Are you dreaming of owning your perfect home, but your credit score is holding you back from a fantastic Freedom Mortgage offer? You’re in the right place! In this comprehensive guide, we’ll explore top strategies to give your credit score a much-needed boost, ultimately unlocking the door to better mortgage deals and interest rates. With our expert tips and insights, you’ll be well on your way to financial freedom and the home of your dreams. So, let’s dive in and discover how to improve your credit score for a better Freedom Mortgage offer today!

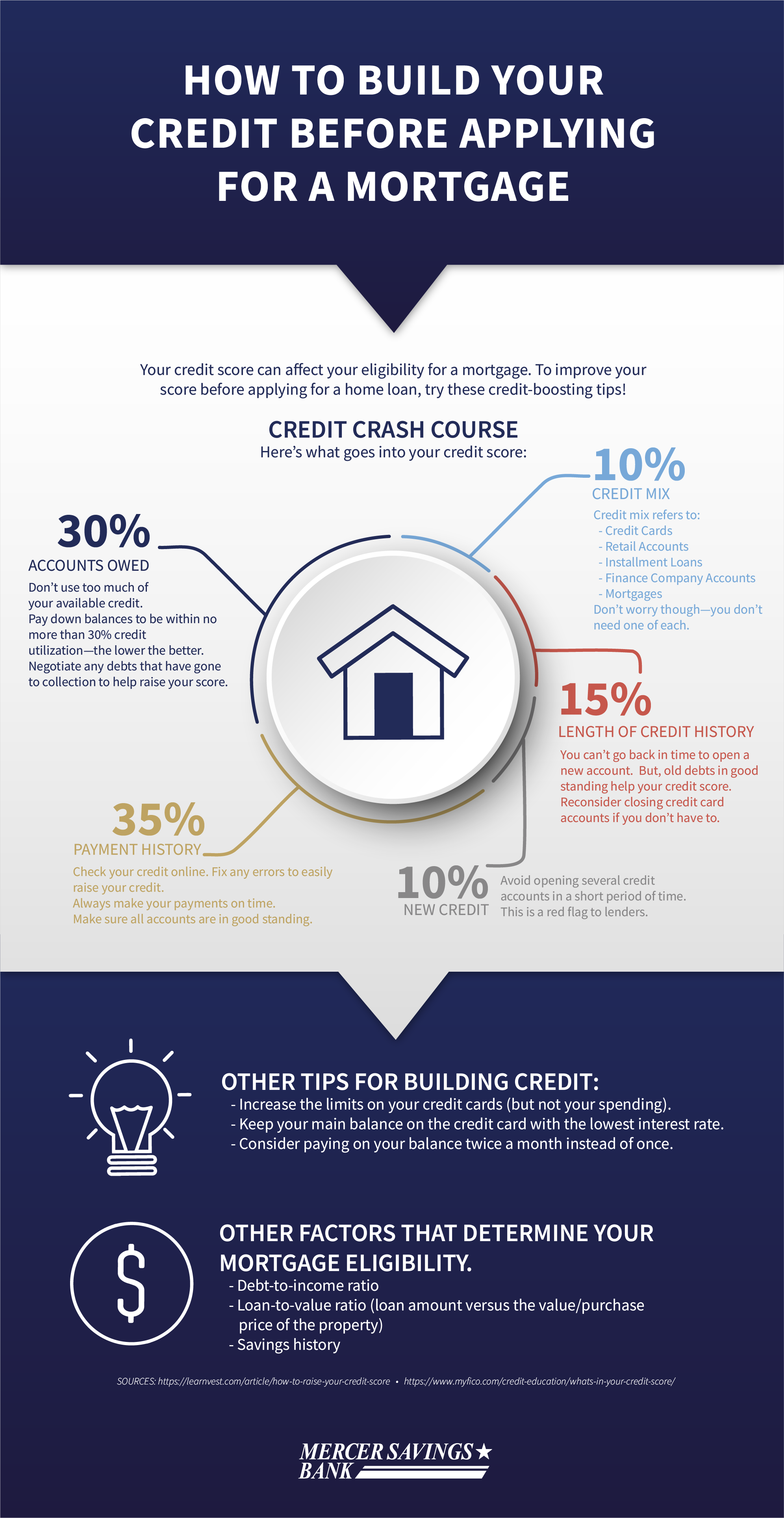

Analyze credit report, fix inaccuracies.

Dive deep into your credit report to spot any errors that may be hurting your score, fam. Fixing these inaccuracies is key to boosting your credit and securing a lit Freedom Mortgage offer. Remember to keep it 💯 and report any discrepancies to the credit bureaus ASAP for a speedy resolution!

Pay debts promptly, reduce balances.

Boost your credit score swiftly by consistently paying off debts on time and minimizing outstanding balances. This not only exhibits solid financial discipline but also makes you a more appealing candidate for favorable Freedom Mortgage offers. Prioritize debt management to unlock better opportunities and enjoy greater financial freedom.

Avoid new credit, limit inquiries.

Keep your credit inquiries in check to boost your score and snag a fantastic Freedom Mortgage deal. Each time you apply for new credit, it triggers a hard inquiry, which can dent your score. So, resist the temptation of shiny new offers and stick to your current credit lines for a better mortgage rate.

Maintain diverse credit types responsibly.

Diversify your credit game, peeps! Mix it up with various credit types like credit cards, loans, and mortgages. Make sure you’re managing them responsibly, though. This shows lenders you’re a boss at handling different credit situations. In turn, you’ll boost your credit score and score a bomb Freedom Mortgage offer! #AdultingGoals

Increase credit limit, lower utilization.

Boost your credit limit and reduce utilization for a superior Freedom Mortgage deal! A higher credit limit lowers your credit utilization ratio (CUR), which significantly impacts your credit score. Pro tip: Keep your CUR under 30% to impress lenders, ensuring you effortlessly snag that sweet mortgage offer. Make your credit game strong!

Monitor progress, set realistic goals.

Keep a keen eye on your credit journey by regularly monitoring your credit score and setting achievable goals. As a savvy 21-year-old, use free credit-tracking tools, like Credit Karma, to stay in control of your financial health. Making realistic milestones will help you unlock better Freedom Mortgage offers, giving you the ultimate financial freedom.