Are you drowning in student loan debt and seeking a lifeline? Look no further! In this comprehensive guide, we’ll dive deep into the world of student loan forgiveness programs, unraveling the mystery behind choosing the best one for your unique situation. Don’t let your financial future be held hostage by overwhelming loans; empower yourself with our expert tips, tailored to help you navigate the ever-changing landscape of student loan forgiveness options. So, buckle up and get ready to embark on a journey towards financial freedom and a debt-free life!

Understanding the Different Types of Student Loan Forgiveness Programs: A Comprehensive Guide

Navigating the world of student loan forgiveness programs can be a daunting task, but our comprehensive guide aims to simplify the process for you. By understanding the different types of loan forgiveness programs available, such as Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment (IDR) Forgiveness, you can make an informed decision tailored to your unique situation. Our in-depth analysis of eligibility requirements, application processes, and potential benefits will help you find the best student loan forgiveness program to alleviate your financial burden while pursuing your career goals. Don’t let student loans hold you back – find the ideal forgiveness program for you today.

Evaluating Your Unique Financial Situation: Factors to Consider for Selecting the Ideal Student Loan Forgiveness Program

When choosing the ideal student loan forgiveness program for your unique financial situation, it’s crucial to evaluate several factors to make an informed decision. First, assess your career path and whether it aligns with forgiveness programs like Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. Next, consider your loan type, as federal loans offer more forgiveness options than private loans. Analyze your repayment plan and its eligibility for forgiveness programs, such as income-driven repayment plans. Lastly, weigh the potential tax implications of loan forgiveness to ensure you select a program that benefits your long-term financial goals.

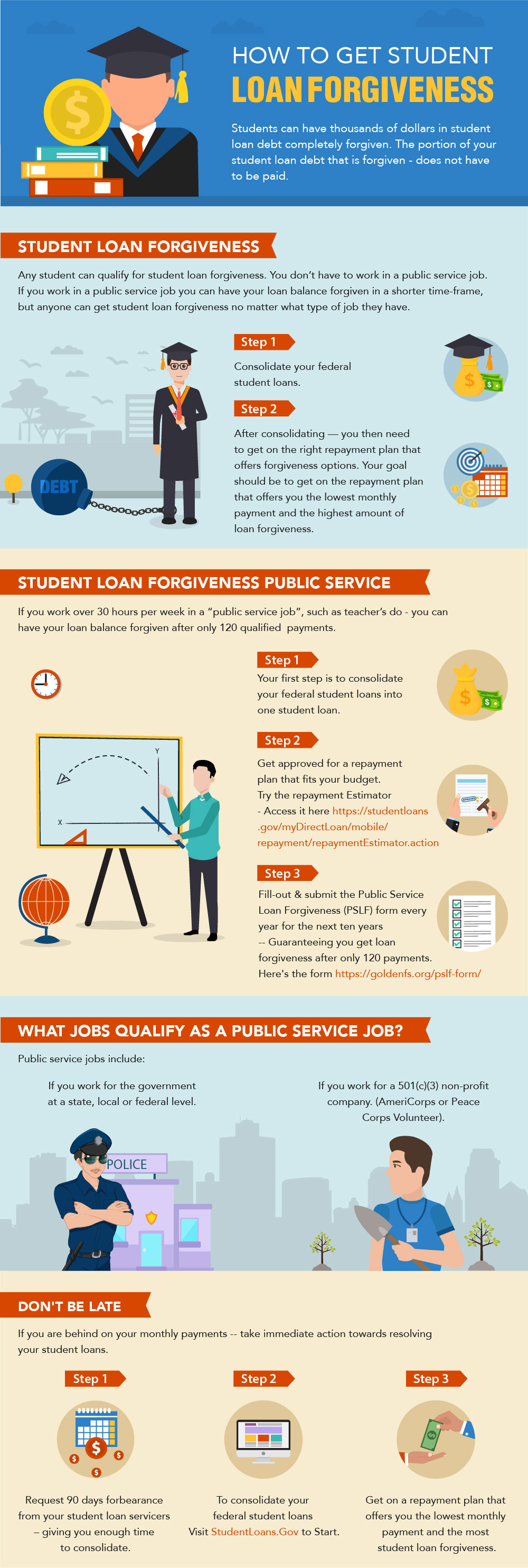

Navigating Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness: A Deep Dive into Eligibility and Benefits

Navigating the complexities of Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness programs can be overwhelming, but understanding the eligibility requirements and benefits is crucial to selecting the best option for your financial situation. Both programs offer substantial loan forgiveness opportunities for those in qualifying public service or teaching positions, but they differ in terms of eligibility criteria, forgiveness amounts, and application processes. By conducting a deep dive into these programs, borrowers can make informed decisions and maximize their potential for student loan forgiveness. Utilize online resources, consult with loan servicers, and stay up-to-date with current regulations to ensure you’re on track for achieving your loan forgiveness goals.

Income-Driven Repayment Plans and Loan Forgiveness: How to Maximize Your Savings and Choose the Right Plan for You

Income-Driven Repayment Plans (IDR) offer a practical solution for managing your student loan debt by adjusting your monthly payments based on your income. To maximize your savings and choose the right IDR plan for your unique financial situation, consider factors like your current income, family size, and future earning potential. The four main IDR plans – Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR) – each have distinct eligibility criteria and forgiveness terms. By thoroughly evaluating and comparing these options, you can make an informed decision that will ultimately lead to loan forgiveness and long-term financial freedom.

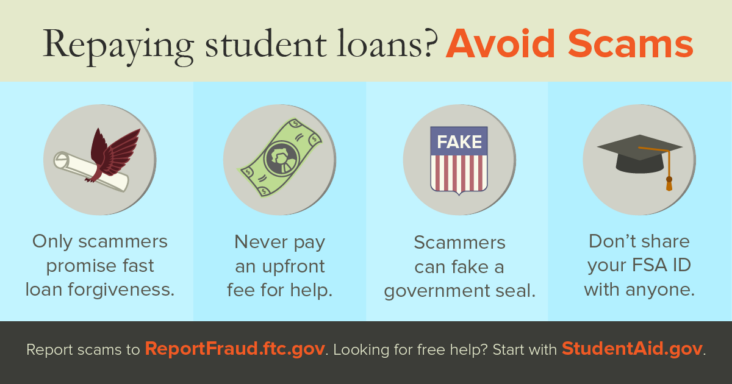

Demystifying the Student Loan Forgiveness Application Process: Expert Tips and Advice for a Successful Outcome

Demystifying the Student Loan Forgiveness Application Process can seem challenging, but with the right guidance, you can secure a successful outcome. To choose the best Student Loan Forgiveness Program for your unique situation, start by evaluating your financial needs, career goals, and loan repayment options. Research the eligibility requirements for various forgiveness programs such as Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, or Income-Driven Repayment (IDR) forgiveness. Seek expert advice from financial professionals, or consult online resources like the Federal Student Aid website. Stay organized throughout the application process, and track your progress with the help of loan servicers. By following these expert tips, you can pave the way for a brighter financial future.