Are you looking for ways to get the most out of your home and increase your wealth? A Growing Equity Mortgage (GEM) could be the answer. A GEM is a type of mortgage where the monthly repayment amount is fixed but increases each year, allowing the borrower to pay off the loan quicker and build equity in their home faster. In this article, we’ll be exploring the benefits of GEMs and how to get one. We’ll help you understand the different types of GEMs available and what you need to consider when selecting the right one for you. We’ll also provide some tips on how to get the best rate and save money on your GEM. So if you’re ready to get started, read on to learn everything you need to know about Growing Equity Mortgages.

Research mortgage lenders.

Researching mortgage lenders is key to getting the best deal on a growing equity mortgage. Check online reviews, compare fees and speak to multiple lenders to find the best fit for you.

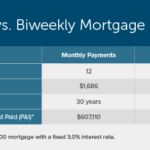

Compare mortgage rates.

Comparing mortgage rates is a great way to find the best deal that fits your budget. Shopping around and comparing different lenders can help you get the best deal and save money in the long run.

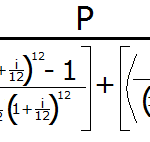

Calculate affordability.

When looking to obtain a growing equity mortgage, it is important to consider how much you can afford. Make sure to calculate your budget and conduct research to find out what type of mortgage best fits your needs.

Check credit score.

Before applying for a growing equity mortgage, it is important to check your credit score to ensure you are eligible. A low credit score could lead to a higher interest rate, or even disqualification from the loan entirely.

Apply for mortgage.

When applying for a growing equity mortgage, it is important to research the different types of loans available and compare the terms and interest rates to find the best deal for you. Make sure to read all the fine print and ask questions if anything is unclear.

Finalize paperwork.

Once you have gathered all the necessary paperwork, go through it carefully to make sure everything is in order. Double check all the information you have provided and make sure it is accurate. It is important to be thorough and make sure you don’t miss any important details.