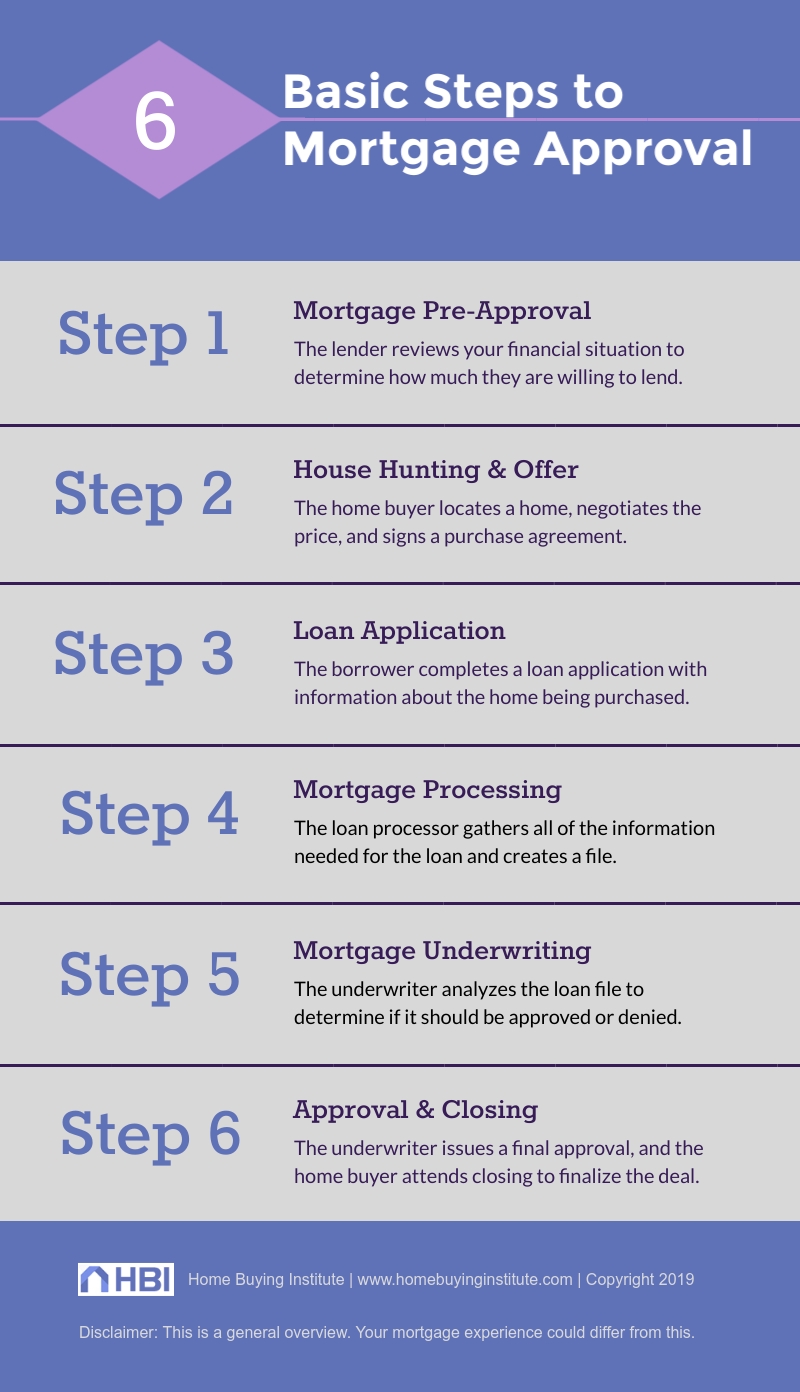

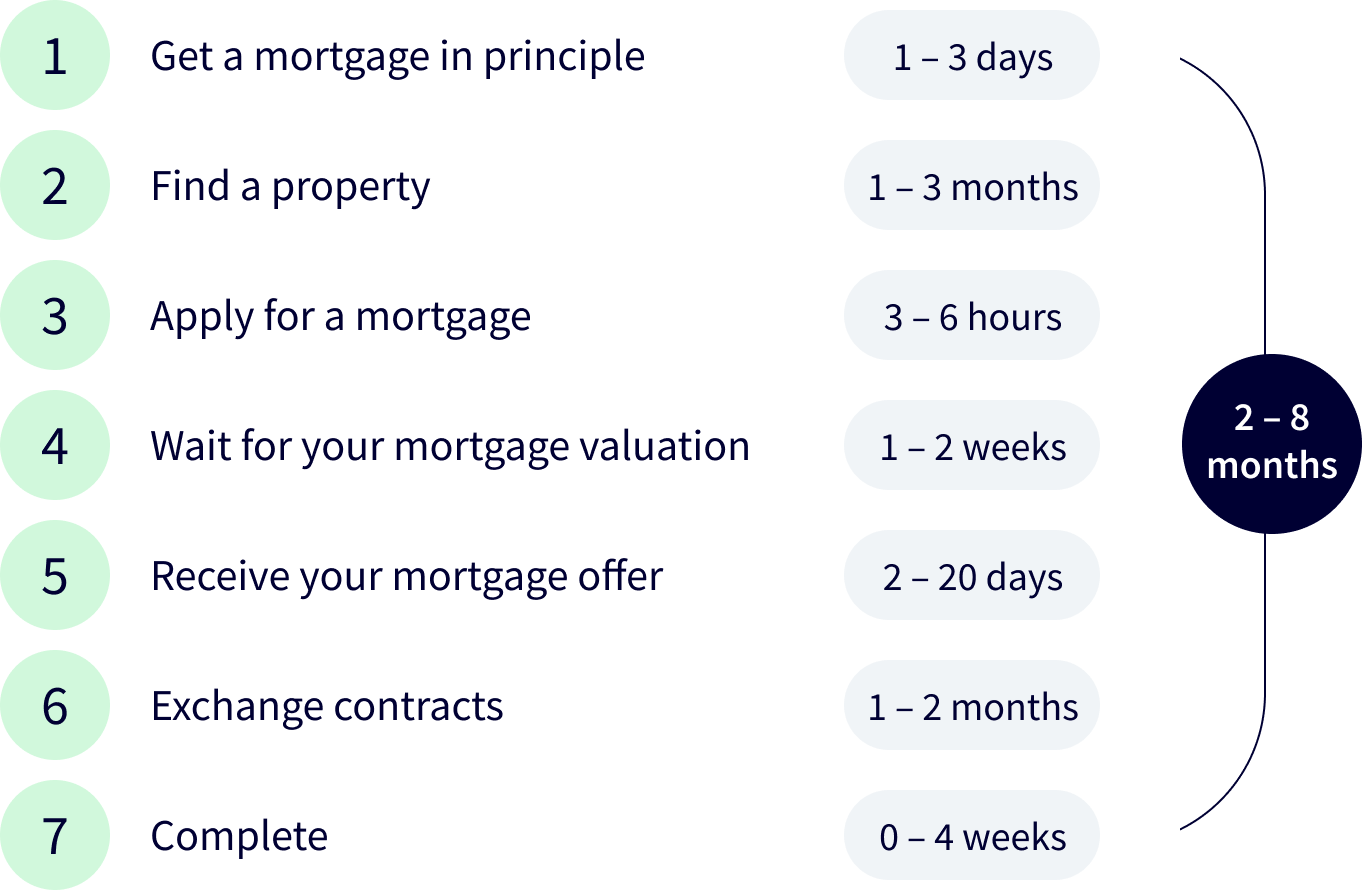

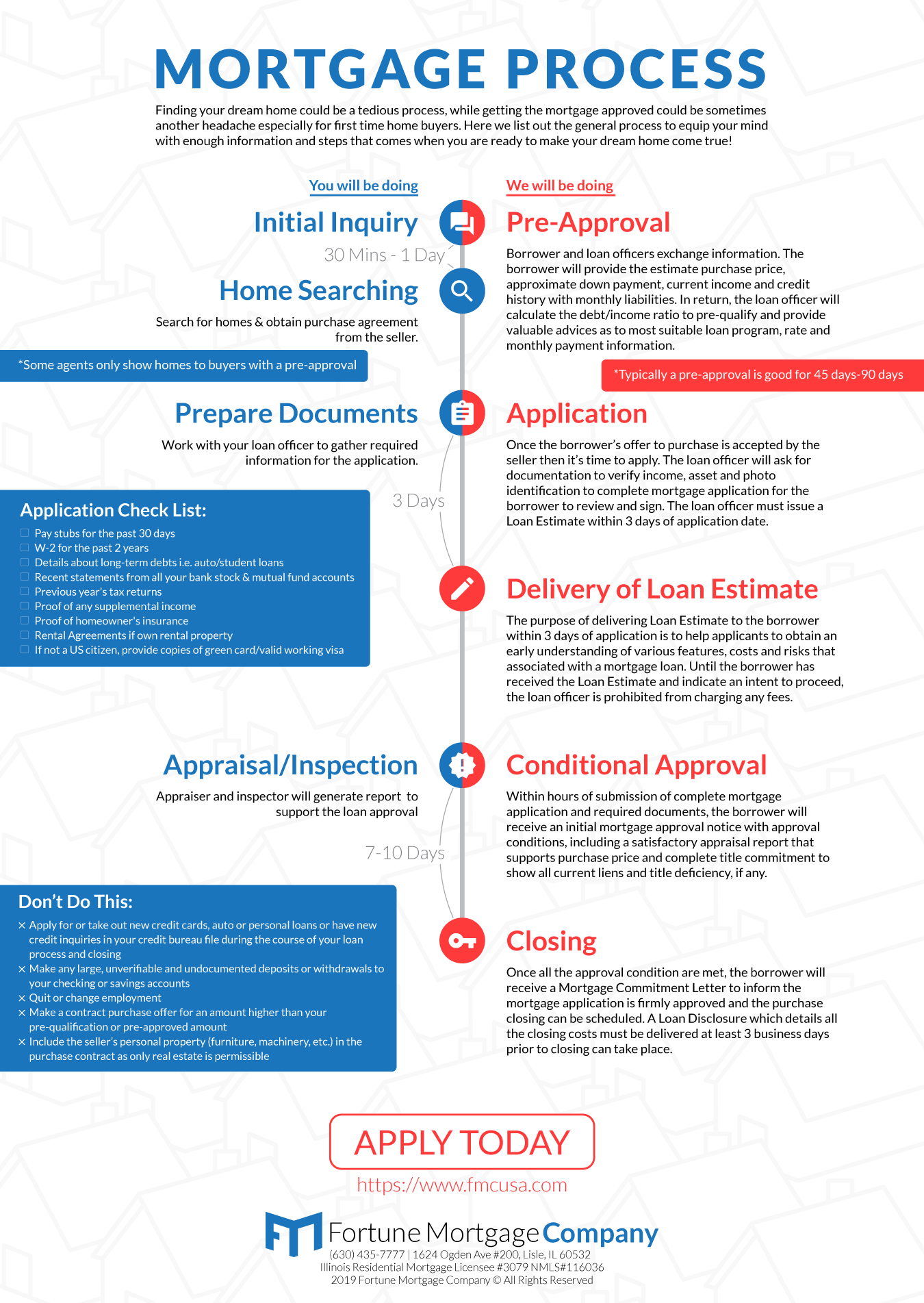

Gather necessary financial documents.

Get your finances sorted by assembling essential documents like pay stubs, tax returns, W-2 forms, and bank statements. Having these docs ready makes the Freedom Mortgage application process smoother and helps secure the best loan terms. Stay ahead of the game and land your dream home faster!

Access Freedom Mortgage application online.

Kickstart your homeownership journey with ease by accessing the Freedom Mortgage application online. This user-friendly platform allows you to quickly apply, upload essential documents, and track your application’s progress in real-time. Say goodbye to tedious paperwork and hello to a hassle-free, digital mortgage experience designed for today’s tech-savvy generation.

