Are you looking for a way to obtain a mortgage but don’t have the traditional qualifications? Don’t give up on your dream of owning a home just yet! A non-traditional mortgage may be the solution you’re looking for. This article will provide you with helpful information on how to get a non-traditional mortgage and how to make sure you’re getting the best deal. We’ll also discuss important factors to consider when applying for a non-traditional mortgage, as well as tips and tricks to help you save money and avoid common pitfalls. Read on to learn more about securing your non-traditional mortgage!

Research non-traditional lenders

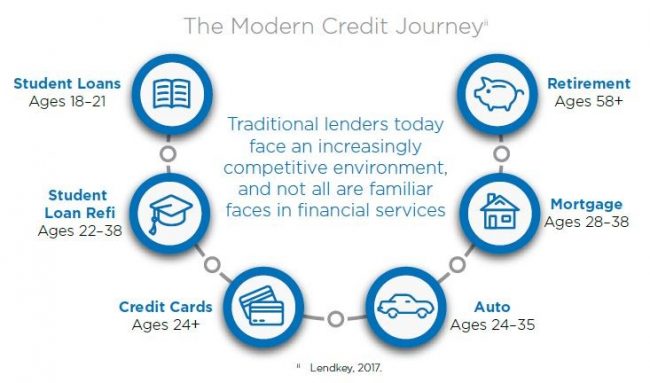

Researching non-traditional lenders may seem intimidating, but with a bit of research and patience, you can find the perfect lender for your needs.

Compare loan terms

Comparison shopping is a great way to find the best loan terms for a non-traditional mortgage. Consider researching different lenders to compare rates, fees, and repayment terms so you can find the best deal for you.

Review credit score

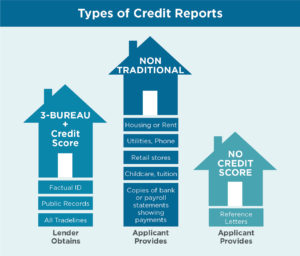

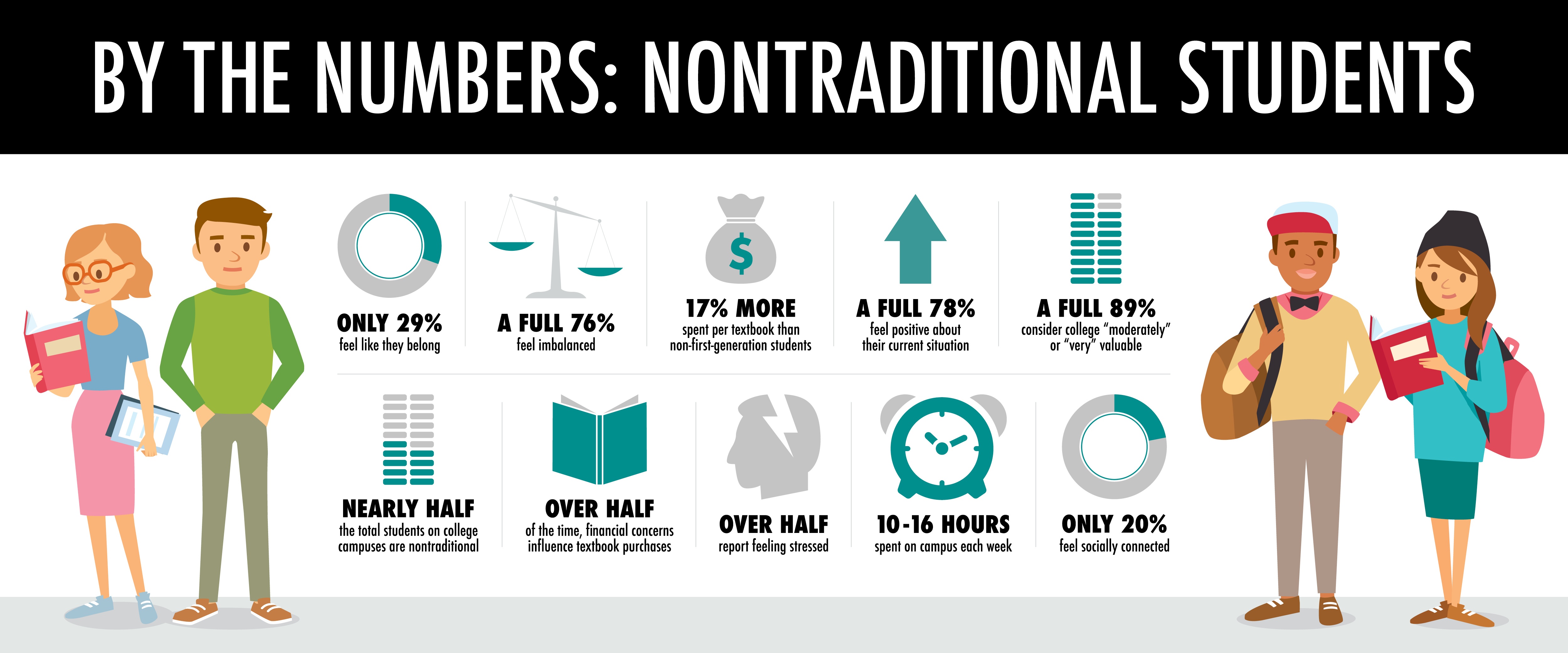

It is important to review your credit score before applying for a non-traditional mortgage. Make sure your credit score is in good standing and that you have a healthy history of paying off debt. This will help you to secure the best rates and terms for your loan.

Calculate total debt

When calculating total debt, it’s important to include any existing loans or credit cards. Make sure to factor in all of your monthly payments, such as car loans, student debts, and so on. This will give you an idea of how much of a mortgage you can qualify for.

Submit loan application

When applying for a non-traditional mortgage, it is important to make sure that all of your paperwork is up to date and accurate. Once you have gathered the required documents, you can then submit your loan application to a lender. This process can be time consuming, so be sure to allow yourself plenty of time to complete it.

Await approval/denial

Once you have submitted all the necessary documents, it is time to wait for the lender’s decision. You may receive an approval or denial, so make sure to prepare yourself for either outcome.