Are you dreaming of owning your ideal home but feel held back by your current credit score? Worry no more! In this comprehensive guide, we’ll reveal the top strategies for boosting your credit score, unlocking the door to better mortgage rates, and ultimately, your dream home. Say goodbye to high interest rates and hello to financial freedom as we delve into expert tips, budget-friendly hacks, and long-term solutions to elevate your creditworthiness. So, let’s embark on this journey towards mortgage success and discover how to improve your credit score for a better mortgage rate today!

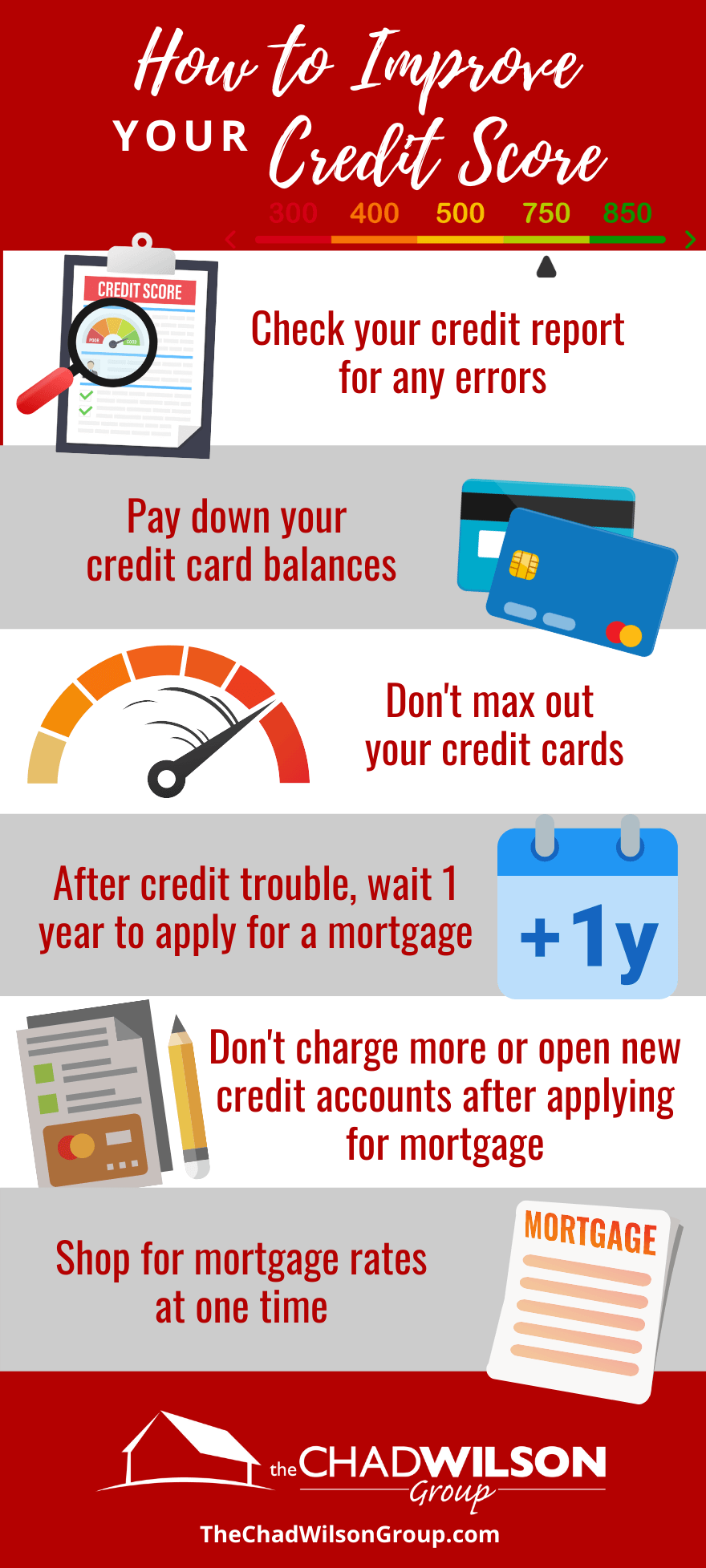

Regularly check credit report accuracy

Don’t sleep on the importance of regularly checking your credit report for accuracy, peeps! This simple habit can save you from nasty surprises and help you lock down a better mortgage rate. Keep your eyes peeled for errors or outdated info, and report any discrepancies ASAP. Stay on top of your credit game!

Timely payments, reduce outstanding debts

Making timely payments and reducing your outstanding debts are key steps to boost your credit score and secure a better mortgage rate. By consistently paying off bills on time and chipping away at debt, you’ll demonstrate responsible borrowing habits to lenders. Plus, a lower debt-to-income ratio improves your chances of snagging a top-notch mortgage rate, so start slashing those debts today for a brighter financial future.

Maintain low credit utilization ratio

Keep your credit utilization ratio in check to boost your credit score and secure a better mortgage rate. This crucial number reveals how much of your available credit you’re actually using. Aim for a utilization rate below 30% to impress lenders and prove you’re a responsible borrower. More green lights, better rates, happy days!

Diversify credit mix, avoid new debt

Boost your credit score by diversifying your credit mix and steering clear of new debt. A healthy blend of credit types, like credit cards and loans, reflects your ability to manage diverse debts responsibly. Simultaneously, refrain from taking on new debt to keep your credit utilization ratio low and your mortgage rate attractive.

Limit hard inquiries, close unused accounts

Boost your credit score for an unbeatable mortgage rate by limiting hard inquiries and shutting down unused accounts! Too many inquiries can mess up your score, so only apply for credit when necessary. Also, ditch those dormant accounts – they’re just dragging you down. Say goodbye to higher rates and hello to a better financial future!

Negotiate with lenders, dispute errors

Negotiating with lenders and disputing errors is a smart move to boost your credit score and snag a better mortgage rate. Don’t hesitate to reach out to creditors to settle unpaid debts or correct inaccuracies on your credit report. Taking this proactive approach can work wonders in improving your financial credibility and unlocking lower interest rates.