Are you ready to dive into the world of homeownership and make one of the biggest financial decisions of your life? With Freedom Mortgage by your side, you can confidently navigate the mortgage market and make the best choice between a fixed-rate and adjustable-rate mortgage. In this comprehensive guide, we’ll explore the key differences, benefits, and drawbacks of these popular mortgage options, and provide expert tips to help you secure the ideal home loan that aligns with your financial goals. Don’t let mortgage jargon overwhelm you – let’s demystify the process and find the perfect mortgage solution for your dream home today!

Assess financial stability and goals.

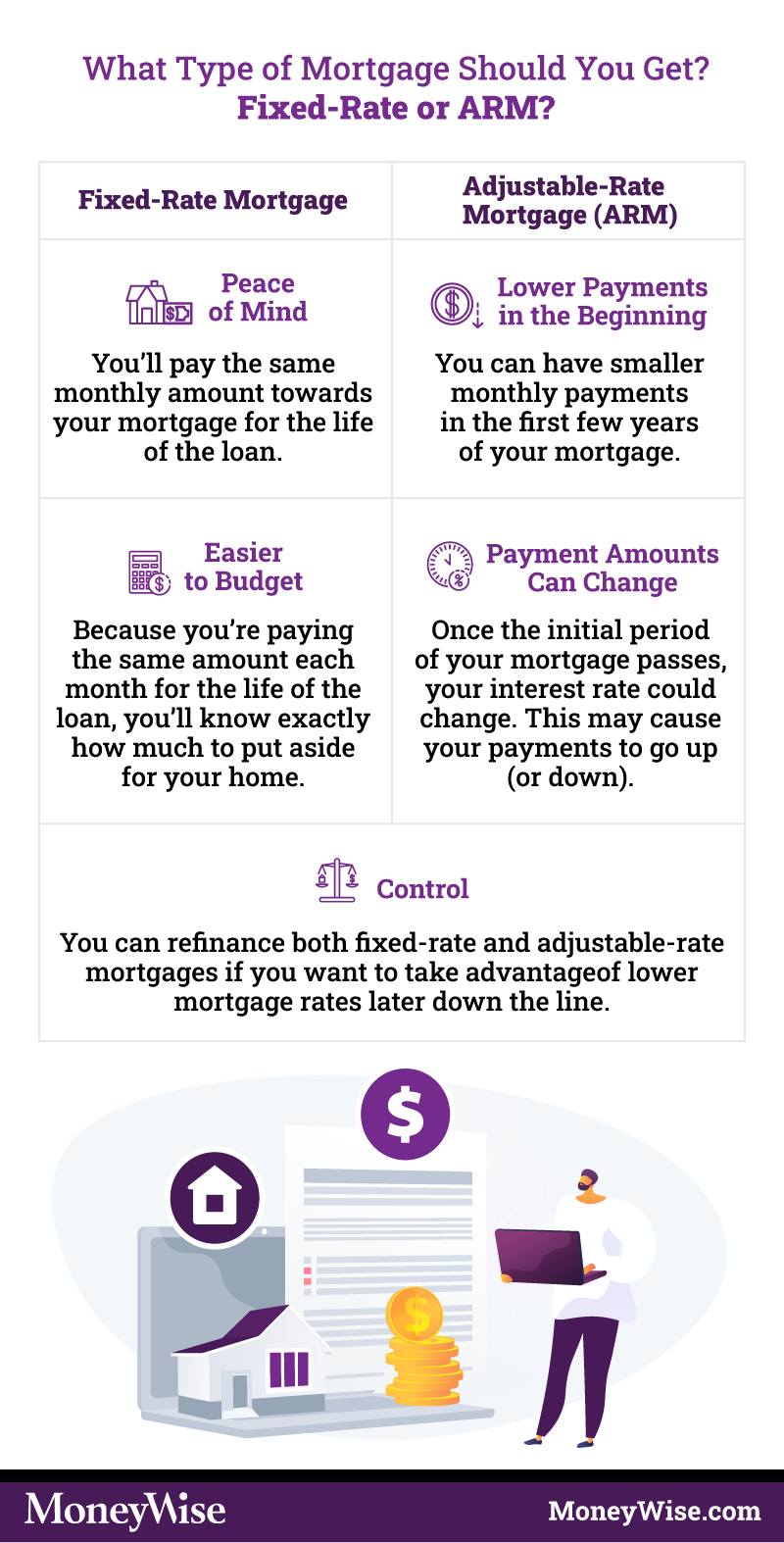

When choosing between a fixed-rate and adjustable-rate mortgage with Freedom Mortgage, it’s essential to assess your financial stability and goals. Consider factors like your job security, expected salary growth, and future plans. Remember, a fixed-rate mortgage offers stability, while an adjustable-rate mortgage can be cost-effective in the short term but riskier long-term.

Compare fixed-rate, adjustable-rate options.

Discover the ideal mortgage for your dream home by comparing fixed-rate and adjustable-rate options with Freedom Mortgage. Weigh the pros and cons of each, considering factors like interest rates, monthly payments, and long-term goals. Make an informed decision by understanding the differences and choosing the mortgage that suits your financial needs and lifestyle.

Evaluate interest rates and future predictions.

When choosing between a fixed-rate and adjustable-rate mortgage with Freedom Mortgage, it’s essential to evaluate current interest rates and future predictions. Keep an eye on market trends and economic factors that could impact rates. Stay informed and make a smart decision, ensuring you snag the best possible mortgage deal for your dream home.

Consider loan term and monthly payments.

When choosing between a fixed-rate and adjustable-rate mortgage, it’s crucial to consider the loan term and monthly payments. Think about how long you plan to stay in your home and how comfortable you are with fluctuating payments. Opt for a fixed-rate mortgage if you prefer predictable payments, or an adjustable-rate mortgage if you’re open to potential savings over time.

Analyze prepayment penalties and fees.

When comparing fixed-rate and adjustable-rate mortgages from Freedom Mortgage, don’t forget to examine prepayment penalties and fees. These extra costs can impact your decision, so make sure you’re aware of any potential charges for paying off your loan early or refinancing. Taking the time to analyze these factors will help you make a well-informed choice for your financial future.

Consult Freedom Mortgage for expert guidance.

Unlock the perfect mortgage solution with Freedom Mortgage’s expert guidance! Our knowledgeable team is committed to helping you navigate the home loan process with ease. We’ll thoroughly discuss your unique financial situation and goals, empowering you to confidently choose between a fixed-rate and adjustable-rate mortgage. Get ready to make a smart, informed decision for your future!