Are you looking to purchase a home? Getting a mortgage can be a daunting task, especially if you’re a first-time homebuyer. Luckily, there are steps you can take to increase your chances of approval and make the process smoother. In this article, we’ll explain how to get a mortgage and the key steps you need to take to secure the best mortgage rate. We’ll also explore the different types of mortgages available and how to choose the right one for you. So keep reading to learn how to get a mortgage and get one step closer to owning your dream home.

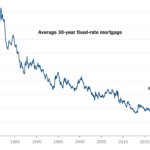

Research lenders and rates.

Researching lenders and rates is an important part of the mortgage process, so take the time to compare different options and get the best deal for you.

Check credit score.

Before applying for a mortgage, it’s important to check your credit score to make sure that it’s accurate and up-to-date. This will help you get the best deal and demonstrate to lenders that you’re a responsible borrower.

Gather financial documents.

Before applying for a mortgage, it is important to have all the right documents ready. Gather up your bank statements, tax returns, pay stubs and other financial information that might be needed to demonstrate your financial stability.

Apply for pre-approval.

When applying for pre-approval, it’s important to be prepared with all of the necessary documents and information. Make sure you have your credit score, income, down payment amount, and other financial details ready.

Compare quotes and offers.

Comparing quotes and offers is the best way to ensure you get the best mortgage deal for you. Don’t just accept the first offer you get – shop around and compare to make sure you’re getting the best deal.

Secure mortgage and close.

Securing a mortgage requires a lot of research and preparation. Make sure to compare different lenders and products to find the best rate and terms for you. Once you’re ready, make sure to provide all the necessary information and documentation to your lender to secure the mortgage. Finally, you’ll need to close the loan and sign the necessary paperwork.