Discover the secrets to financial freedom with our comprehensive guide on how to implement effective mortgage prepayment strategies! Unlock the potential of your hard-earned dollars by paying off your mortgage early, and say goodbye to decades of debt. With our expert tips and proven strategies, you’ll not only save thousands in interest payments, but also experience the unparalleled satisfaction of owning your home outright. Dive into the world of mortgage prepayment and start paving your way to a secure, debt-free future today!

Assess financial goals and budget.

Kickstart your mortgage prepayment journey by evaluating your financial objectives and crafting a realistic budget. By identifying your short-term and long-term money goals, you’ll be able to devise a tailored prepayment plan that accelerates your journey to financial freedom without compromising your lifestyle or future aspirations.

Choose suitable prepayment plan.

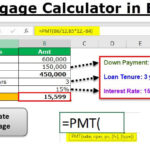

Selecting the right prepayment plan is crucial in optimizing your mortgage repayment strategy. Analyze your financial situation, goals, and loan terms to determine the most suitable option. Consider plans that allow you to make lump-sum payments, increase monthly payments, or make bi-weekly payments for faster debt reduction while saving on interest.

Allocate extra payment amounts.

Boost your mortgage prepayment game by allocating extra payment amounts smartly. Channel those additional funds towards your principal balance, reducing interest costs and accelerating your loan payoff. Be vigilant about specifying the purpose of extra payments to your lender and witness your mortgage shrink faster than ever before.

Consider bi-weekly payment schedule.

Opt for a bi-weekly payment schedule to accelerate your mortgage payoff and save on interest. By making half of your monthly payment every two weeks, you’ll effectively make an extra payment each year, reducing the principal balance faster. This easy strategy can shave years off your mortgage term and boost your financial freedom!

Utilize bonuses for prepayments.

Unlock the power of bonuses by using them for mortgage prepayments! Channeling extra cash, like tax refunds or work bonuses, towards your mortgage can significantly reduce your loan term and interest costs. Say goodbye to debt earlier by smartly leveraging these windfalls for a financially savvy prepayment strategy!

Monitor progress, adjust strategy accordingly.

Keep a close watch on your mortgage prepayment journey to ensure you’re on track to achieve your financial goals. Regularly assess your progress, and if necessary, tweak your strategy to optimize savings and accelerate debt reduction. Stay adaptable and informed, as this will enable you to make the most of your mortgage prepayment plan.