Complete application with accurate information.

Embark on your home buying journey with ease by completing the Freedom Mortgage application accurately. Providing the correct information, such as employment history, income, and debts, is vital for a seamless process. This not only accelerates the approval but also helps you snag the best mortgage deal suited for your needs.

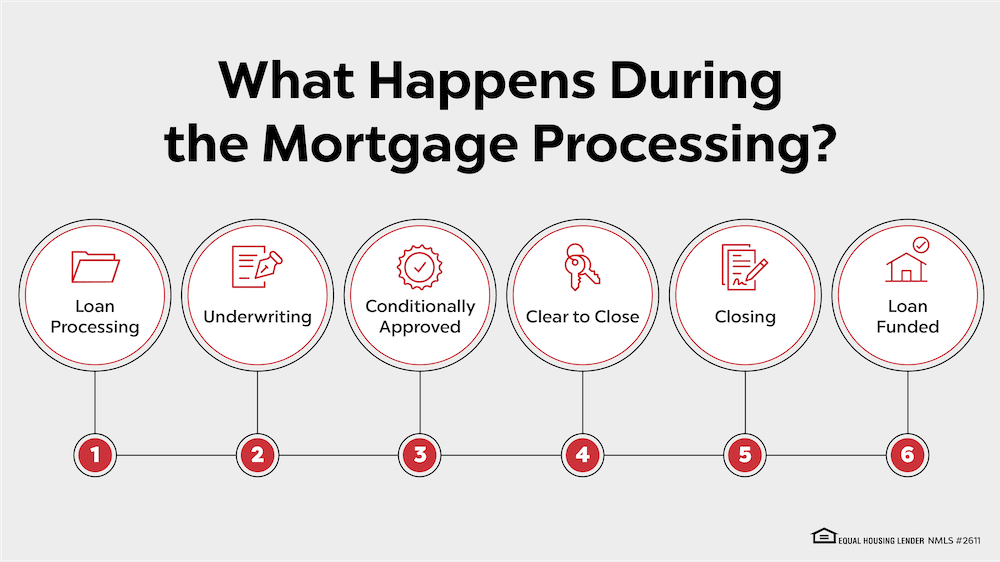

Submit application and await response.

After submitting your Freedom Mortgage application, it’s time to patiently await their response. Stay on top of your inbox and phone, as they might request additional documents or information. Remember, the faster you respond, the quicker you’ll move through the mortgage application process and be on your way to homeownership!

Provide additional documents if requested.

In the mortgage application process, you may be asked to provide additional documents to support your financial profile. Be prepared to promptly submit any requested paperwork, such as bank statements, tax returns, or proof of employment, to ensure a smooth and speedy approval. This responsiveness increases your chances of securing your dream home.

Review loan terms, finalize process.

In this final step of the Freedom Mortgage application process, carefully review your loan terms and ensure you fully understand the interest rate, monthly payments, and other fees involved. By thoroughly examining these details, you’ll confidently finalize the process and be on your way to securing your dream home!