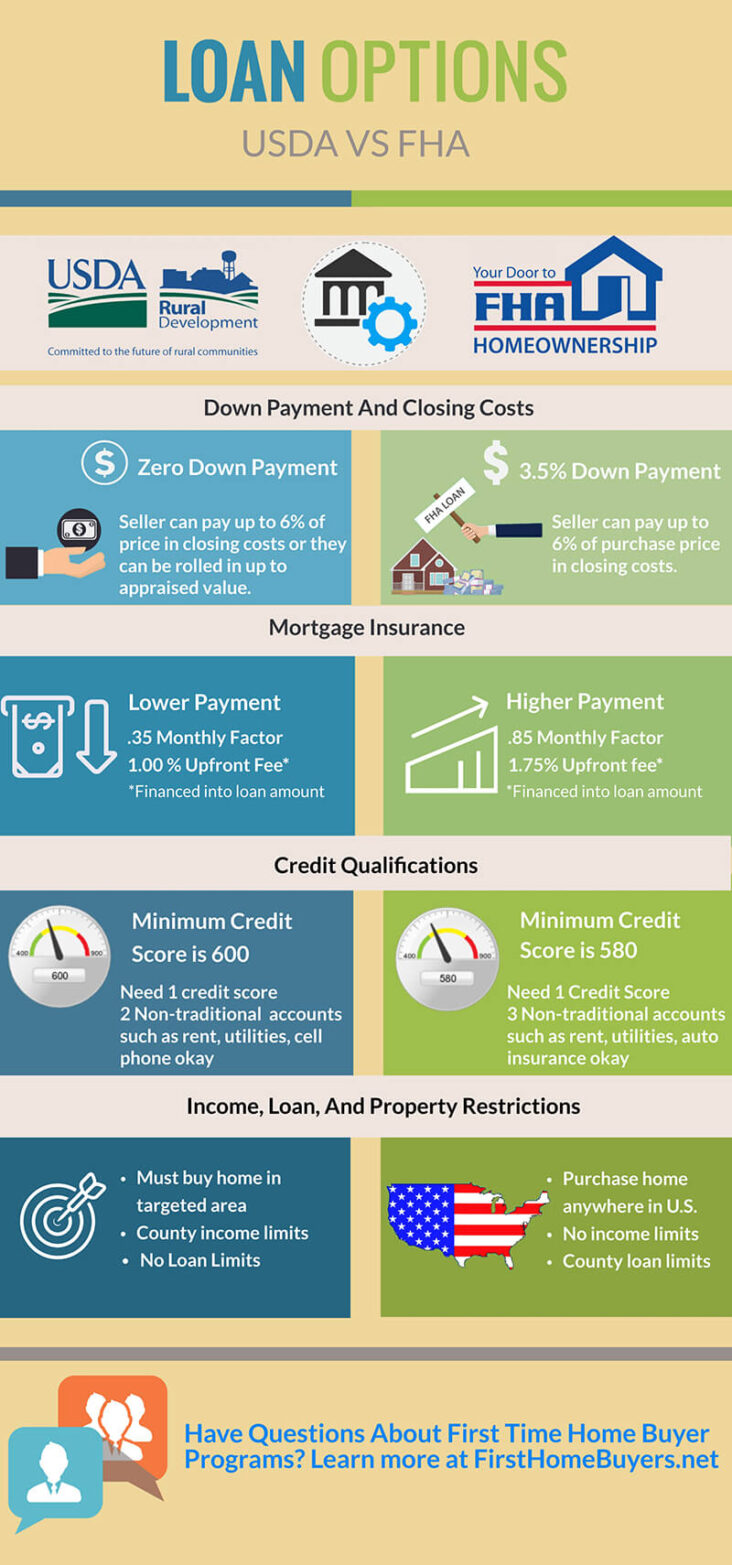

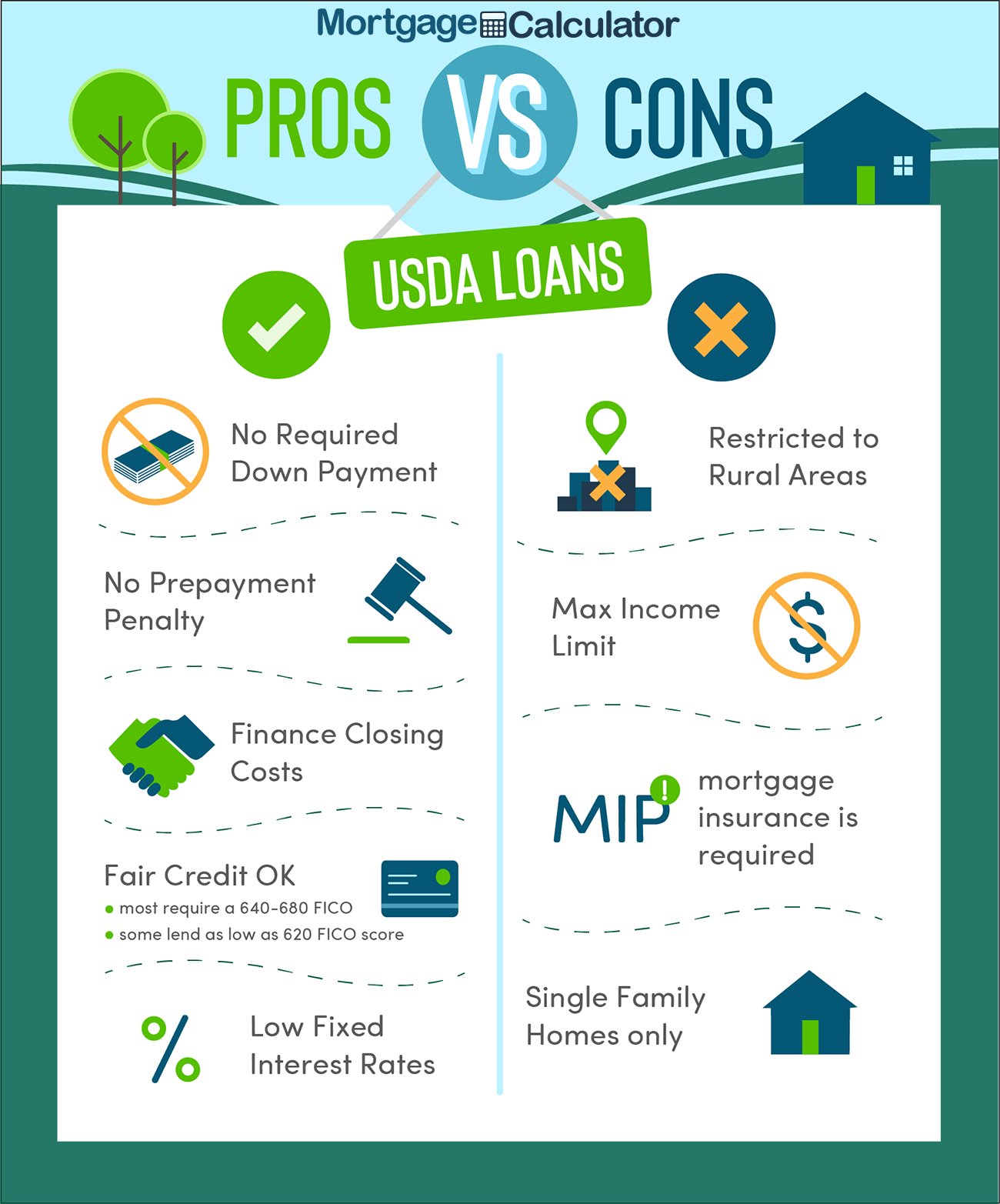

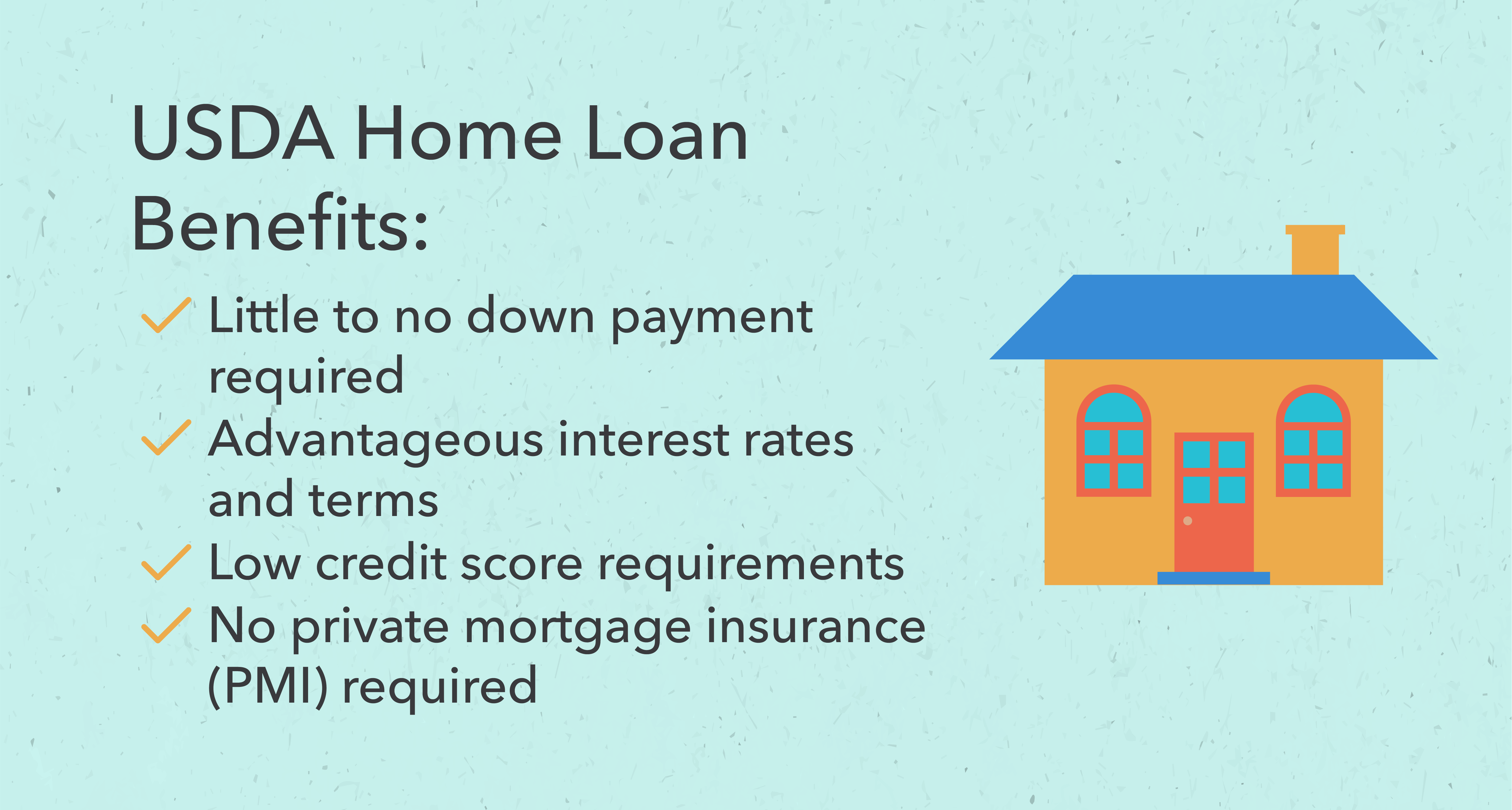

Are you looking to buy a home but don’t have the money for a down payment? A USDA mortgage could be the solution you need! USDA mortgages are a great option for those with limited funds and offer the potential of zero down payment, low interest rates and flexible credit requirements. This article will provide you with a detailed overview of everything you need to know about USDA mortgages, including eligibility requirements and the application process, so you can make an informed decision about whether this type of loan is the best fit for your financing needs.

Research USDA eligibility.

Researching USDA eligibility is an important step in the process of getting a USDA mortgage. It is important to check if you meet the income requirements and if the property you want to purchase is located in an eligible area.

Find lender offering USDA.

When searching for a lender that offers USDA loans, it is important to compare different lenders to ensure you get the best rate and terms.

Compare mortgage rates.

Comparing mortgage rates is essential when trying to get a USDA mortgage. Shopping around can help you find the best rate that works for your budget and financial goals.

Apply for loan pre-approval.

It’s important to apply for a loan pre-approval before you start house hunting so you know exactly how much you can afford. This step can help you save time and money down the road and make the home buying process smoother.

Submit mortgage paperwork.

Once you have gathered all of the necessary paperwork for your USDA mortgage, it is important to make sure that everything is in order before submitting it. Take the time to double-check that your documents are accurate and complete to ensure a smoother processing experience.

Receive USDA approval.

It is important to research USDA requirements and make sure that you meet all of them before applying for a USDA mortgage. Make sure to discuss your financial situation with a lender and take all the necessary steps to receive USDA approval.