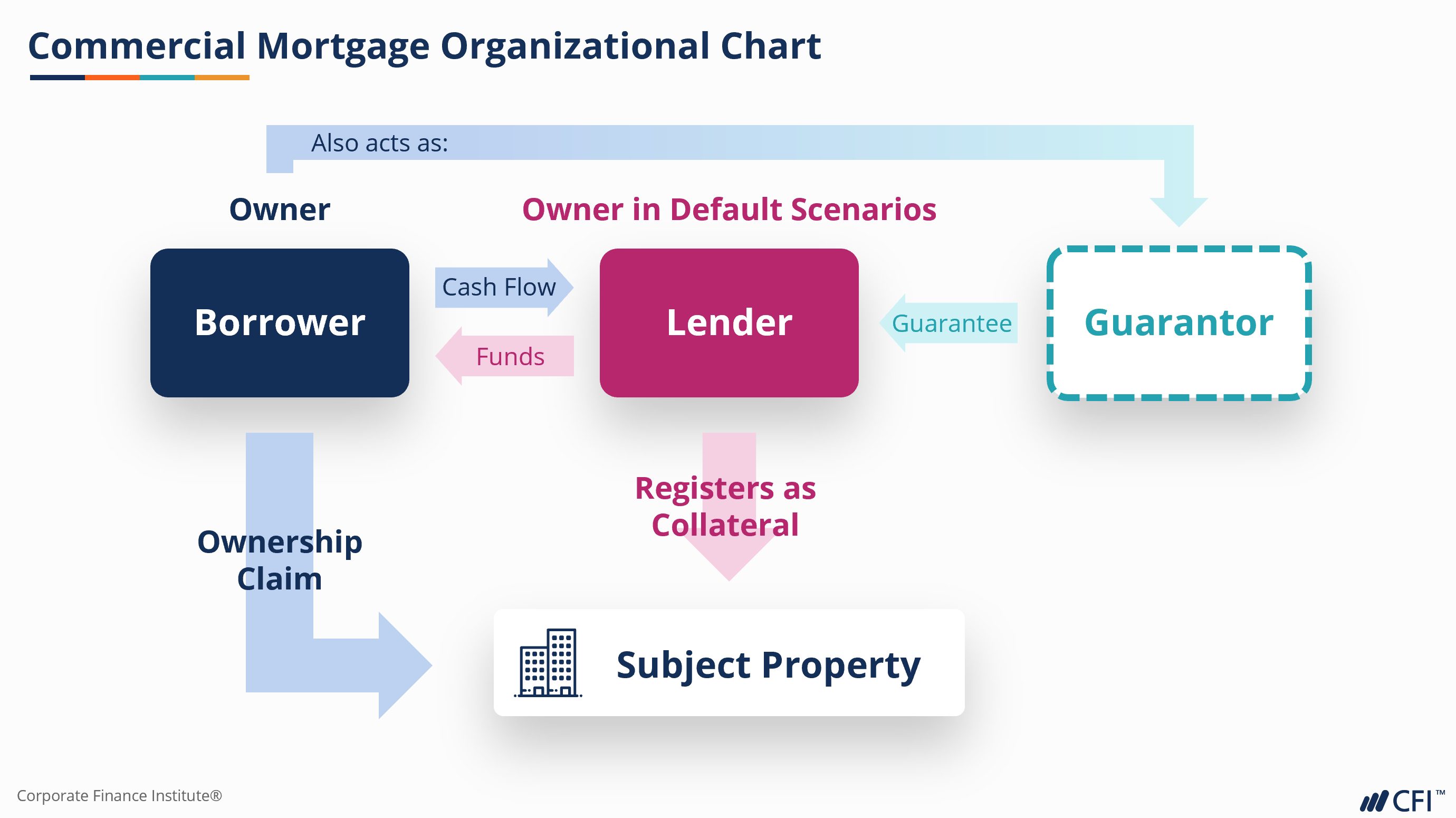

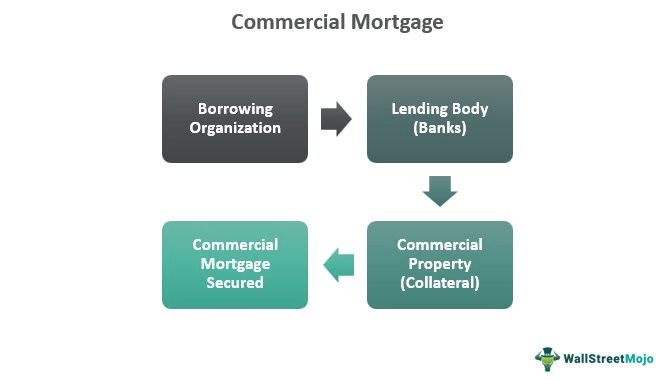

Are you 18 years old and looking to get a commercial mortgage? Well, you’ve come to the right place! It can seem intimidating to take on such a big expense, but with the right knowledge and preparation, you can finance your business and reach your financial goals. In this article, you will learn all the steps necessary to get your commercial mortgage, from understanding the process to finding the best lender. So, if you’re ready to get started, read on to find out more!

Research lenders & rates.

Researching lenders and rates for a commercial mortgage can be overwhelming. To make it easier, I suggest starting with online reviews and comparison websites. Doing this will help you get a better understanding of the different lenders and their rates. Also, be sure to talk to a financial advisor to help you choose the best options for your specific needs.

Choose loan type & terms.

Choosing the right type of loan and terms for a commercial mortgage can be overwhelming. With so many options available, it’s important to take the time to research and think about what will work best for you. Consider factors like loan length, interest rate, and fees to find the best option for your needs. With a little bit of research, you can find the right loan type and terms that fit your budget and goals.

Gather financial documents.

Gathering all your financial documents is the first step to getting a commercial mortgage. To get started, make sure you have all your documents in order, such as your tax returns, bank statements, and credit reports. It’s also important to have proof of income and a list of assets to show the lender. Once you have all your documents ready, you can start shopping for the best commercial mortgage rates.

Submit application & documents.

Getting a commercial mortgage requires submitting an application and providing the necessary documents. It can be a daunting task for an 18-year-old, but if you take it step by step, it’s doable. Get all the paperwork together, such as tax returns, bank statements, and a business plan, and make sure it’s all up to date. If you’re organized and prepared, you’ll have a smoother application process.

Wait for lender’s decision.

Once you submit your application for a commercial mortgage, all you can do is wait for the lender to make a decision. It’s a nerve-wracking process, but try to remain positive and be patient. You might be tempted to check back multiple times a day, but it won’t speed up the process. Instead, focus on other aspects of your business while you wait.

Sign loan agreement & close.

Once you’ve found the perfect commercial mortgage for your business, the next step is signing the loan agreement and closing. This process can be a bit daunting, but with the right preparation and guidance, it will be smooth sailing. Make sure you read through the agreement in detail and ask any questions if something is unclear. Once you’re satisfied with the agreement, sign it and you’re good to go! Congratulations, you’ve just secured a commercial mortgage for your business!