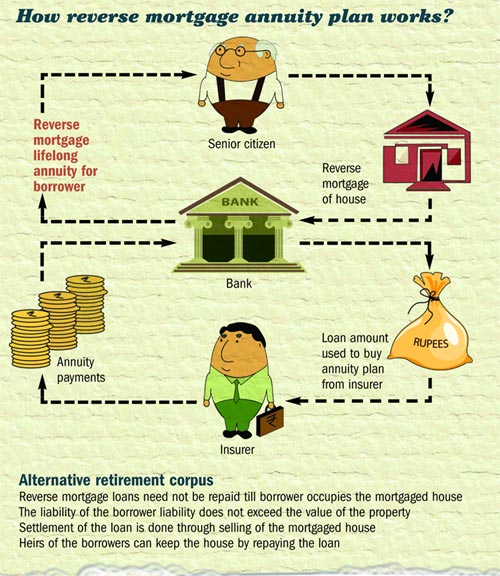

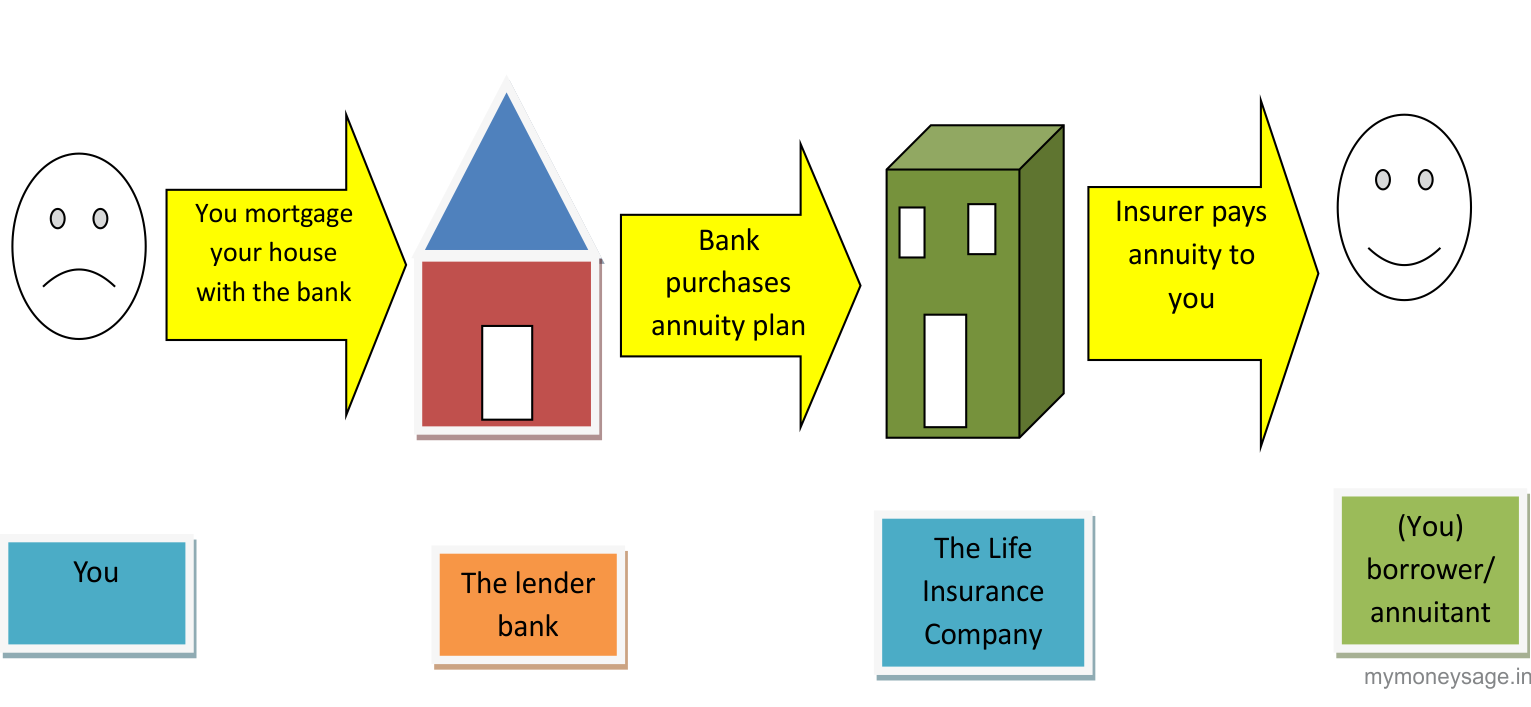

Are you looking for an innovative way to get the most out of your retirement and make your golden years even more comfortable? Then a Reverse Annuity Mortgage (RAM) may just be the answer you’ve been looking for! A RAM is a special type of mortgage loan that allows you to use the equity in your home to create a steady stream of income. In this article, we’ll discuss the basics of RAM and how to get the most out of this financial product. Read on to learn more and make sure you’re taking advantage of all the benefits of a Reverse Annuity Mortgage.

Research reverse mortgage options

When researching reverse mortgage options, it is important to compare different lenders and products to find the best fit for you. Make sure to ask questions and read reviews to ensure you are getting the best deal possible.

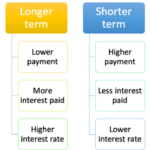

Compare interest rates

When shopping around for a reverse annuity mortgage, it’s important to compare interest rates. Rates will vary depending on the lender and individual financial situation, so be sure to check multiple offers and find the best deal for you.

Contact lenders or brokers

When searching for a reverse annuity mortgage, it’s important to speak with a few lenders or brokers to ensure you get the best deal. Make sure to ask questions and compare rates to ensure you find the right fit for your financial needs.

Submit application paperwork

When applying for a reverse annuity mortgage, make sure you have all the necessary paperwork in order. This typically includes proof of income, a credit report, and bank statements. Take your time to ensure that all your documents are accurate and up to date. That way, you can make the process as smooth and stress-free as possible.

Receive approval decision

Once you’ve collected all the necessary documents and applied, you’ll soon receive a decision on your reverse annuity mortgage. Make sure to carefully read the details of the decision and review any applicable fees or restrictions.

Sign loan agreement.

Once you have been approved for a reverse annuity mortgage, the next step is to sign the loan agreement. It is important to carefully read through the entire agreement and ask for clarification on any points that may not be clear.