Discover the secrets to unlocking and understanding your Freedom Mortgage Loan Estimate and Closing Disclosure like a pro! This comprehensive guide will provide you with invaluable insights and expert advice to help you make sense of these critical documents, ensuring a stress-free home buying experience. Don’t miss out on your chance to become an empowered homeowner; dive into this essential resource and gain the confidence to navigate your way through the financial maze with ease. Say goodbye to confusion and hello to clarity as we demystify the intricacies of your mortgage loan process, one step at a time.

Gather Loan Estimate and Closing Disclosure.

Ready to decode your Freedom Mortgage Loan Estimate and Closing Disclosure? Start by gathering these essential documents to unveil the mysteries of your mortgage. With our easy-to-follow tips and tricks, we’ll help you make sense of the numbers and unlock the secrets to a stress-free home buying experience. Let’s get started on this mortgage decoding adventure!

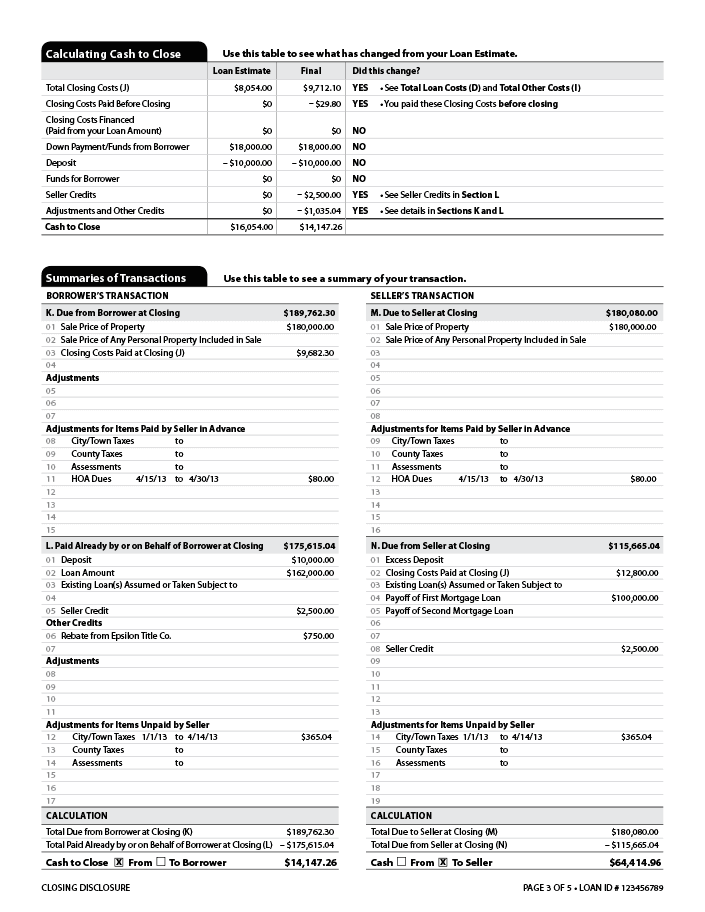

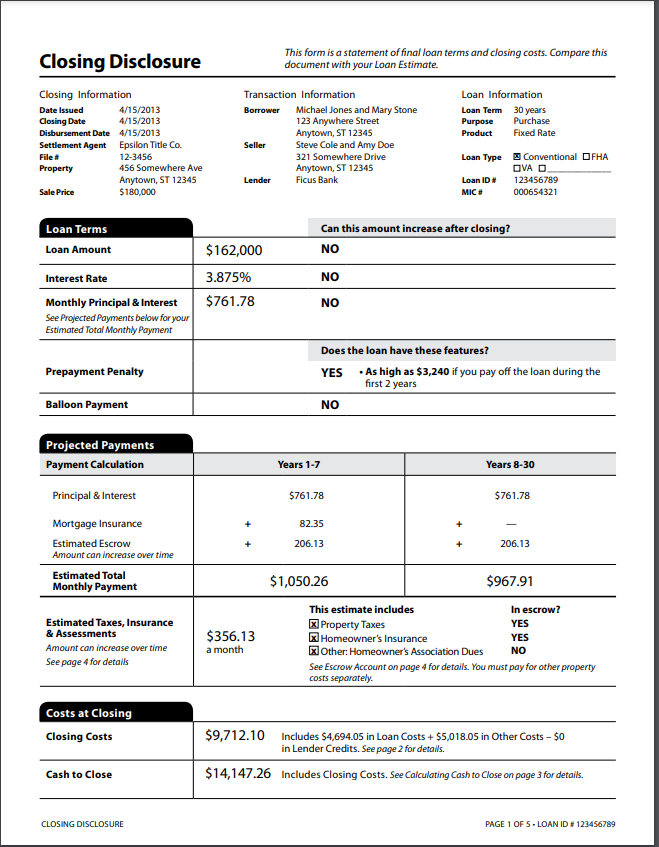

Compare estimated costs and fees.

Dive into the deets by comparing estimated costs and fees on your Freedom Mortgage Loan Estimate and Closing Disclosure. Unravel the mysteries behind those numbers and see how they impact your budget. Keep it savvy, peeps, by making sure you’re not overpaying on interest rates, origination fees, or other hidden expenses! #AdultingGoals

Review loan terms and conditions.

Dive deep into your loan terms and conditions to fully grasp all the deets of your Freedom Mortgage loan estimate and closing disclosure. Understanding the deets will help you make a smart decision for your financial future. Stay woke on interest rates, repayment schedules, and potential fees to avoid unpleasant surprises.

Check for errors or discrepancies.

When navigating the home-buying process, it’s crucial to keep an eye out for errors or discrepancies in your Freedom Mortgage loan estimate and closing disclosure. Meticulously reviewing these documents can ensure you’re not overpaying or encountering any unexpected costs. So, always double-check the figures and terms to avoid potential financial setbacks.

Seek clarification from lender, if needed.

Don’t be afraid to reach out to your lender if you’re feeling lost or confused. It’s crucial to understand your Freedom Mortgage Loan Estimate and Closing Disclosure before signing on the dotted line. So, shoot your questions their way – they’re there to help! Remember, knowledge is power, especially when it comes to securing your dream home.

Confirm final costs before closing.

Before sealing the deal on your Freedom Mortgage, always double-check the final costs. You don’t want any nasty surprises at closing, right? Take a few minutes to review your Loan Estimate and Closing Disclosure, ensuring all fees and charges are accurate. Being proactive now can save you a lot of headaches (and cash) later.