Are you on the hunt for the perfect mortgage lender to finance your dream home? Look no further, as we bring to you an in-depth comparison of Freedom Mortgage with other lenders in the market. Discover the pros and cons of each mortgage provider, and make an informed decision to ensure a hassle-free journey towards homeownership. Read on to find valuable insights and expert tips on choosing the right mortgage partner, tailored to suit your unique financial needs and preferences. Don’t miss out on this essential guide to mastering the mortgage maze!

Research various mortgage lender options.

Dive deep into exploring numerous mortgage lender options to make an informed decision. Compare interest rates, closing costs, customer reviews, and tailor-made loan offers. Keep an eye on lenders’ transparency, flexibility, and reputation. Investigate thoroughly for a mortgage that best fits your financial goals and homeownership dreams.

Analyze interest rates and loan terms.

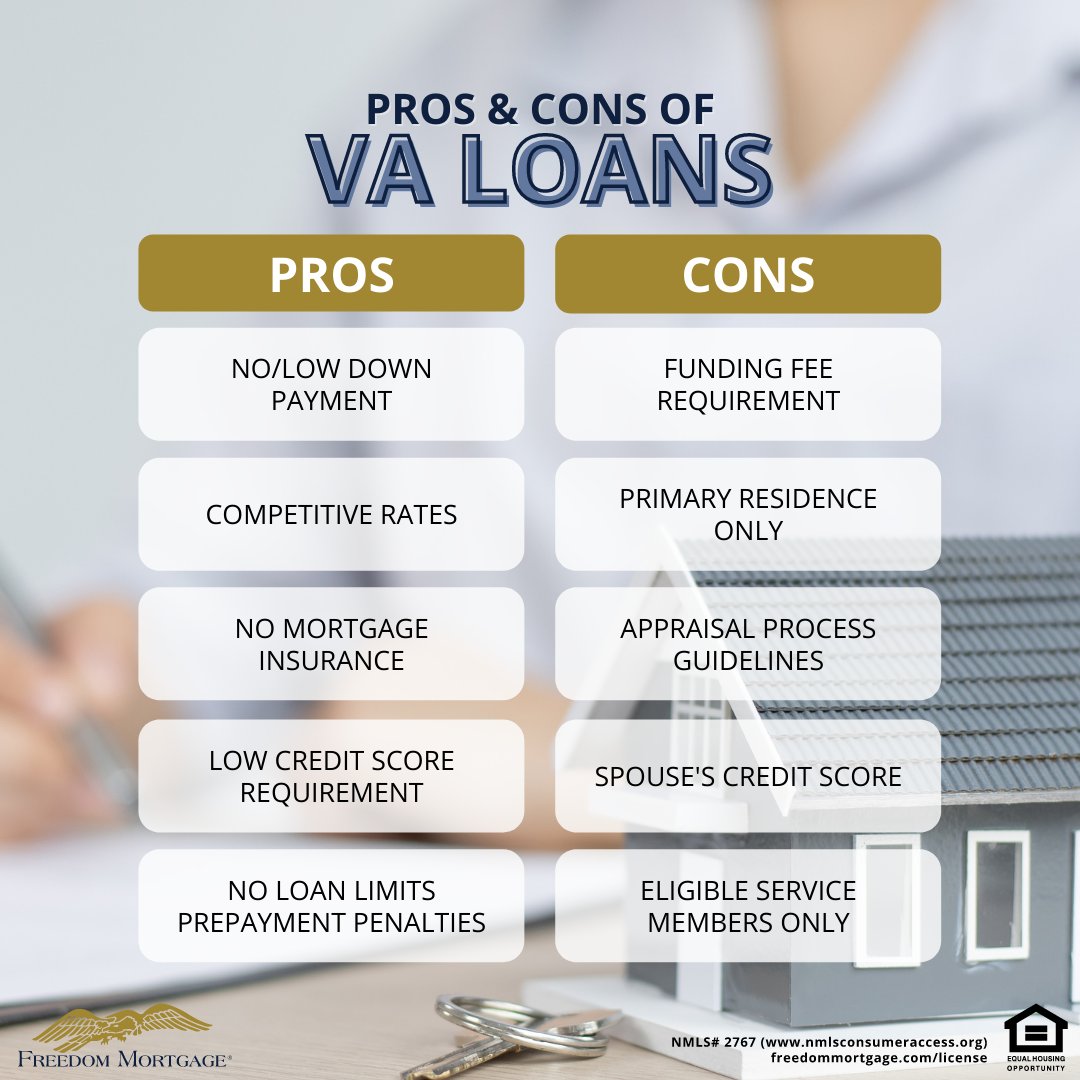

Dive into the deets by analyzing interest rates and loan terms! Comparing Freedom Mortgage with other lenders puts you in control of your financial future. Scope out those juicy interest rates, and weigh the pros and cons of various loan terms to find your perfect match. Knowledge is power, my friends! #AdultingGoals

Examine customer service and support.

Delving into customer service and support is crucial when comparing Freedom Mortgage to other lenders. Stellar customer service, easy-to-reach representatives, and efficient problem-solving are key factors that set a lender apart. Analyzing reviews and ratings will give you insights into real experiences, ensuring a smooth lending journey.

Assess lender fees and closing costs.

When comparing Freedom Mortgage to other lenders, it’s crucial to evaluate their lender fees and closing costs. These can significantly impact your finances, so make sure to compare origination fees, third-party charges, and other expenses. This will help you make an informed decision and potentially save you thousands of dollars in the long run.

Investigate online tools and resources.

Dive deep into the world of online tools and resources to compare Freedom Mortgage with other lenders. Harness the power of comparison websites, mortgage calculators, and customer reviews to make informed decisions. Unleash your inner researcher and discover the pros and cons of each lender to find your perfect match.

Evaluate overall reputation and reliability.

In your quest to find the perfect mortgage lender, it’s crucial to evaluate their overall reputation and reliability. Do some research online by reading reviews, checking ratings, and browsing testimonials from previous clients. This will give you a better understanding of how Freedom Mortgage compares to other lenders in terms of customer satisfaction and trustworthiness.