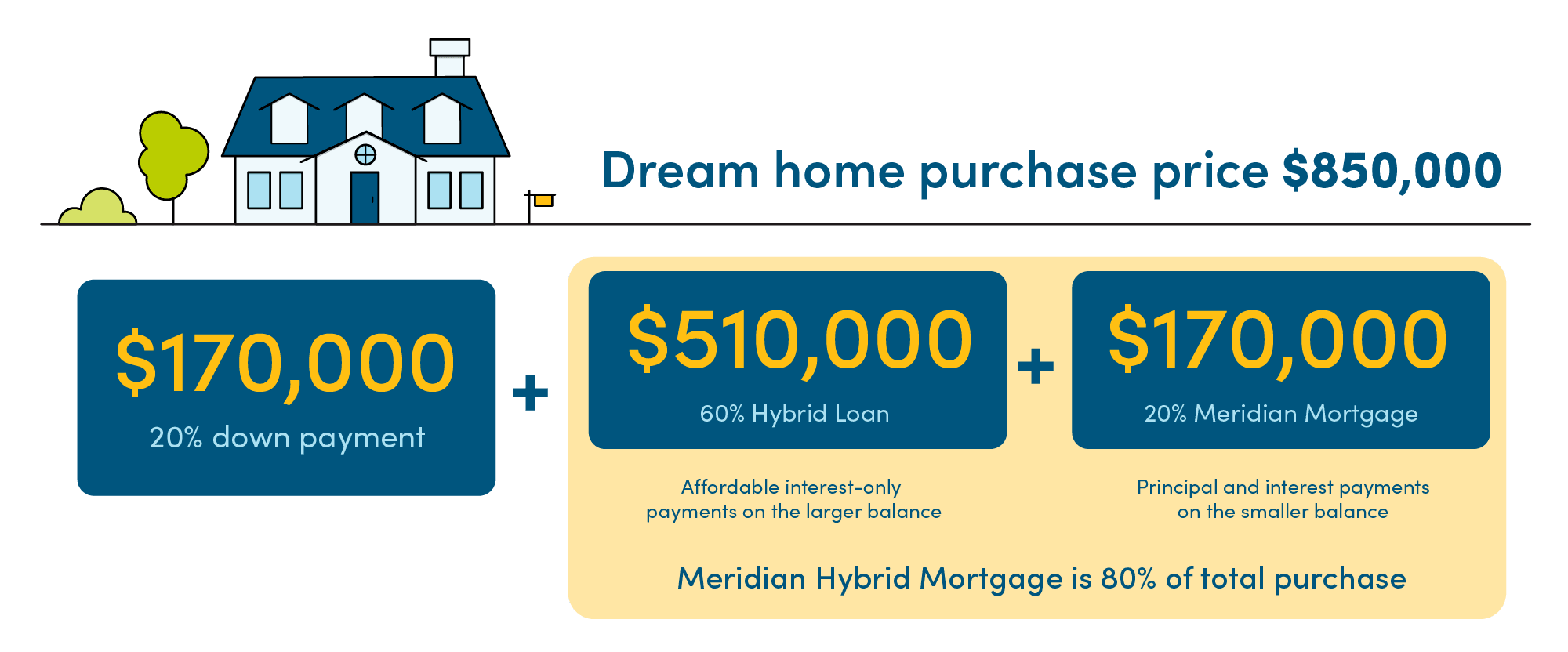

Are you interested in a hybrid mortgage but don’t know where to start? A hybrid mortgage is a great way to save money and reduce monthly payments. This article will explain the basics of a hybrid mortgage and provide tips on how to get the best deal. We’ll walk you through the different types of hybrid mortgages, the advantages and disadvantages of each, and how to apply for a hybrid mortgage. With this information, you’ll be well-equipped to make an informed decision about the type of mortgage that’s right for you.

2.Compare lenders

When shopping for a hybrid mortgage, it’s important to compare lenders and rates to find the best deal. Look for lenders that offer competitive rates, flexible repayment plans, and loan terms that fit your budget.

3.Check credit score

Before you apply for a hybrid mortgage, it’s important to check your credit score to make sure it’s in good shape. Make sure to review your credit report to make sure all the information is accurate and up-to-date.

4.Apply online

Once you have decided on the best hybrid mortgage for your needs, the next step is to apply online. Applying for a mortgage can be a daunting process, but you can make it easier by having all the necessary documents ready, such as income and asset information.

5.Collect documents

Before applying for a hybrid mortgage, it’s important to gather all the necessary documents, such as proof of income, bank statements, and credit score. Take the time to collect these documents so you can apply for the loan without delays.

6.Submit application.

Once you have gathered all of the paperwork and materials needed to apply for a hybrid mortgage, you can submit your application. It is important to review the application thoroughly to ensure accuracy before submitting.