Are you a student looking to buy your first home and wondering how to get a low ratio mortgage? Well, you’re in luck! Getting a low-ratio mortgage can be a great way to make your dreams of home ownership a reality. In this article, I’ll explain what a low-ratio mortgage is, how to get one, and the benefits of having one. With this guide, you’ll be able to find the best mortgage for you!

Research mortgage options.

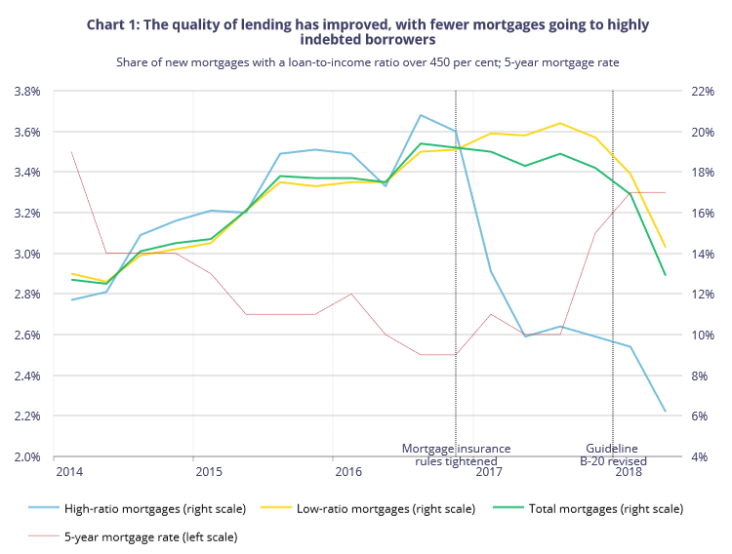

When researching mortgage options, it’s important to consider the loan-to-value (LTV) ratio. A low LTV ratio means you will have to put more down on the house upfront and usually results in lower monthly payments. Be sure to compare different lenders to find the best rates, and shop around for the lowest LTV ratio to save money in the long run. Don’t be afraid to ask questions and take your time to make the best decision.

Compare interest rates.

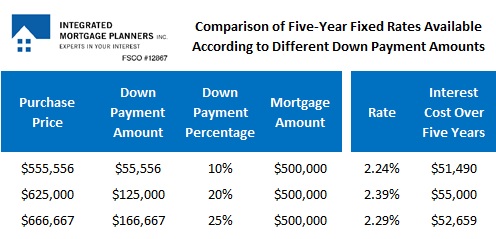

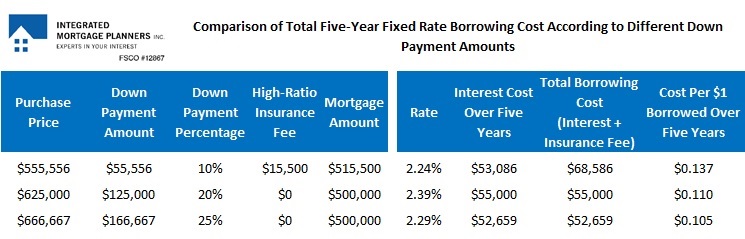

Comparing interest rates is key to getting a low ratio mortgage. Take the time to shop around and compare rates, as this can make a huge difference in your monthly payments. Do your research on the various lenders and ask questions about their fees and interest rates. Make sure you understand all the terms and conditions before signing on the dotted line. It’s worth it to get the best rate possible!

Calculate monthly payments.

Calculating your monthly payments for a low ratio mortgage can seem intimidating. However, it doesn’t have to be! To make it easier, use an online mortgage calculator to get an idea of what your payments would look like. Just enter in your loan amount, interest rate, and loan term, and it will give you a good estimate of what you’ll be paying each month. Don’t forget to adjust your payment terms to fit your budget.

Evaluate loan terms.

Evaluating loan terms is a crucial step when getting a low ratio mortgage. Make sure to read all the fine print and do your research. Ask yourself questions like ‘what is the interest rate?’, ‘am I eligible for any discounts?’, ‘what fees are associated with this loan?’. Don’t be afraid to negotiate and shop around for the best deal available. It’s important to consider the long-term cost of taking out a loan, not just the short-term savings.

Submit application.

Submitting an application for a low ratio mortgage is the first step in getting one. As an 18-year-old student, I understand the importance of having a good credit score and the importance of getting a good interest rate. I’ve done my research and now I’m ready to submit my application. I’m sure the process is going to be long, but I’m determined to get the best mortgage rate I can.

Finalize paperwork.

Finalizing the paperwork for a low ratio mortgage can be daunting, but it doesn’t have to be. Make sure you have all the necessary documents ready, like proof of income, asset statements, and credit reports. Having everything organized in advance will make the process smoother and will help you get the best home loan rate possible!