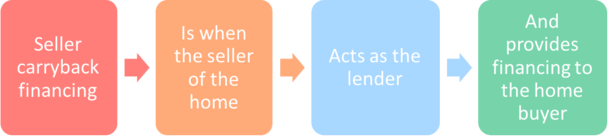

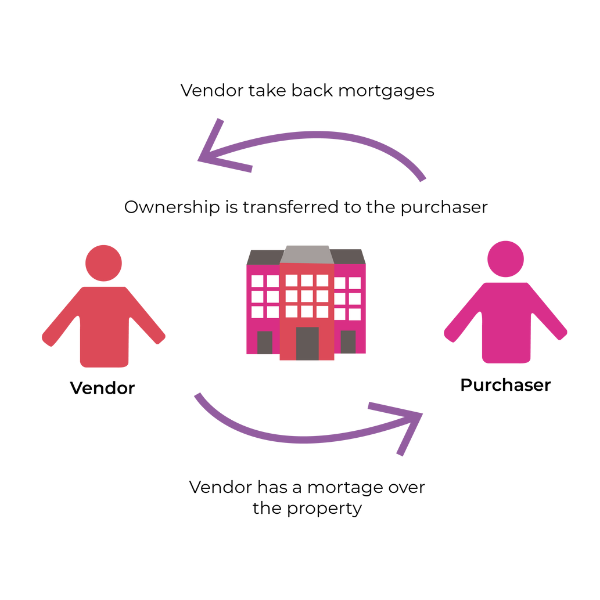

Are you looking for a way to purchase a home without having to save up for a large down payment? A seller take-back mortgage may be the perfect solution for you! A seller take-back mortgage is a type of mortgage that allows a seller to carry a portion of the loan for the buyer. This can provide the buyer with a lower down payment, but there are a few things to consider before signing on the dotted line. In this article, we’ll break down the details of a seller take-back mortgage, so you can decide if it’s the right choice for you.

Research seller financing

Researching seller financing is a great way to find a take-back mortgage. It allows buyers the opportunity to potentially get a better deal than at a traditional bank.

Contact seller for details

When contacting the seller for details about a seller take-back mortgage, make sure to ask for all the specifics such as down payment amount, interest rate, repayment terms, and any other conditions. This will help ensure you understand the agreement and make an educated decision.

Compare rates/terms

When you’re shopping for a seller take-back mortgage, it’s important to compare the rates and terms to find the best deal. Look for lenders who offer competitive rates, flexible repayment terms, and low fees. Don’t forget to factor in closing costs and other fees associated with the loan.

Negotiate agreement

When negotiating a seller take-back mortgage, it is important to be realistic and flexible. It is best to discuss the terms of the mortgage with a real estate attorney to ensure that all the parties are protected and that the agreement is legally binding.

Get pre-approval

Before applying for a seller take-back mortgage, it is important to get pre-approved by a financial institution. This will give you a better understanding of exactly how much you can afford to borrow, as well as what interest rate you may qualify for.

Finalize mortgage

Once you have finalized the mortgage, be sure to read and review the agreement carefully. Make sure that all of the terms and conditions are understood before signing, and feel free to ask questions if anything is unclear.